- United States

- /

- Banks

- /

- NYSE:FLG

Flagstar Bank (NYSE:FLG): Evaluating Valuation After Better-Than-Expected Q3 Results and Improved Credit Trends

Reviewed by Simply Wall St

Flagstar Bank National Association (NYSE:FLG) just delivered its third quarter results, exceeding revenue expectations and signaling brighter prospects ahead. The company attributes this performance to rising commercial lending, tighter expense controls, and significantly lower net charge-offs.

See our latest analysis for Flagstar Bank National Association.

After a rocky few years for regional banks, Flagstar’s latest results and improving credit trends have helped lift sentiment. The bank’s share price has gained 28.6% year-to-date, reflecting renewed investor confidence. However, its three-year total shareholder return remains sharply negative, highlighting how far it still has to go.

If you’re interested in seeing what else is gathering momentum right now, now’s a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares rallying and fundamentals turning, is Flagstar still trading at a meaningful discount? Or has the recent optimism already been fully reflected in the price, leaving limited upside for new investors?

Price-to-Book Ratio of 0.6x: Is it justified?

Flagstar Bank National Association is trading at a price-to-book ratio of 0.6x, which puts its valuation below both its industry and peer averages. With the share price currently at $11.88, investors may wonder if the market is underestimating its future potential or if lower expectations are warranted.

The price-to-book (P/B) ratio compares a company's market value to its book value. This metric is especially relevant for banks, where asset quality and balance sheet strength are key. A lower P/B can suggest undervaluation if assets are sound, or it could point to doubts about earnings power or risk profile.

Compared to the US Banks industry average of 1x and a peer average of 1.2x, Flagstar appears attractively priced on this metric. However, ongoing unprofitability and a relatively high level of bad loans might contribute to this discount.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 0.6x (UNDERVALUED)

However, persistent net losses and a history of weak long-term returns could still weigh on Flagstar’s recovery, even with the recent positive momentum.

Find out about the key risks to this Flagstar Bank National Association narrative.

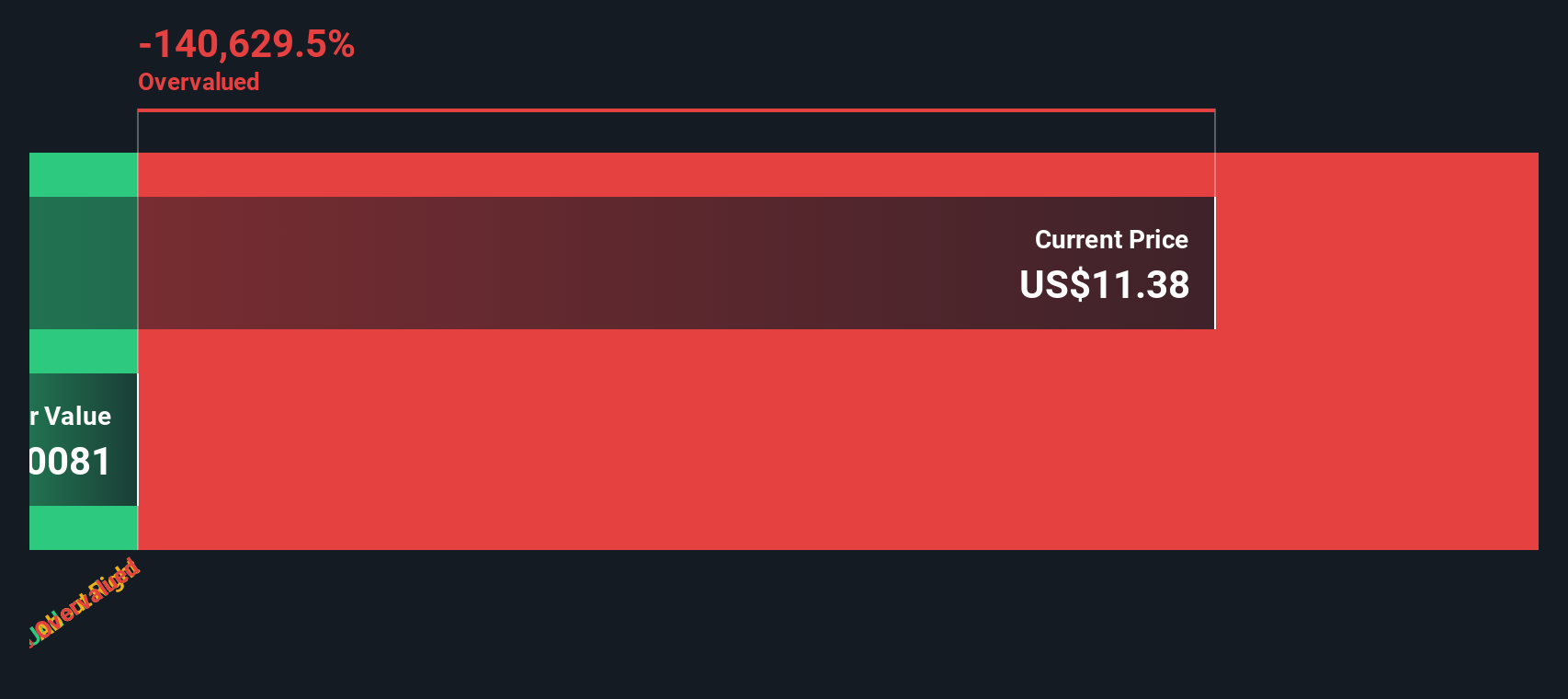

Another View: Discounted Cash Flow Model Suggests Overvaluation

While the price-to-book ratio paints Flagstar as undervalued, our DCF model tells a different story. It estimates fair value at just $2.48 per share, well below the current price of $11.88. This highlights a sharp disconnect between valuation models. Could the market be pricing in more optimism than fundamentals support?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Flagstar Bank National Association for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Flagstar Bank National Association Narrative

If you want a different perspective or would rather draw your own conclusions, you can build your own analysis in just a few minutes with Do it your way.

A great starting point for your Flagstar Bank National Association research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step ahead of the crowd by tapping into unique opportunities you might be missing in today’s market. Don’t let these potential winners pass you by. Take charge.

- Unlock hidden value and tap into growth potential with these 874 undervalued stocks based on cash flows to screen for companies trading below their intrinsic worth.

- Maximize your passive income by targeting these 19 dividend stocks with yields > 3% with attractive yields above 3% for improved cash flow and steady returns.

- Join the innovation wave and access these 27 AI penny stocks for exposure to next-generation artificial intelligence leaders shaping tomorrow’s business landscape today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLG

Flagstar Bank National Association

Operates as the bank holding company for Flagstar Bank, N.A.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives