- United States

- /

- Banks

- /

- NYSE:FHN

First Horizon (FHN): Exploring Valuation After Steady Share Price Rise

Reviewed by Simply Wall St

See our latest analysis for First Horizon.

First Horizon’s share price has shown renewed life lately, with today’s 2.7% move capping off a steady 3.8% gain over the month, and total shareholder return up 10.5% for the year. After a volatile stretch marked by industry-wide uncertainty, momentum appears to be building again as investors respond to stabilizing fundamentals and emerging opportunities.

If you’re interested in what’s capturing attention outside the banking sector right now, it’s a perfect moment to broaden your outlook and discover fast growing stocks with high insider ownership

But with First Horizon still trading below analyst price targets and posting solid fundamentals, investors are left wondering if the stock is still undervalued or if the market has already priced in all the anticipated growth ahead.

Most Popular Narrative: 12.9% Undervalued

First Horizon's most prominent narrative says shares are trading well below the estimated fair value, signaling potential for upside versus Monday's closing price. The valuation is built on forecasts for stable growth and disciplined execution over the coming years.

The company has opportunities for organic loan growth, particularly through its mortgage warehouse segment, which may enhance overall earnings if economic conditions or rate cuts increase demand. First Horizon's strategic capital deployment through a share repurchase program may lead to higher earnings per share as outstanding shares are reduced.

Want to understand the math that sets this price target apart? Dive in to uncover the key assumptions and the high-stakes estimates fueling this undervalued rating. This story hinges on bold revenue forecasts, margin discipline, and some financial predictions you might not expect. Go deeper to reveal the full thesis behind the numbers.

Result: Fair Value of $24.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty and rising provision expenses could challenge this outlook. These factors have the potential to derail forecasts if credit pressures intensify further.

Find out about the key risks to this First Horizon narrative.

Another View: What Do the Valuation Ratios Say?

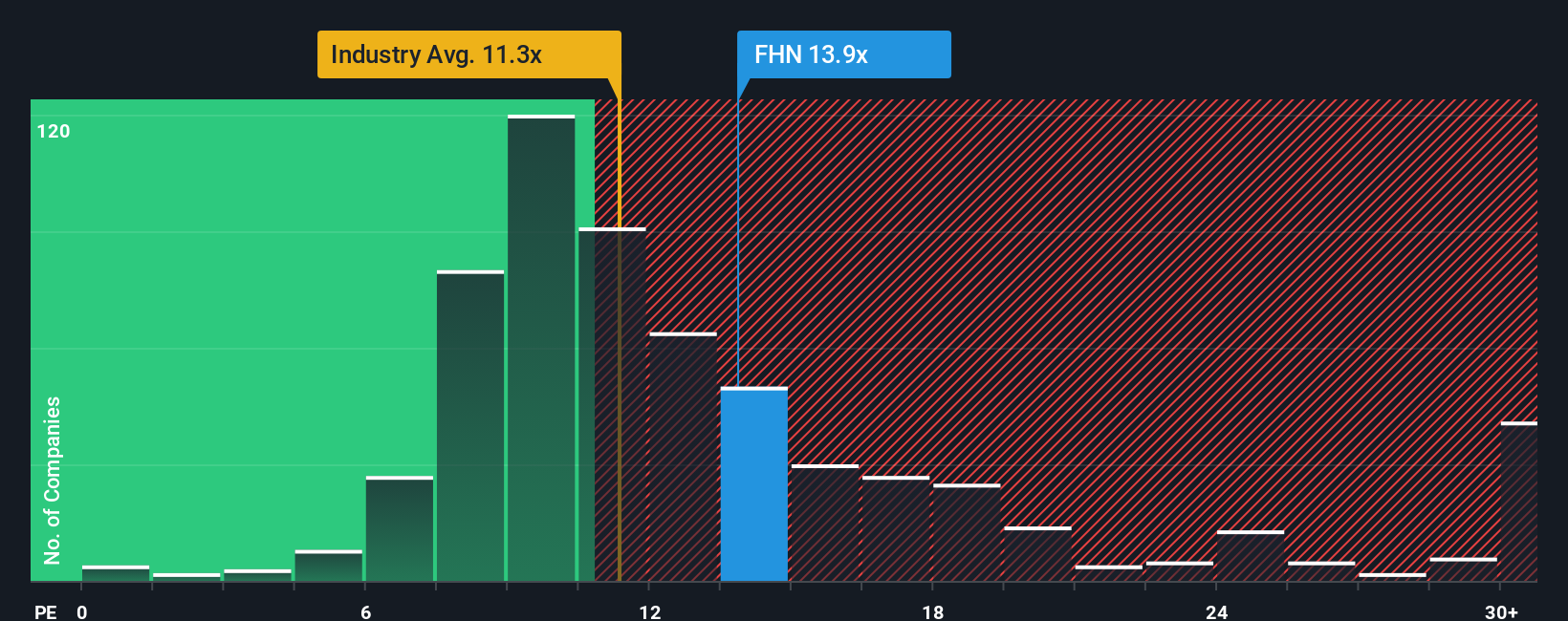

While the discounted cash flow model suggests upside, First Horizon’s price-to-earnings ratio stands at 12.3x, which is higher than both US Banks industry peers at 11x and its own fair ratio of 11.7x. This indicates that, based on this metric, the stock is not especially cheap. Could there be risks that the market sees ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Horizon Narrative

If the current analysis doesn't fully align with your perspective or you're keen to dig into the numbers personally, it's quick and easy to build your own view. Do it your way.

A great starting point for your First Horizon research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to seize tomorrow’s winners. Use the Simply Wall Street Screener to spot high-potential opportunities and uncover stocks other investors are overlooking.

- Accelerate your gains by targeting cash flow bargains found on these 895 undervalued stocks based on cash flows and see which companies are priced for growth.

- Tap into stable income streams by checking out these 15 dividend stocks with yields > 3%, which features businesses delivering attractive yields above 3%.

- Step ahead of market trends with these 27 AI penny stocks, where artificial intelligence is fueling the next wave of disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FHN

First Horizon

Operates as the bank holding company for First Horizon Bank that provides various financial services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives