- United States

- /

- Banks

- /

- NYSE:FHN

A Fresh Look at First Horizon’s Valuation Following $1.2 Billion Share Buyback Authorization

Reviewed by Simply Wall St

First Horizon, following a new board authorization, is set to repurchase up to $1,200 million in common stock through January 2027. Investors often watch these buyback moves closely, as they can hint at management’s optimism about the company’s future direction.

See our latest analysis for First Horizon.

First Horizon has seen its 1-year total shareholder return climb an impressive 30.1%, outpacing its more modest year-to-date share price return of 7.3%. After a series of moves, including fresh board appointments, bylaw changes, and ongoing dividend payouts along with the newly expanded buyback, the stock’s momentum seems to be building as the market gets behind management’s strategy and value-creation efforts.

If you’re curious about what other companies are attracting insider confidence and rapid growth, now’s the perfect time to explore fast growing stocks with high insider ownership.

With shares trading at a notable 14 percent discount to analyst targets and an even wider gap to intrinsic value, the question for investors is clear: is First Horizon truly undervalued, or has the market already priced in its future growth?

Most Popular Narrative: 11.8% Undervalued

First Horizon’s latest fair value estimate sits at $24.32, about 11.8% above the last close of $21.46. This makes it a focal point for both momentum traders and long-term investors who see pricing disconnects as opportunities worth exploring.

The company's diversified business model and focus on cost discipline may boost earnings stability and shield against economic fluctuations. The diversified business model, offering countercyclical revenue support, may shield earnings from macroeconomic volatility and ensure a steady revenue stream across various interest rate environments.

Wondering what insights lead to that premium? Key assumptions around margins, growth, and long-term profit expectations are driving the narrative. Some of the crucial levers behind this fair value may surprise you. Unpack the story to reveal the catalysts and projections shaping the view.

Result: Fair Value of $24.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks such as macroeconomic uncertainty and rising credit costs could quickly undermine the current fair value and growth outlook for First Horizon.

Find out about the key risks to this First Horizon narrative.

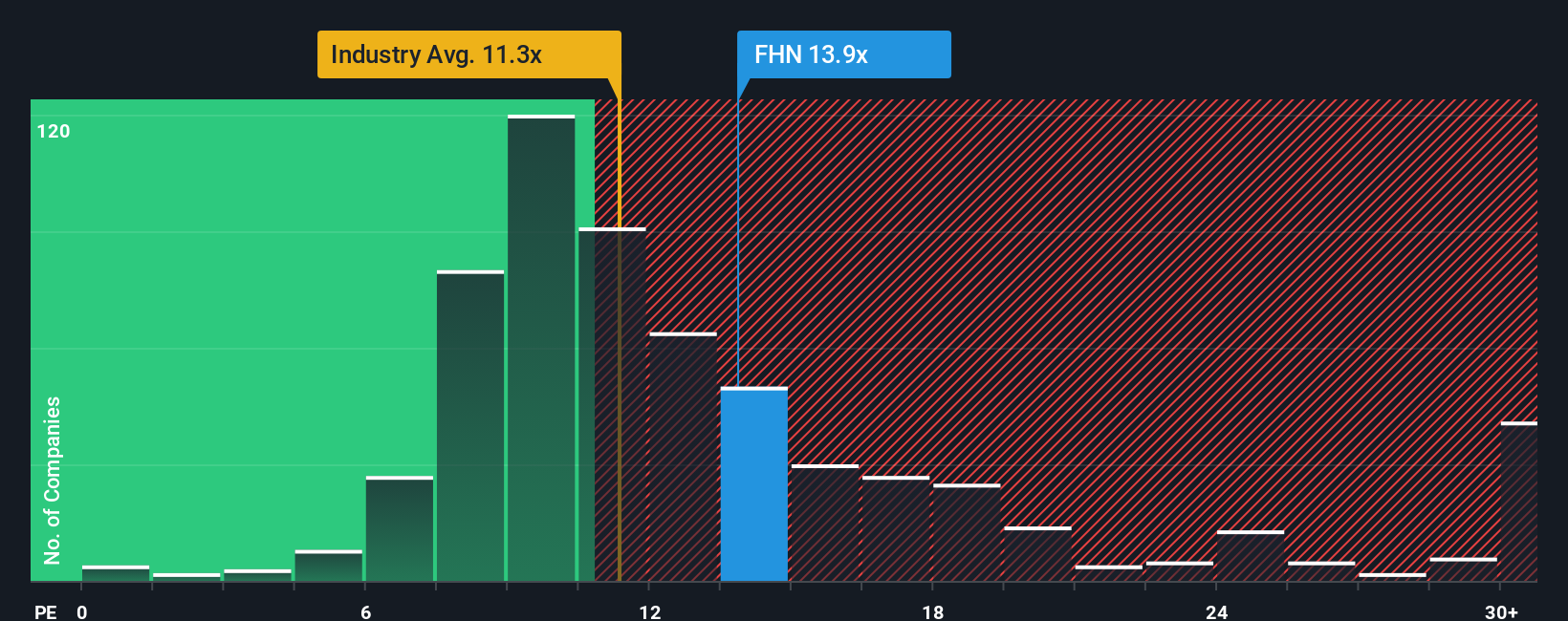

Another View: Multiples Raise Different Questions

While fair value estimates suggest First Horizon is undervalued, a look at its price-to-earnings ratio tells a more complicated story. The stock trades at 12.5x earnings, which is pricier than both the industry (11x) and peer average (10.1x), as well as above the fair ratio of 11.9x. Does this premium reflect real upside, or just higher risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Horizon Narrative

Should you want to dig into the details yourself or challenge the story, crafting your own narrative is quick and straightforward. Just a few minutes is all it takes. Do it your way

A great starting point for your First Horizon research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Gain an edge on your portfolio by seeing which sectors are packed with hidden gems. There has never been a better time to act on these timely themes.

- Unlock the growth potential in AI-driven companies by reviewing these 27 AI penny stocks, where innovation meets real opportunity for tech-focused investors.

- Tap into the stability of companies with strong yield by checking out these 18 dividend stocks with yields > 3%, offering robust dividend payouts for those seeking reliable income streams.

- Spot tomorrow’s market leaders early by researching these 843 undervalued stocks based on cash flows, featuring undervalued stocks based on cash flows with significant upside left to capture.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FHN

First Horizon

Operates as the bank holding company for First Horizon Bank that provides various financial services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives