- United States

- /

- Banks

- /

- NYSE:FBP

Strong Earnings and New Buyback Program Might Change the Case for Investing in First BanCorp (FBP)

Reviewed by Sasha Jovanovic

- In late October 2025, First BanCorp. reported third quarter results showing year-over-year growth in net interest income and net income, authorized a new share repurchase program of up to US$200 million through 2026, and reaffirmed a quarterly dividend of US$0.18 per share.

- These actions reflect management's confidence in both the bank's current financial strength and its continued commitment to returning value to shareholders through dividends and buybacks.

- We'll explore how First BanCorp's robust earnings and large buyback authorization could impact its investment narrative and future outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

First BanCorp Investment Narrative Recap

To be a shareholder of First BanCorp, you need to believe in the region’s economic recovery, supported by robust loan demand and continued federal infrastructure investment in Puerto Rico and Florida. The recent earnings announcement, highlighting increases in net interest income and net income, reinforces the bank’s growth narrative and its emphasis on capital returns, but does not materially address the risk around persistent demographic stagnation or intensifying competition driving up funding costs in its core markets.

Among recent announcements, the new US$200 million share repurchase program stands out as most relevant. This buyback not only provides additional downside support for the share price but also signals management’s ongoing efforts to prioritize capital returns, which ties directly to investors’ focus on stability amid competition for deposits and evolving funding conditions.

Yet on the other hand, investors should be aware that heightened competition for deposits could still put pressure on net interest margins if...

Read the full narrative on First BanCorp (it's free!)

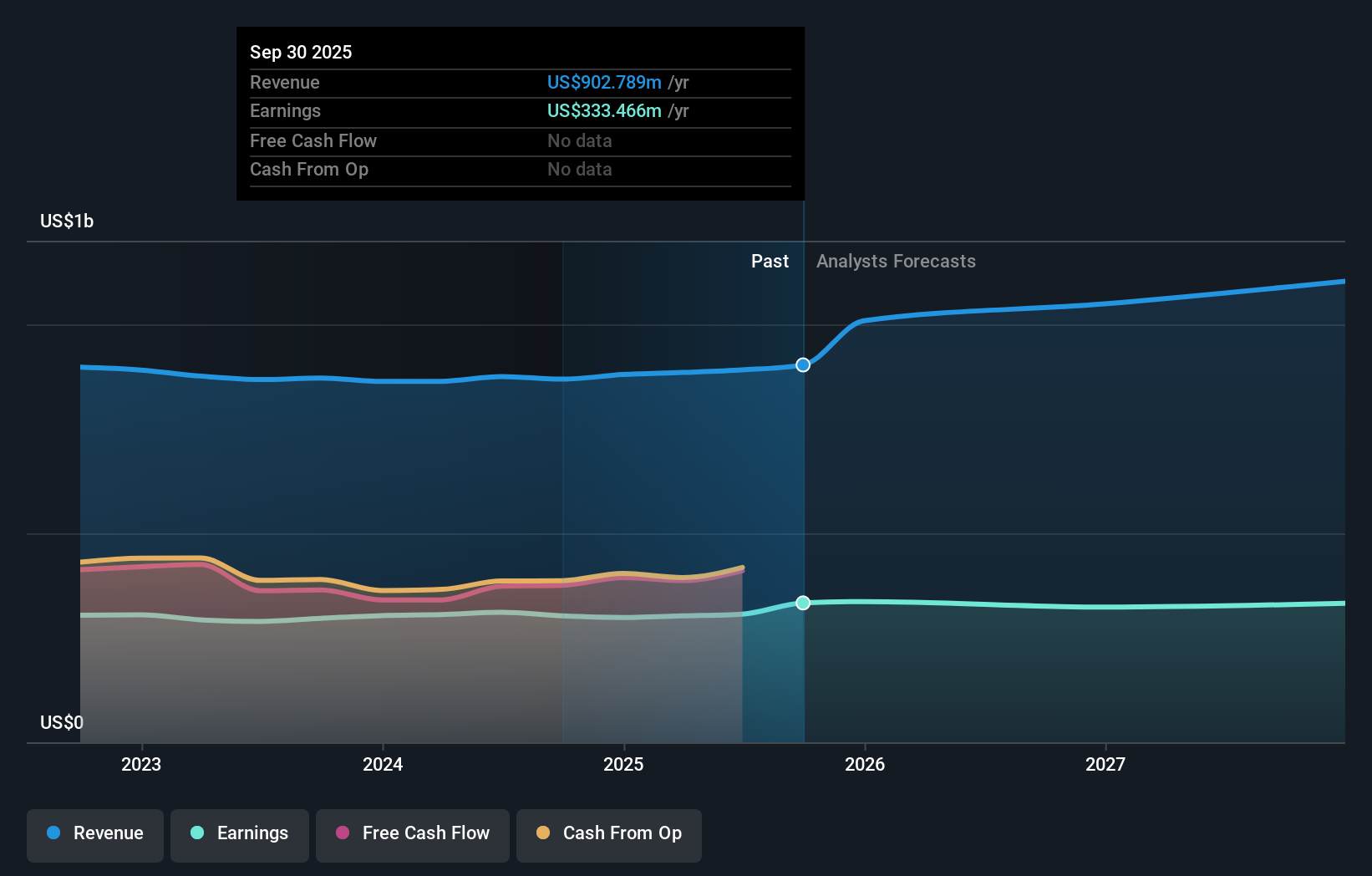

First BanCorp's narrative projects $1.2 billion revenue and $349.9 million earnings by 2028. This requires 10.2% yearly revenue growth and a $43 million earnings increase from $306.7 million.

Uncover how First BanCorp's forecasts yield a $24.33 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members’ fair value estimates for First BanCorp range widely from US$24.33 to US$51.77 based on three individual analyses. Even as many see deep undervaluation, heightened competition for deposits could impact future profitability and is something you will want to consider alongside these varied viewpoints.

Explore 3 other fair value estimates on First BanCorp - why the stock might be worth just $24.33!

Build Your Own First BanCorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First BanCorp research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free First BanCorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First BanCorp's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FBP

First BanCorp

Operates as the bank holding company for FirstBank Puerto Rico that provides financial products and services to consumers and commercial customers.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives