- United States

- /

- Banks

- /

- NYSE:CMA

Could Comerica’s (CMA) New Preferred Stock Offering Redefine Its Capital Allocation Strategy?

Reviewed by Simply Wall St

- Comerica Incorporated recently announced a new fixed-to-floating rate non-cumulative perpetual preferred stock offering with callable, variable-rate features, and also affirmed a regular quarterly dividend of US$0.71 per share payable October 1, 2025.

- The introduction of a variable-rate preferred stock may attract income-focused investors and indicates ongoing efforts to strengthen the company's capital base and meet shareholder expectations.

- With the launch of this preferred stock offering, we’ll consider how expanding fixed-income options could influence Comerica’s investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

Comerica Investment Narrative Recap

To be a Comerica shareholder, you need to see value in its stable dividend payouts, ongoing capital management, and the potential for long-term profitability even as the bank's loan growth and cost structure remain in focus. The fixed-to-floating preferred stock offering may broaden the appeal to income-seeking investors, but it does not materially shift the current catalysts or the main risk, subdued loan growth and margin pressure from rising deposit costs.

Among recent developments, the quarterly cash dividend affirmation of US$0.71 per share stands out, reinforcing Comerica’s commitment to shareholder returns. This action could provide reassurance to investors seeking consistency, although structural challenges tied to loan and margin expansion continue to temper the near-term outlook.

Yet, despite these steps to reward shareholders, persistent competitive pressures on deposit pricing and their impact on earnings are a risk investors should not ignore...

Read the full narrative on Comerica (it's free!)

Comerica's narrative projects $3.5 billion in revenue and $703.0 million in earnings by 2028. This requires 3.1% yearly revenue growth and a $11.0 million earnings increase from $692.0 million today.

Uncover how Comerica's forecasts yield a $66.65 fair value, in line with its current price.

Exploring Other Perspectives

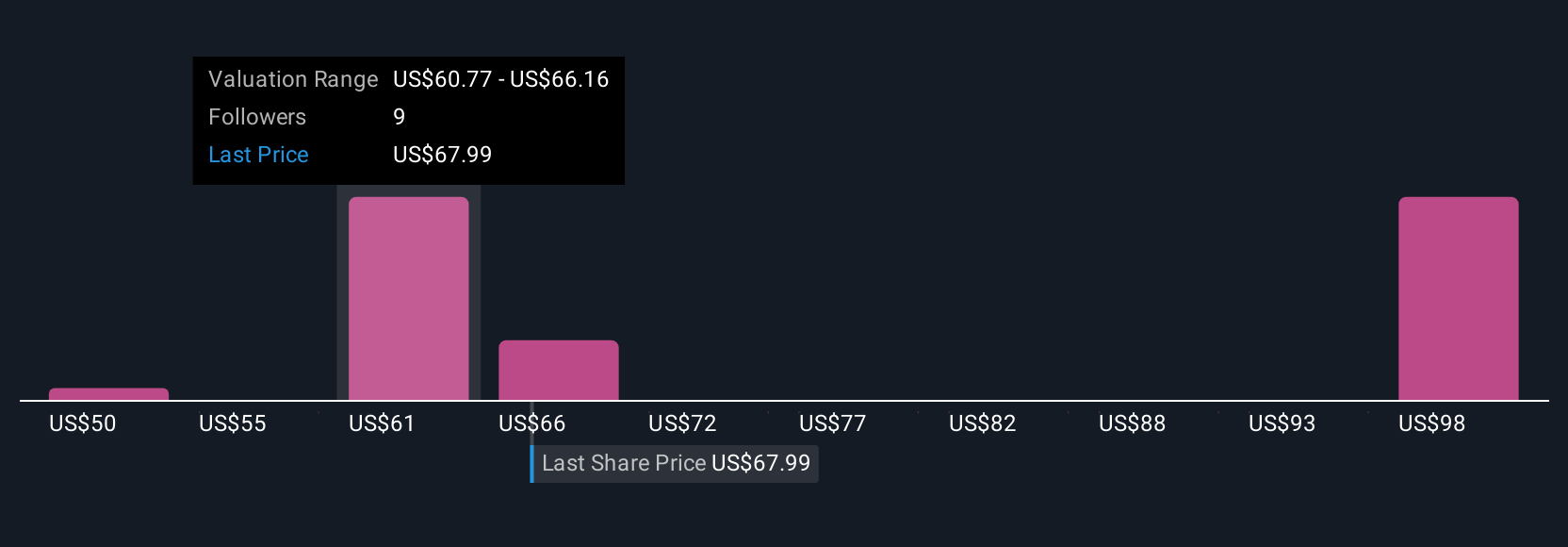

Fair value estimates from five members of the Simply Wall St Community range from US$50 to US$94.32, reflecting wide variance in growth expectations. Many believe Comerica’s ability to manage deposit costs will shape its future profitability, so it pays to compare these viewpoints.

Explore 5 other fair value estimates on Comerica - why the stock might be worth 25% less than the current price!

Build Your Own Comerica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Comerica research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Comerica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Comerica's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMA

Comerica

Provides financial services in the United States, Canada, and Mexico.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives