- United States

- /

- Banks

- /

- NYSE:CMA

Comerica (CMA): Examining the Bank’s Valuation After Steady Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Comerica.

Backing up that long-term momentum, Comerica has delivered a 27.44% year-to-date share price return and a 20.05% total shareholder return over the past 12 months, outpacing many regional banks. This steady climb suggests renewed optimism around sector stability and growth potential.

If you’re interested in finding what else might be building momentum, now is the perfect time to expand your search and discover fast growing stocks with high insider ownership

But with shares now approaching analyst price targets and the bank’s fundamentals improving at a steady, not explosive, pace, investors are left to wonder if Comerica remains a bargain or if the market has already priced in further gains.

Most Popular Narrative: 3.7% Undervalued

With Comerica’s fair value from the most popular narrative standing at $81.28, the last close price of $78.31 suggests room for upside according to current assumptions. This narrative highlights forward-looking drivers with an eye toward both long-term growth and structural headwinds.

The bank's asset-sensitive balance sheet and favorable positioning to benefit from the ongoing trend of higher rates and swap portfolio maturities are expected to provide structural tailwinds to net interest income and further enhance earnings in 2025 and beyond. Prudent risk management and historically strong credit metrics (for example, low charge-offs and conservative capital levels with CET1 at 11.94%) put Comerica in a position to maintain lower credit losses and deliver more consistent earnings through market cycles, supporting long-term profitability.

Want to know what drives this valuation above today’s price? The narrative is built on profit margins that buck the sector trend and ambitious payout assumptions. The real twist is that it hinges on certain financial levers and bold earnings projections usually reserved for industry leaders. See which metrics hold the key to that upside.

Result: Fair Value of $81.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including modest loan growth and rising expenses. These factors could challenge long-term profitability and the validity of this optimistic outlook.

Find out about the key risks to this Comerica narrative.

Another View: Multiples Tell a Different Story

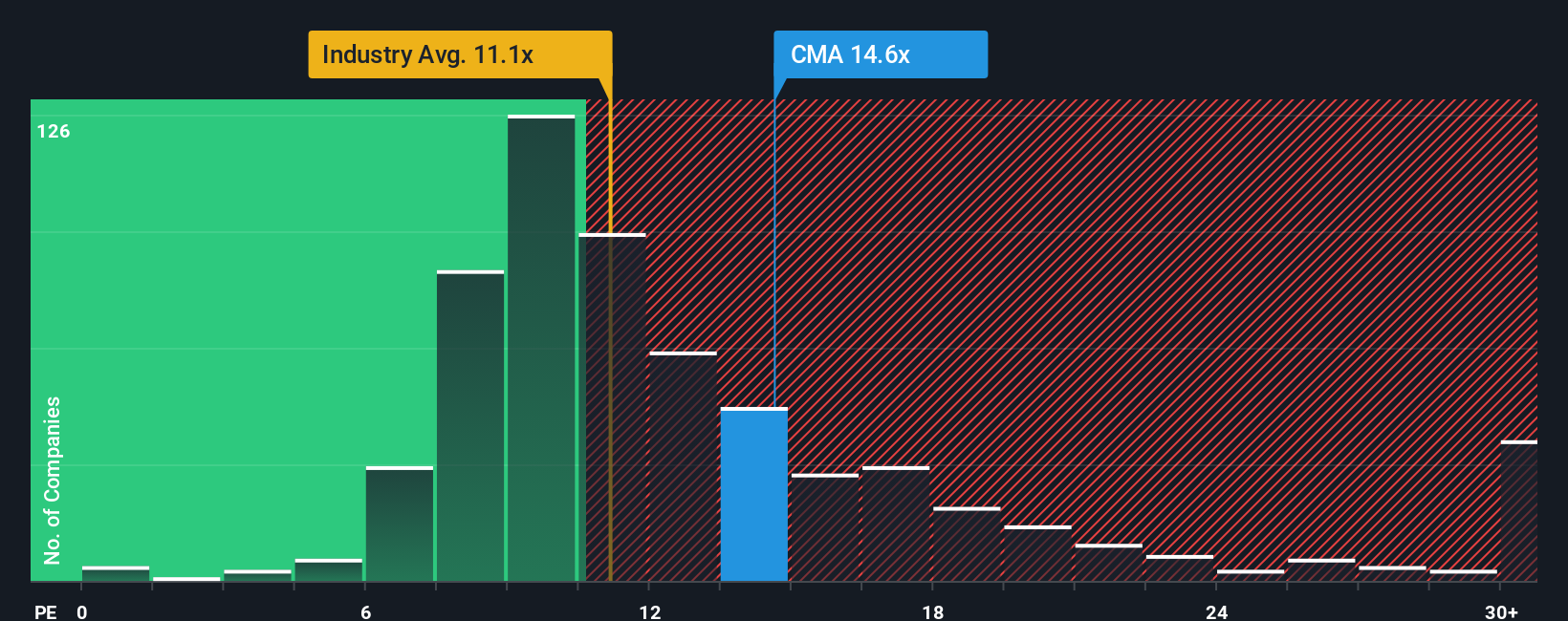

While some models suggest Comerica trades below fair value, its current price-to-earnings ratio of 14.5x stands noticeably above the US Banks average of 11.2x, the peer average of 13.4x, and even the fair ratio of 11x. Such a premium indicates the market is betting on outperformance. However, it also raises the risk of disappointment if expectations cool.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Comerica Narrative

If these perspectives do not align with your own or you value drawing your own conclusions from the numbers, you can craft a personalized view in just a few minutes by using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Comerica.

Looking for More Compelling Investment Ideas?

Don’t wait for the market to pass you by. Use Simply Wall Street’s powerful screener to pinpoint stocks poised for growth and opportunity right now.

- Zero in on potential breakout opportunities by checking out these 3577 penny stocks with strong financials, which are making waves despite their small size and strong financials.

- Capitalize on the surge in innovation by targeting these 26 AI penny stocks, which are pushing boundaries in artificial intelligence and automation.

- Strengthen your portfolio with these 16 dividend stocks with yields > 3%, which offers reliable income and attractive yield potential above the market average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMA

Comerica

Provides financial services in the United States, Canada, and Mexico.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives