- United States

- /

- Banks

- /

- NYSE:CFR

Cullen/Frost Bankers (CFR): Assessing Current Valuation After Recent Share Price Dip

Reviewed by Simply Wall St

Cullen/Frost Bankers (CFR) recently continued its steady pace in the market, leaving investors curious about how its long-term performance might measure up compared to recent trends. The bank's recent quarterly results provide some perspective for both seasoned and new shareholders.

See our latest analysis for Cullen/Frost Bankers.

While Cullen/Frost Bankers’ latest $125.73 share price reflects a minor dip over the past month, long-term momentum remains clear, with a five-year total shareholder return of 80.2%. Despite a modest short-term pullback, this result stands out for patient investors seeking stable compounding.

If you’re curious about other stocks showing consistent growth and insider buy-in, this is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading roughly 23 percent below their estimated intrinsic value, investors may be asking if Cullen/Frost Bankers is undervalued or if the market has already factored in its future growth potential.

Most Popular Narrative: 8.5% Undervalued

Cullen/Frost Bankers’ narrative sets its fair value at $137.47, suggesting more room for upside from the last close of $125.73 if key assumptions hold. Investors will want to understand what’s driving this outlook and whether it holds up under scrutiny.

The full payoff from the branch expansion strategy is approaching, with maturing branches in high-growth markets shifting from breakeven to accretive by 2026. This will unlock operating leverage and drive faster bottom-line growth relative to the past three years.

Is the secret sauce behind this valuation the pace-shifting profits from Texas expansion, or a quiet margin recovery most have missed? The narrative’s math hinges on a handful of bold projections, but only the full story reveals which forecasts make the difference and what could tip the scales next.

Result: Fair Value of $137.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Texas market growth falters or digital banking lags behind competitors, Cullen/Frost’s long-term upside could face significant challenges.

Find out about the key risks to this Cullen/Frost Bankers narrative.

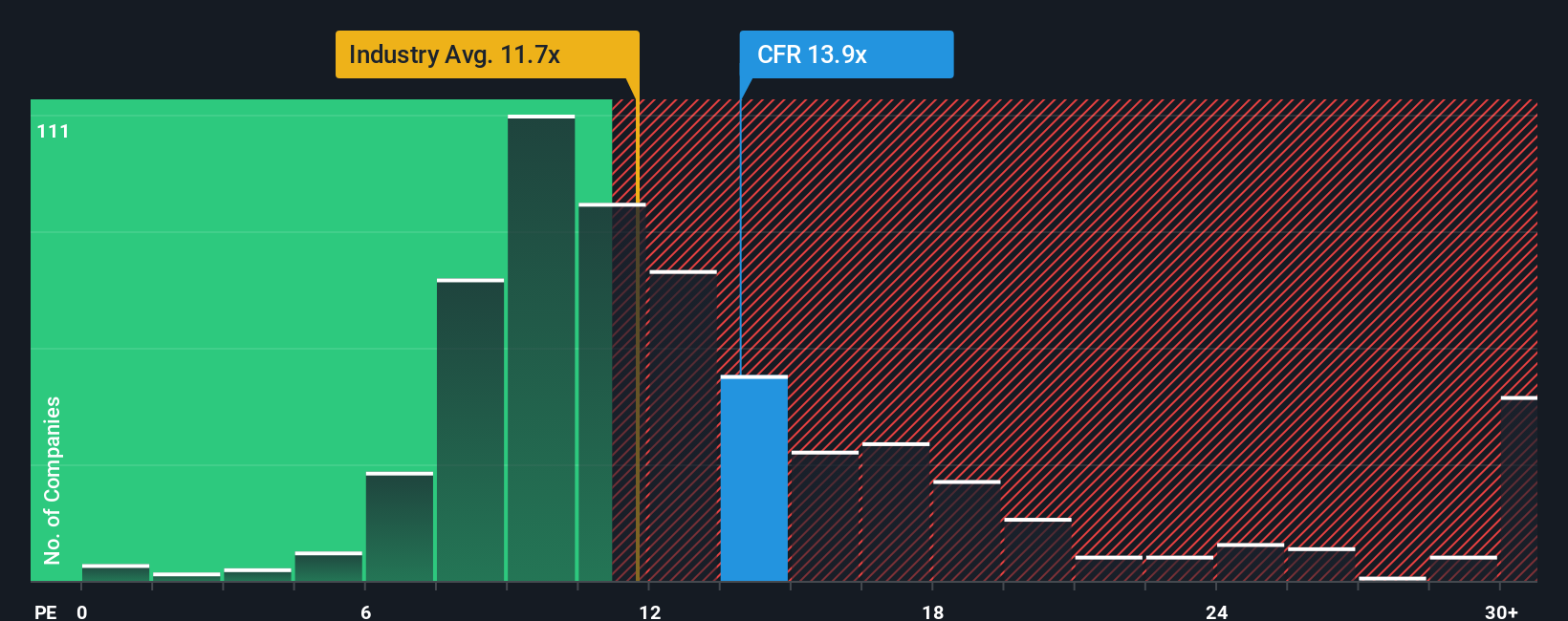

Another View: Multiples Suggest a Different Story

Looking at valuation from another angle, the current price-to-earnings ratio stands at 12.9x, which is notably higher than both the US Banks industry average of 11x and the calculated fair ratio of 10.4x. This suggests the market may be pricing in more optimism or less risk than the fundamentals might justify. Does this premium point to hidden strengths, or is it a sign of downside risk investors should weigh?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cullen/Frost Bankers Narrative

If you’re curious to dig into the numbers yourself or want a fresh perspective, you can analyze key trends and piece together a story that fits what you see. If you’re ready to try it hands-on, Do it your way.

A great starting point for your Cullen/Frost Bankers research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that opportunity rarely waits. Make sure you’re not missing out by expanding your horizons with strategies tailored to emerging trends and reliable growth.

- Boost your portfolio’s income by targeting these 16 dividend stocks with yields > 3% that consistently deliver yields above 3% and support your long-term wealth plans.

- Catalyze your potential gains by tracking these 24 AI penny stocks at the forefront of artificial intelligence, automation, and disruptive innovation.

- Capitalize on value opportunities with these 870 undervalued stocks based on cash flows spotted by their strong free cash flows and healthy financial metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFR

Cullen/Frost Bankers

Operates as the bank holding company for Frost Bank that provides commercial and consumer banking services in Texas.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives