- United States

- /

- Banks

- /

- NYSE:CFG

Does Citizens' Latest Preferred Dividend Reveal a Confident Capital Strategy at CFG?

Reviewed by Sasha Jovanovic

- On November 3, 2025, Citizens Financial Group announced board-approved quarterly cash dividends on multiple preferred stock series, payable in January 2026 to shareholders of record as of late December 2025.

- This move highlights Citizens' emphasis on returning capital to preferred shareholders, reflecting ongoing confidence in its liquidity and capital position amid recent strong financial results.

- We’ll examine how management’s decision to maintain robust preferred dividends signals continued financial strength within Citizens’ updated investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Citizens Financial Group Investment Narrative Recap

To be a shareholder in Citizens Financial Group, you need confidence in its ability to leverage growth in private banking, robust deposit expansion, and capital discipline to drive long-term value. The latest preferred dividend announcement underpins management’s assurance in Citizens’ financial flexibility, but it does not meaningfully alter the most important near-term catalyst, sustained private bank and wealth franchise growth, or the ongoing risk posed by commercial real estate exposure. In the short term, the dividend action reinforces a steady capital return policy rather than signaling a change in business trajectory.

The October dividend increase for common shareholders is especially relevant, as it highlights Citizens' recent focus on shareholder rewards alongside earnings strength. When evaluated with the continued payout of preferred dividends, this move points to healthy capital generation and reliable earnings, which are key pillars underlying current growth catalysts such as market expansion initiatives and successful new product rollouts.

By contrast, investors should stay alert to the potential for a renewed downturn in commercial real estate, as...

Read the full narrative on Citizens Financial Group (it's free!)

Citizens Financial Group's outlook anticipates $10.3 billion in revenue and $2.8 billion in earnings by 2028. This reflects a required yearly revenue growth rate of 12.6% and an $1.3 billion increase in earnings from the current $1.5 billion.

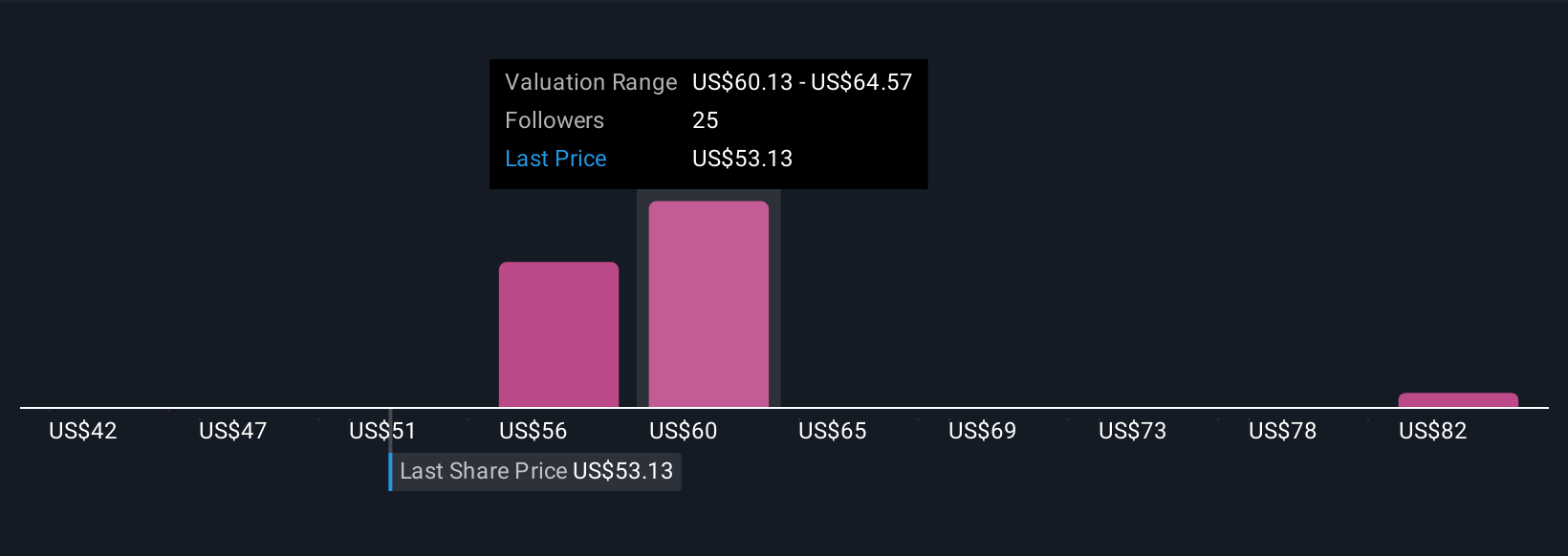

Uncover how Citizens Financial Group's forecasts yield a $61.72 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimate Citizens’ fair value between US$42.41 and US$79.98. As many opinions as there are risks, with commercial real estate exposure likely to affect performance if troubled asset trends worsen.

Explore 3 other fair value estimates on Citizens Financial Group - why the stock might be worth as much as 55% more than the current price!

Build Your Own Citizens Financial Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Citizens Financial Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Citizens Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Citizens Financial Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFG

Citizens Financial Group

Operates as the bank holding company that provides retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives