- United States

- /

- Banks

- /

- NYSE:C

Should Citigroup's (C) Goodwill Impairment Charge Prompt Investors to Rethink the Near-Term Outlook?

Reviewed by Sasha Jovanovic

- In the past week, Citigroup reported a goodwill impairment charge of US$726 million (US$714 million after-tax) for the third quarter ended September 30, 2025, signaling a reassessment of asset values in its business units.

- This significant write-down often points to structural or operational adjustments within the company and can prompt investors to re-examine expectations for future performance.

- We will explore how this sizeable impairment charge may shift Citigroup's investment narrative and reshape assumptions about its near-term outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Citigroup Investment Narrative Recap

To be a Citigroup shareholder, you need to believe in the bank’s global network and digital transformation, especially its strength in cross-border payment services and institutional banking. The recent US$726 million goodwill impairment charge points to challenges in select business units, but doesn’t appear material enough to change the primary near-term catalyst: successful execution of digital and operational improvements. The biggest risk remains operational and regulatory complexity, which can strain margins and require ongoing transformation spend.

Amid this, Citi’s new collaboration with Coinbase deserves attention. This partnership to expand digital asset payment capabilities is relevant, as it reflects Citi’s commitment to strengthening its institutional offerings and payment infrastructure, key levers for growth. It also aligns well with ongoing efforts to compete in an increasingly digital, fintech-driven market, supporting the bank’s largest growth catalyst.

In contrast, investors should not overlook the continuing risk that high transformation and compliance costs may continue to...

Read the full narrative on Citigroup (it's free!)

Citigroup's narrative projects $88.8 billion revenue and $17.2 billion earnings by 2028. This requires 6.8% yearly revenue growth and a $4.3 billion earnings increase from $12.9 billion today.

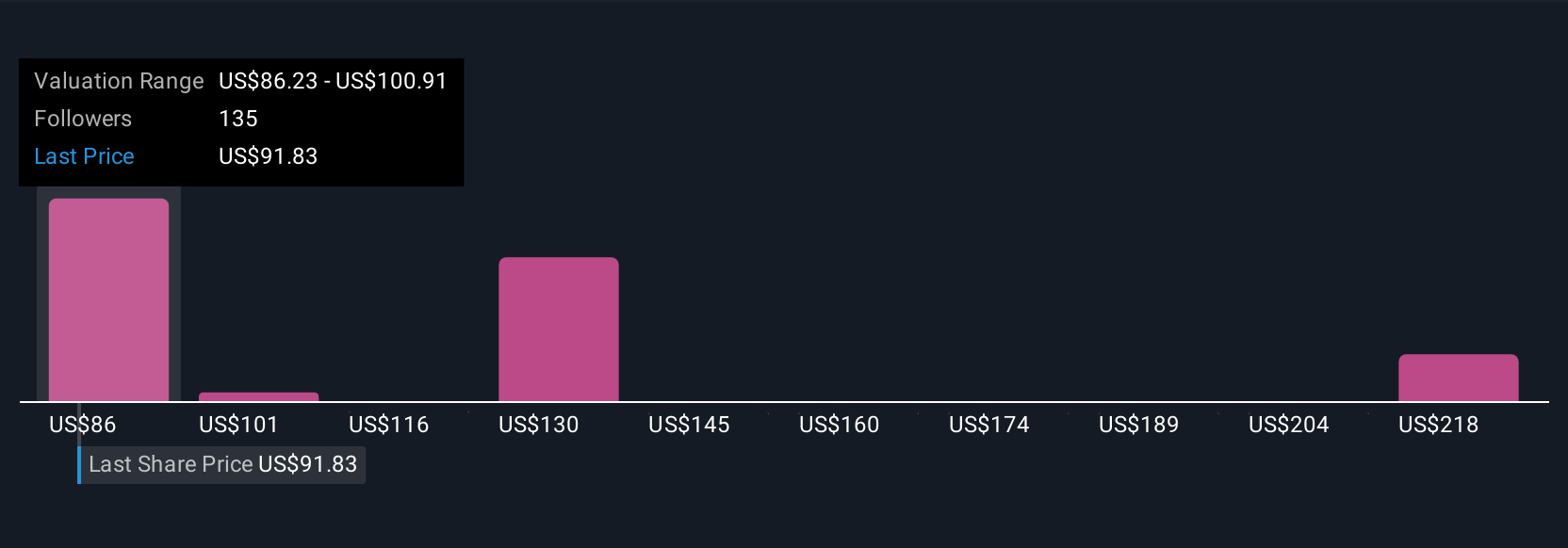

Uncover how Citigroup's forecasts yield a $113.38 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Some analysts were highly optimistic before this news, expecting Citigroup’s annual revenues to reach US$91.3 billion and earnings to hit US$20 billion by 2028. These forecasts make a stronger case for digital investment and global expansion, yet the recent impairment could require rethinking such assumptions. It’s worth exploring these different viewpoints, as your expectations may differ widely from those of the most bullish analysts.

Explore 12 other fair value estimates on Citigroup - why the stock might be worth 25% less than the current price!

Build Your Own Citigroup Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Citigroup research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Citigroup research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Citigroup's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives