- United States

- /

- Banks

- /

- NYSE:C

Citigroup’s Digital Payments Push with Coinbase and Rate Cut Might Change the Case for Investing in C

Reviewed by Sasha Jovanovic

- Recently, Citigroup Inc. and Coinbase announced a collaboration to develop digital asset payment solutions for U.S.-based institutional clients, and Citigroup lowered its base lending rate by 25 basis points in alignment with a Federal Reserve move.

- This combination of a digital payments partnership and a lending rate cut underscores Citigroup's intent to both expand its digital capabilities and compete more aggressively for borrowers in an evolving financial landscape.

- We'll explore how Citigroup's partnership with Coinbase to enhance digital asset payments may influence its growth outlook and investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Citigroup Investment Narrative Recap

To be a shareholder in Citigroup today, you need confidence in its ability to accelerate digital banking transformation, remain agile in the face of regulatory scrutiny, and protect its core transaction services business from intensifying competition. While the Coinbase partnership and lending rate cut speak to Citi’s push for innovation and borrower attraction, the wave of recent fixed-income offerings does not materially affect the main short-term catalyst of transaction banking growth or the ongoing risk of digital disruption and high compliance costs.

Among Citi's recent announcements, the expansion of Citi Token Services into Euro transactions and Dublin stands out as most relevant to the current digital payments focus. This move builds on Citi's efforts to offer 24/7, cross-border payment and liquidity solutions, which directly support its ambitions in digital asset payments and could reinforce its competitive position in institutional banking.

Yet, against these advances, investors should especially watch for how persistent regulatory and compliance costs might…

Read the full narrative on Citigroup (it's free!)

Citigroup's narrative projects $88.8 billion in revenue and $17.2 billion in earnings by 2028. This requires 6.8% yearly revenue growth and a $4.3 billion increase in earnings from the current $12.9 billion.

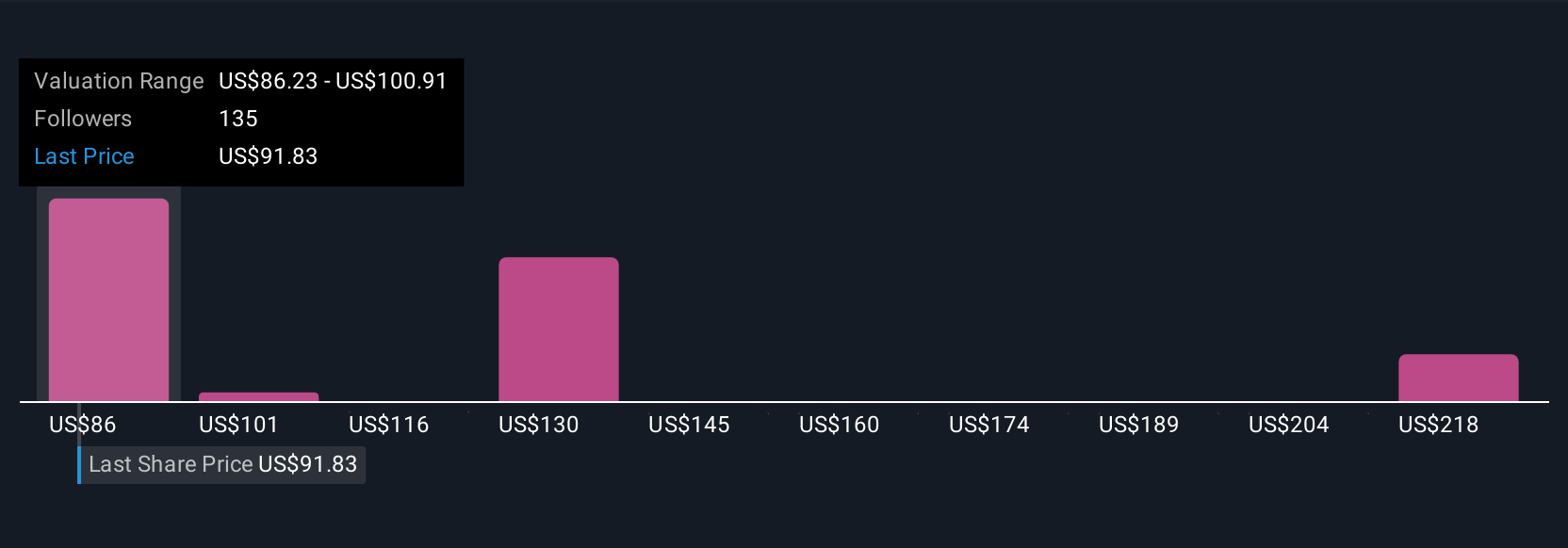

Uncover how Citigroup's forecasts yield a $114.10 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Compared to the consensus view, some of the most optimistic analysts believed Citigroup’s revenue could reach US$91.3 billion by 2028, assuming even greater digital adoption or operational efficiency from investments like Citi Token Services. These higher forecasts illustrate how widely investor expectations can vary, especially given continued uncertainties around regulatory costs and economic conditions. Take time to consider the range of views and how they might shift after this latest news.

Explore 12 other fair value estimates on Citigroup - why the stock might be worth 23% less than the current price!

Build Your Own Citigroup Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Citigroup research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Citigroup research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Citigroup's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives