- United States

- /

- Banks

- /

- NYSE:C

Citigroup (NYSE:C) Appoints Jonathan Moulds As Non-Executive Director To Oversee Risk Management

Reviewed by Simply Wall St

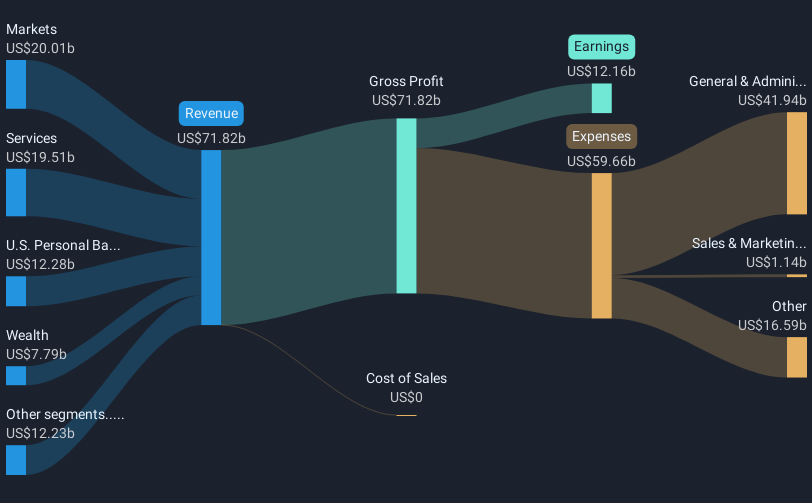

Citigroup (NYSE:C) recently appointed Jonathan Moulds as a Non-Executive Director, enhancing its leadership with significant industry expertise. This, along with other notable executive appointments during the last quarter, added credibility to the company's strategic direction and governance. As Citigroup's share price rose by 9% over the last quarter, the broader market also saw a similar trend with a 9.9% increase over the past year. The company's successful strategies, substantial earnings growth, consistent dividends, and extensive share repurchase program likely aligned with overall market performance, complementing these broader market dynamics without dramatically diverging from them.

Buy, Hold or Sell Citigroup? View our complete analysis and fair value estimate and you decide.

The recent appointment of Jonathan Moulds as a Non-Executive Director at Citigroup could enhance the company's strategic governance, potentially bolstering its client confidence and market position. Given that Citigroup's total return, including dividends, was 86.77% over the past three years, this leadership change might further solidify the company's trajectory amidst its ongoing transformation initiatives. The strategic focus on AI and wealth management upgrades aligns with the expectations of revenue and net margin improvements, potentially influencing future earnings growth.

Over the last year, Citigroup outperformed the US Market, which delivered a return of 9.9%. However, with its shares currently trading at US$69.47, the stock is viewed as below the consensus analyst price target of US$85.10, suggesting an opportunity for upside in alignment with positive projections. In relation to the market, despite past impressive returns, Citigroup's future growth assumptions could be impacted by broader economic uncertainties and evolving regulatory landscapes.

The integration of AI and modernization may bolster operational efficiency, supporting the projected revenue climb to US$91.30 billion as suggested by bullish analysts. However, potential changes in the economic environment or credit portfolios could pose risks to these forecasts. As the company actively works to optimize cost structures and increase noninterest revenues, the new executive leadership signals a commitment to these growth avenues, which if successful, could justify the higher fair value target proposed by the bullish analyst cohort.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives