- United States

- /

- Banks

- /

- NYSE:BOH

Lower Inflation Readings and Rate Cut Hopes Could Be a Game Changer for Bank of Hawaii (BOH)

Reviewed by Sasha Jovanovic

- Bank of Hawaii and several other regional banks saw increased investor optimism in the past week after a lower-than-expected inflation report boosted hopes for potential Federal Reserve interest rate cuts.

- This shift in rate expectations is important for lenders like Bank of Hawaii, as lower interest rates can ease funding costs and potentially spur loan demand.

- We’ll explore how heightened expectations for lower interest rates could impact Bank of Hawaii’s investment outlook and overall business narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Bank of Hawaii Investment Narrative Recap

To be a shareholder in Bank of Hawaii, you need to believe in the island economy’s stability and the resilience of local demand for financial services, even as its geographic and sector concentration remain sources of risk. The recent inflation report has fueled optimism about potential Federal Reserve rate cuts. While lower rates can benefit the bank by reducing funding costs and possibly spurring loan demand, the most significant short-term catalyst remains the direction of interest rates, while the biggest risk continues to be Hawaii’s concentrated economic exposure, this news does not fundamentally alter either. Among company developments, the board’s consistent commitment to dividends, even during uncertain quarters, stands out. Most recently, the announced quarterly dividend on preferred and common shares demonstrates ongoing confidence in capital strength and earnings consistency. This is particularly relevant amid shifting interest rate expectations, as reliable dividend payments can underscore stability when investors are weighing rate-driven catalysts. But even in the face of positive rate news, it is worth being aware that Bank of Hawaii’s high geographic concentration means...

Read the full narrative on Bank of Hawaii (it's free!)

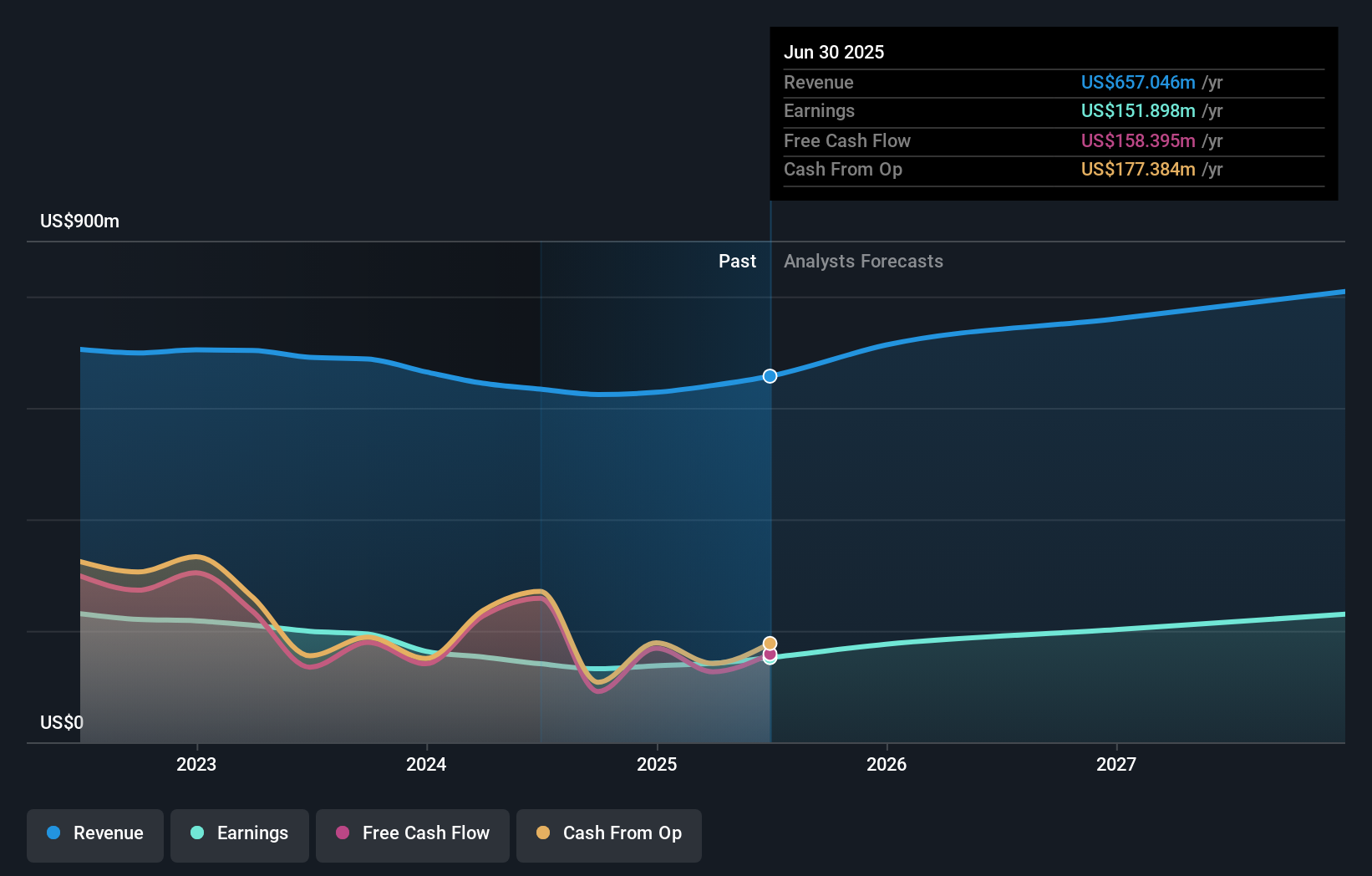

Bank of Hawaii's outlook anticipates $850.6 million in revenue and $251.7 million in earnings by 2028. This assumes a 9.0% annual revenue growth rate and an earnings increase of $99.8 million from the current $151.9 million.

Uncover how Bank of Hawaii's forecasts yield a $70.50 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have provided two fair value estimates for Bank of Hawaii, ranging from US$70.50 to US$106,031.19. In contrast, analysts continue to see the bank’s concentration in Hawaii as a core risk with broader implications for stability and long term growth, so it pays to review diverse opinions before making your own call.

Explore 2 other fair value estimates on Bank of Hawaii - why the stock might be a potential multi-bagger!

Build Your Own Bank of Hawaii Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of Hawaii research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Bank of Hawaii research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of Hawaii's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Hawaii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOH

Bank of Hawaii

Operates as the bank holding company for Bank of Hawaii that provides various financial products and services in Hawaii, Guam, and other Pacific Islands.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives