- United States

- /

- Banks

- /

- NYSE:BOH

Bank of Hawaii (BOH) Profit Margin Beats, Challenging Concerns Over Multi-Year Declines

Reviewed by Simply Wall St

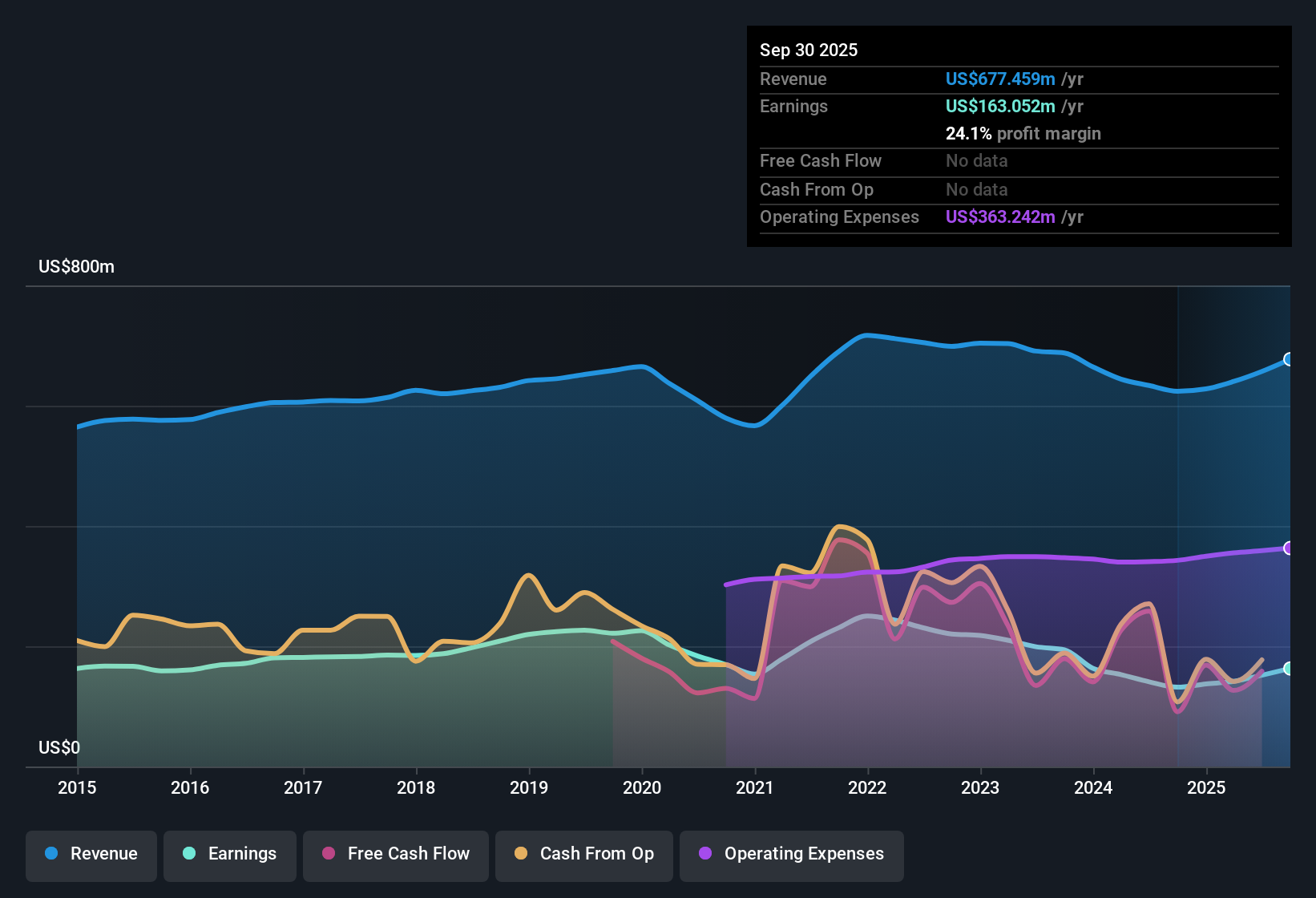

Bank of Hawaii (BOH) reported a net profit margin of 23.1%, up from last year’s 22.2%, with EPS growth over the past year hitting 7.8% compared to an average annual earnings decline of 7.8% over the last five years. Shares are trading at $64.07, notably below the estimated fair value of $94.9, but with a price-to-earnings ratio of 16.8x that stands above industry and peer group averages. Investors see improved profit quality, no notable risk factors, and three clear reward signals, signaling an overall positive turn for BOH’s latest period.

See our full analysis for Bank of Hawaii.The next section puts these headline figures side by side with the most widely followed community narratives, highlighting where the data confirms or contradicts the market’s expectations.

See what the community is saying about Bank of Hawaii

Profitability Outpaces Asset Growth

- Analysts project Bank of Hawaii's profit margins to climb from the current 23.1% to 29.6% over the next three years, even though revenue is only anticipated to grow 9% annually.

- Analysts' consensus view highlights that, while a stable deposit base and "fortress" local market help support the profitability outlook,

- continued investment in digital banking and wealth services is expected to enhance efficiency and revenue diversification. This may help mitigate pressure on growth from the slower revenue pace.

- The bank's high-quality loan portfolio and low credit losses preserve current earnings but also create dependence on local economic health for future upside.

- Consensus narrative suggests the latest operational improvements could reinforce Bank of Hawaii's reputation for stability and margin strength if current forecasts materialize. 📊 Read the full Bank of Hawaii Consensus Narrative.

Loan Book Leans Heavily on Local Real Estate

- 93% of Bank of Hawaii's loans are concentrated in Hawaii, with a large portion tied to real estate. This puts future asset quality at the mercy of local property demand and values.

- Consensus narrative notes this concentration provides resilience during strong periods:

- Migration trends and demand for housing have kept credit losses low and assets high-quality in recent years.

- This also heightens sensitivity to natural disasters, climate risks, or demographic shifts. Any of these factors could swiftly challenge earnings and net interest income.

Valuation Sits Between DCF and Market Consensus

- Bank of Hawaii trades at $64.07, well below its DCF fair value of $94.90 but just 3.4% under the consensus analyst target of $70.33. It currently has a 16.8x P/E ratio versus 11.2x for the industry and 13.3x for peers.

- Consensus narrative frames this pricing as reasonable, given expected growth in margins and earnings:

- The DCF fair value offers a more optimistic outlook premised on long-term earnings expansion.

- The consensus analyst price target implies current upside is modest unless future growth or valuation multiples outperform forecasts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bank of Hawaii on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your view and shape a fresh narrative in just a few minutes by clicking Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bank of Hawaii.

See What Else Is Out There

Bank of Hawaii’s heavy concentration in local real estate and muted revenue growth leave it exposed if property values or broader demand falter.

If you want steadier performance across different markets, try finding companies with proven consistency and stable expansion using stable growth stocks screener (2110 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Hawaii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOH

Bank of Hawaii

Operates as the bank holding company for Bank of Hawaii that provides various financial products and services in Hawaii, Guam, and other Pacific Islands.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives