- United States

- /

- Banks

- /

- NYSE:BOH

Bank of Hawaii (BOH): Exploring Current Valuation Following Recent Share Price Trends

Reviewed by Simply Wall St

Bank of Hawaii (BOH) shares have seen some movement lately, drawing investor attention as the company’s performance trends are weighed against its long-term results. Investors are now examining recent returns in context.

See our latest analysis for Bank of Hawaii.

Over the past year, Bank of Hawaii's share price has drifted lower, with a 1-year total shareholder return of -13.2%. This result hints at fading momentum, despite some modest short-term improvements. In recent weeks, only minor share price swings have occurred, suggesting investors remain cautious as they wait for stronger signals of growth or improved risk sentiment.

If you’re interested in discovering what else is drawing investor attention lately, now’s an ideal time to broaden your perspective with fast growing stocks with high insider ownership

With shares trading about 10% below analyst price targets and showing a significant discount to intrinsic value, is Bank of Hawaii currently undervalued or is the market already pricing in future growth prospects?

Most Popular Narrative: 9.8% Undervalued

With Bank of Hawaii last closing at $65.54, the most-followed valuation narrative suggests shares are priced nearly 10% below its estimated fair value. This presents a story defined by stable growth assumptions and deep local market strength, inviting scrutiny of what is really driving this gap.

Ongoing digital transformation and sustained investments in digital banking platforms are expected to enhance operational efficiency, improve customer acquisition and retention, and support controlled expense growth. These factors may help boost long-term net margins.

Want to know which key assumptions fuel this nearly double-digit discount to fair value? The narrative focuses on consistent profit growth, margin expansion, and the impact of digital innovation. Find out exactly how these factors come together to justify the upside potential cited here.

Result: Fair Value of $72.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Bank of Hawaii's heavy focus on Hawaiian real estate and local market reliance means that shifts in property values or the economy could quickly change the outlook.

Find out about the key risks to this Bank of Hawaii narrative.

Another View: What Market Multiples Suggest

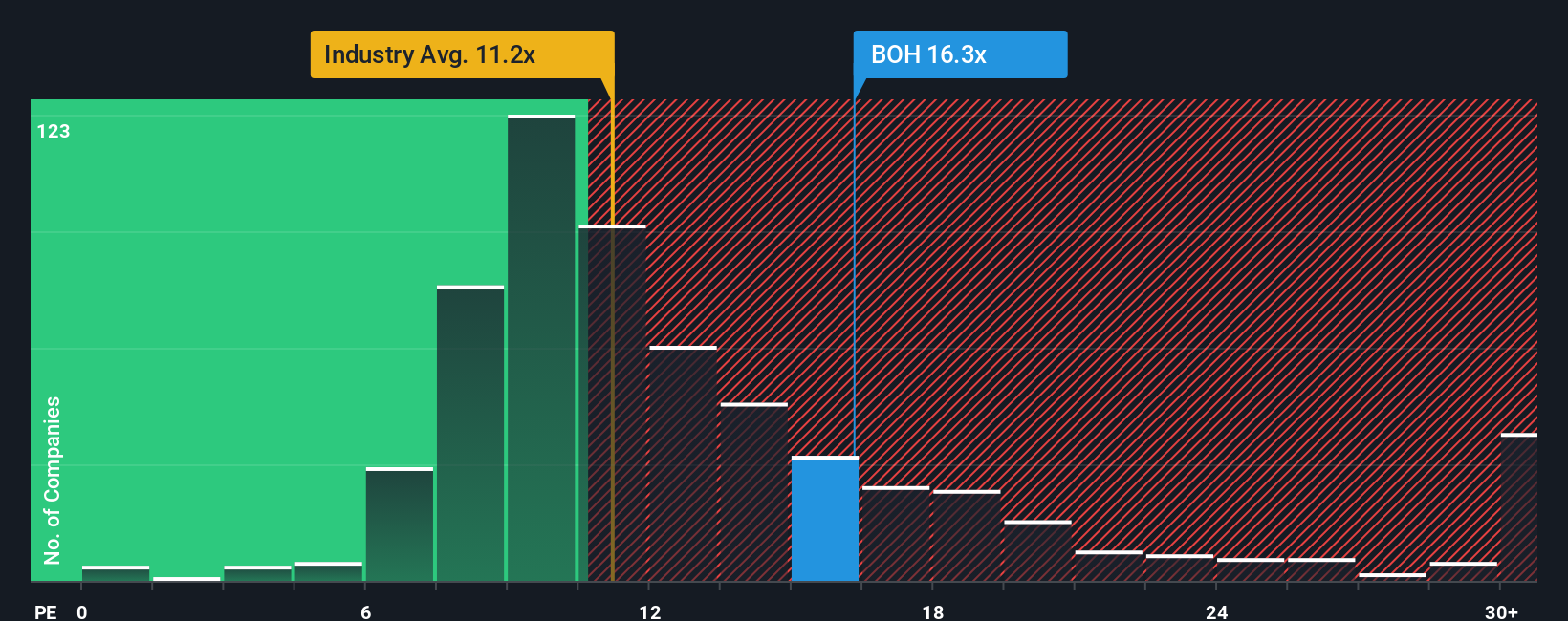

Looking through the lens of price-to-earnings, Bank of Hawaii currently trades at 16x earnings, which is higher than both the industry average of 11.4x and the fair ratio of 13.6x. This suggests the market may be placing a premium on the stock relative to peers. Does that mean higher expectations, or a risk if the outlook changes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bank of Hawaii Narrative

If you have a different perspective or prefer to analyze the numbers your own way, you can put together your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Bank of Hawaii.

Looking for More Smart Investment Ideas?

Stay ahead of the crowd by putting your capital to work in the sectors everyone’s buzzing about. Let Simply Wall Street’s expert screeners point the way to hidden gems and timely opportunities you don’t want to miss.

- Boost your portfolio with reliable income streams by finding these 15 dividend stocks with yields > 3% offering impressive yields above 3%.

- Target tomorrow’s innovators as you tap into these 25 AI penny stocks that are reshaping industries with transformative artificial intelligence and machine learning solutions.

- Secure strong upside by hunting for these 916 undervalued stocks based on cash flows the market may be overlooking based on robust cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Hawaii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOH

Bank of Hawaii

Operates as the bank holding company for Bank of Hawaii that provides various financial products and services in Hawaii, Guam, and other Pacific Islands.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026