- United States

- /

- Banks

- /

- NYSE:BKU

BankUnited (BKU) Margin Jump to 25.4% Reinforces Bullish Recovery Narrative

Reviewed by Simply Wall St

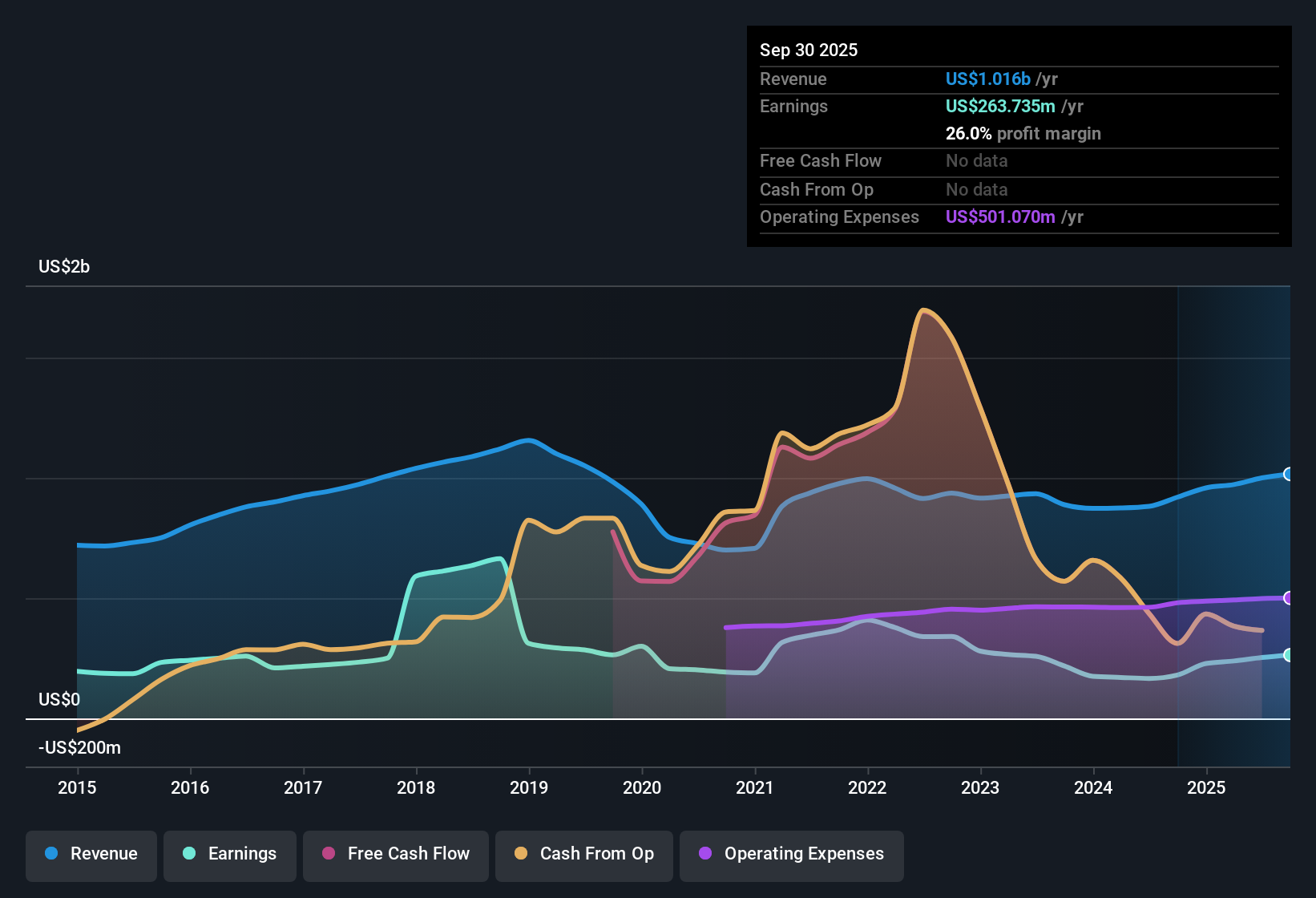

BankUnited (BKU) posted a net profit margin of 25.4%, up meaningfully from last year’s 18.8%, and delivered strong earnings momentum with a 52.5% rise over the past year. The turnaround in profitability, especially after a five-year stretch of 9.2% annual earnings decline, puts the spotlight on this quarter’s growth. Ongoing forecasts point to annual increases in both earnings and revenue at a mid-single-digit pace. Investors will likely welcome these results as a sign of restoring margin strength and a possible return to form for BankUnited.

See our full analysis for BankUnited.Now, let's see how BankUnited's results compare to the market narratives. Where do the latest numbers support consensus, and where do they raise new questions?

See what the community is saying about BankUnited

Margin Expansion Outpaces Market Growth

- BankUnited's net profit margin held strong at 25.4%, notably higher than the US banks industry average. Forecasts anticipate a modest decrease toward 22.6% in three years.

- Analysts' consensus view notes that this sustained high margin gives BankUnited a head start over regional peers, especially as long-term industry averages trend lower.

- They highlight that the margin strength supports continued capital returns. Future EPS is guided to rise from $4.07 in 2024 toward $291.8 million in profit by 2028.

Bulls and skeptics alike are watching to see if margin leadership persists as competition for deposits heats up.

📊 Read the full BankUnited Consensus Narrative.

Business Diversification Supports Profit Durability

- BankUnited is expanding into high-growth markets and investing in fee-based business lines. The company aims to decrease reliance on net interest income, which remains its primary earnings driver.

- Consensus narrative suggests that entry into areas like Charlotte and New Jersey, paired with new revenue streams from commercial card and capital markets activities, should widen the customer base and help cushion against interest rate swings.

- Analysts expect the company’s annual revenue growth rate of 8.9% over the next three years to outpace recent history, reflecting early wins from these diversification efforts.

Valuation Discount Versus Peers

- At a share price of $37.46, BankUnited trades at an 11.1x Price-to-Earnings ratio. This is lower than US regional bank peers at a 16x average and just under the US banks industry at 11.2x.

- Consensus narrative points out that this valuation gap could close if BankUnited meets earnings projections. Stock buybacks and consistent dividends may also enhance total returns for shareholders.

- However, the stock is still priced below its DCF fair value of $52.46, indicating room for future appreciation if execution stays on track.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for BankUnited on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Share your own analysis and shape the story in just a few minutes by selecting Do it your way.

A great starting point for your BankUnited research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While BankUnited's margins have improved, analysts highlight that its earnings growth outlook remains modest and may lag more stable and consistently expanding peers.

If steady performance is your priority, use our stable growth stocks screener (2094 results) to pinpoint companies delivering reliable revenue and profit growth through various market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BankUnited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKU

BankUnited

Operates as the bank holding company for BankUnited, a national banking association that provides a range of banking services in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives