- United States

- /

- Banks

- /

- NYSE:BANC

Banc of California (BANC): Valuation Spotlight After J.P. Morgan Upgrade and Optimism Over Cost Improvements

Reviewed by Kshitija Bhandaru

Investor sentiment in Banc of California (BANC) climbed Wednesday after a Wall Street upgrade. J.P. Morgan’s more optimistic view was driven by expectations for lower funding costs and the potential for further expense cuts at the bank.

See our latest analysis for Banc of California.

Banc of California’s shares have shown clear upside momentum following key positive catalysts, with Wednesday’s rally building on a broader recovery trend. The stock’s 1-year total shareholder return of 25.3% points to a strong turnaround, as investors respond to improving fundamentals and shifting risk perceptions in the sector.

If the recent move in BANC has you thinking more broadly, it might be the perfect moment to expand your search and discover fast growing stocks with high insider ownership

With shares rallying and analysts turning bullish, the question now is whether Banc of California is trading below its true value or if the current price already reflects all the expected future gains. Is there still a buying opportunity, or has the market already priced in the bank’s next phase of growth?

Most Popular Narrative: 6.2% Undervalued

Banc of California's fair value estimate, at $18.05, sits above its recent close of $16.92. This difference signals optimistic potential and sets the stage for a deeper dive into what is driving analysts’ positive stance.

Strategic merger integration and targeted lending shifts are enhancing profitability, stabilizing asset quality, and supporting above-peer revenue expansion.

Curious how bold cost-saving bets and a fresh business mix might remake this bank’s earnings path? The narrative is built on daring profit margin calls and an ambitious three-year outlook that breaks away from the industry pack. One key financial lever could shift everything. Discover where future value could come from and what number analysts are watching most closely.

Result: Fair Value of $18.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on regional real estate and rising deposit costs remain real risks. These factors could challenge Banc of California’s growth story ahead.

Find out about the key risks to this Banc of California narrative.

Another View: What Peers and Ratios Reveal

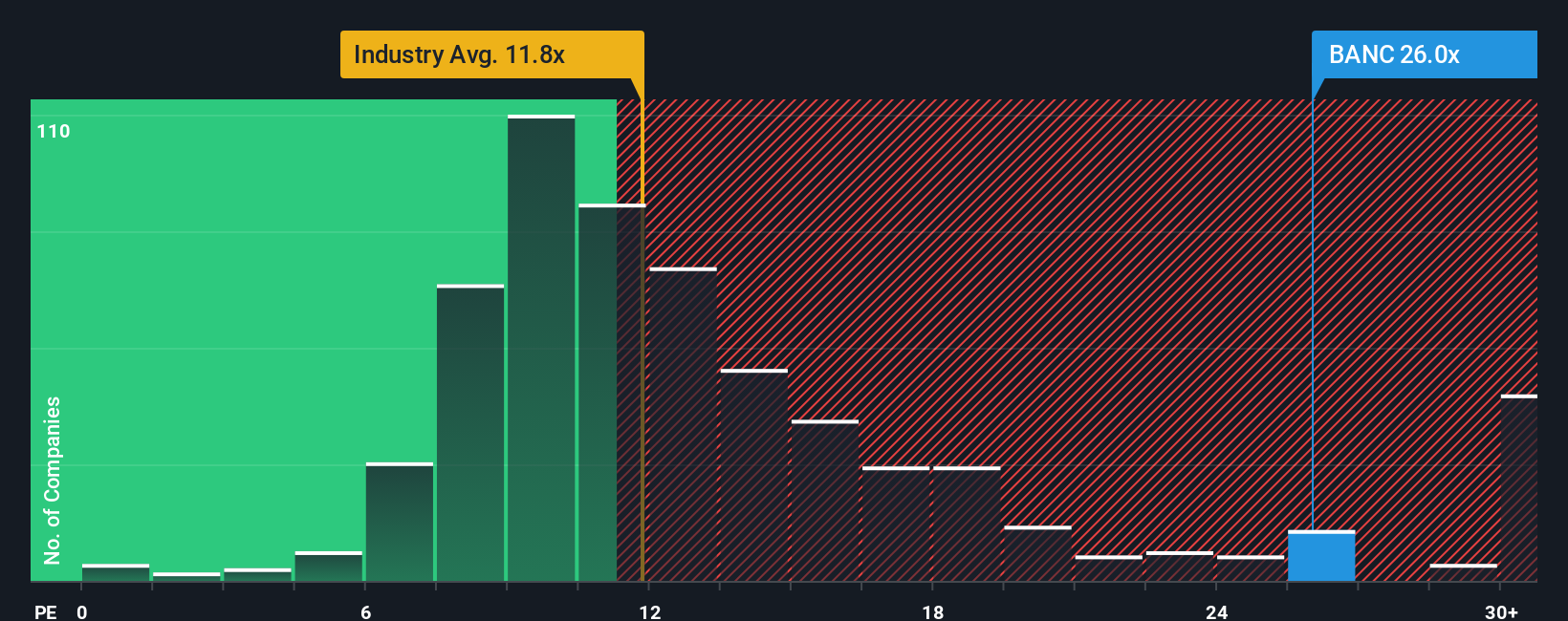

While our fair value assessment paints Banc of California as undervalued, the market ratio tells a different story. The bank trades at a price-to-earnings multiple of 24.7x, which is not only above its peer average of 19.7x but also significantly higher than the US Banks industry average of 11.8x. Compared to its fair ratio of 19.3x, the current premium signals a higher valuation risk if growth expectations fall short. So, is this optimism justified or could sentiment soon shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Banc of California Narrative

If the current analysis does not fit your perspective or you prefer digging into the numbers yourself, you can easily craft your own view in just minutes. Do it your way

A great starting point for your Banc of California research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next smart move and keep up with the markets by finding stocks that fit your goals, sector interests, or growth ambitions using these handpicked tools:

- Tap into tomorrow’s technology trends with these 24 AI penny stocks, which are fueling advances from automation to everyday innovation.

- Lock in potential regular income streams by reviewing these 19 dividend stocks with yields > 3%, designed to reward shareholders with yields above 3%.

- Spot undervalued gems before others catch on by checking out these 910 undervalued stocks based on cash flows, filled with companies trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banc of California might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BANC

Banc of California

Operates as the bank holding company for Banc of California that provides various banking products and services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives