- United States

- /

- Banks

- /

- NYSE:BAC

How Will Stablecoin Ambitions Impact Bank of America’s 2025 Valuation?

Reviewed by Bailey Pemberton

If you are eyeing Bank of America’s stock and wondering if now is the right moment to buy, hold, or even double down, you are not alone. Bank of America has long been a bellwether for the entire banking sector, and its latest price moves have given investors plenty to talk about. Just over the past week, the stock jumped 5.4%. Expanding the timeframe, it is up an impressive 15.8% year-to-date. That momentum appears even stronger if you look at the past three and five years, notching gains of 58.8% and a substantial 132.6% respectively. Yet, the past 30 days have been flat, hinting at some hesitation in the market as new headlines grab attention.

Part of the recent optimism seems tied to big-picture news, including the group of ten major banks—Bank of America included—exploring a move into stablecoins pegged to G7 currencies. This development signals that major financial institutions are not content to sit out the next wave of innovation in digital finance, which opens the door to new growth opportunities. At the same time, healthy competition for roles in anticipated blockbuster IPOs like Fannie Mae and Freddie Mac also underscores the institution’s clout and ambition.

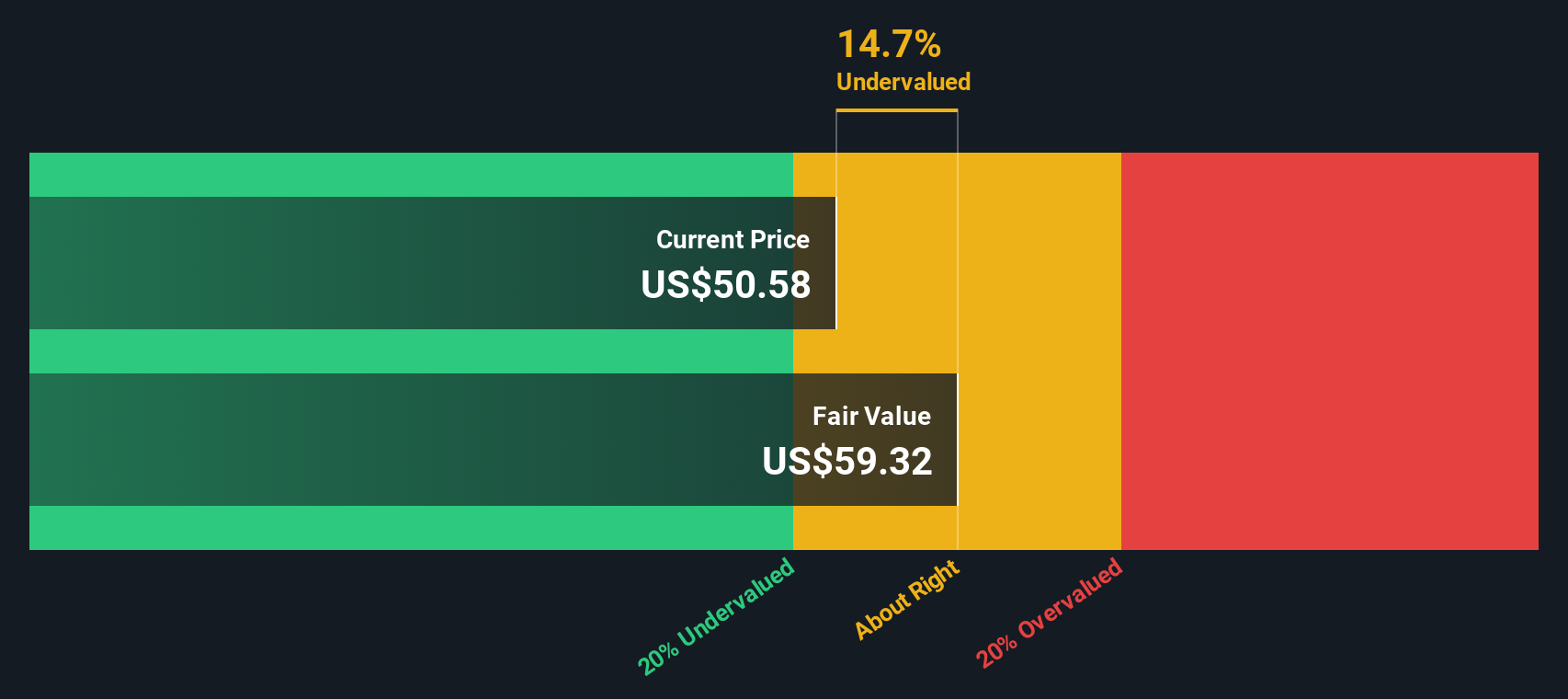

But with all the headlines and some big gains already in the bag, how does Bank of America stack up on valuation? Using a straightforward scoring system that checks whether the company looks undervalued based on six different criteria, Bank of America earns a score of 2. This suggests it may look attractively priced in a couple of areas, but not across the board. Still, not all valuation checks are created equal, and as we break them down, you may discover an even better way to judge whether this stock deserves a place in your portfolio.

Bank of America scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bank of America Excess Returns Analysis

The Excess Returns valuation model focuses on how much value a company generates above and beyond the cost of capital. Rather than relying solely on reported earnings, this approach looks at the returns Bank of America achieves on its invested equity, then subtracts the cost of equity to estimate the true “excess profit” generated for shareholders.

For Bank of America, analysts estimate a stable Return on Equity averaging 10.93%. With a Book Value per share of $37.95 and a Stable Book Value projected at $40.77, the company’s future earning capacity is grounded in consistently strong fundamentals. The model projects Stable EPS (earnings per share) at $4.45 and estimates the Cost of Equity at $3.35 per share. After deducting this cost from returns, Bank of America delivers an Excess Return of $1.10 per share. These figures are based on weighted future expectations from a range of Wall Street analysts.

Applying this analysis, the Excess Returns model estimates Bank of America’s intrinsic value at $62.26 per share. With the stock currently trading at a notable discount, the implied undervaluation stands at 17.6%. This suggests the market may be underestimating Bank of America’s earning power and growth potential based on its return on equity performance.

Result: UNDERVALUED

Our Excess Returns analysis suggests Bank of America is undervalued by 17.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

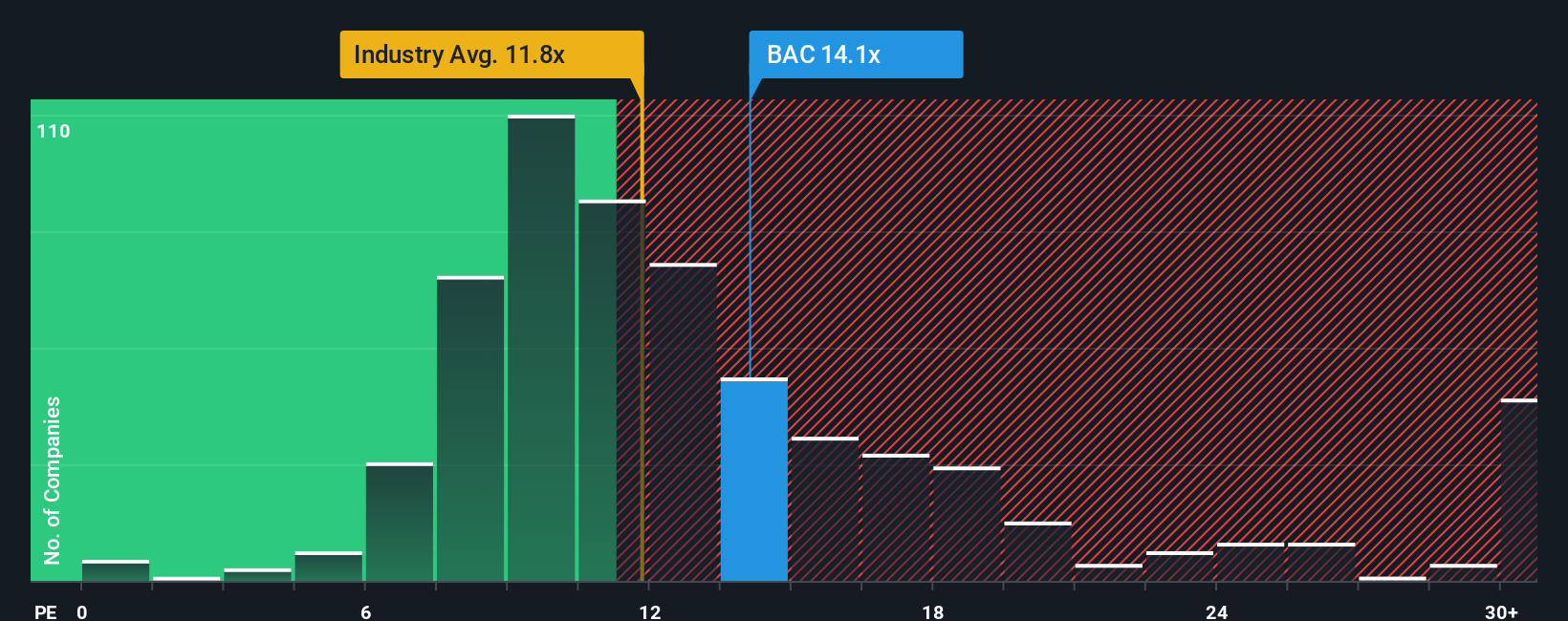

Approach 2: Bank of America Price vs Earnings

For well-established and profitable companies like Bank of America, the Price-to-Earnings (PE) ratio is a tried-and-true valuation tool. The PE ratio helps investors gauge how much they are paying for each dollar of a company’s earnings, making it especially useful when those earnings are stable and predictable.

The level at which a PE ratio appears fair, expensive, or cheap is influenced by two key factors: a company’s growth prospects and the risks it faces. Higher expected earnings growth or lower risk can justify a loftier multiple. Conversely, slower growth or greater uncertainty traditionally pull it lower.

Currently, Bank of America trades at a PE ratio of 13.3x. This sits just above the average for large U.S. banks (peer average is 12.9x), yet notably higher than the wider banking industry’s average of 11.2x. To get a more accurate picture, Simply Wall St’s proprietary “Fair Ratio” is estimated at 15.9x for Bank of America. The Fair Ratio accounts for many variables that static comparisons miss, including projected growth, risk profile, profit margins, the company’s size, and industry placement. This comprehensive approach helps investors avoid the pitfalls of making decisions based solely on simple peer or industry multiples.

When we compare the Fair Ratio of 15.9x to Bank of America’s current PE of 13.3x, the stock appears undervalued on this metric, trading below the level justified by its fundamentals and future prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

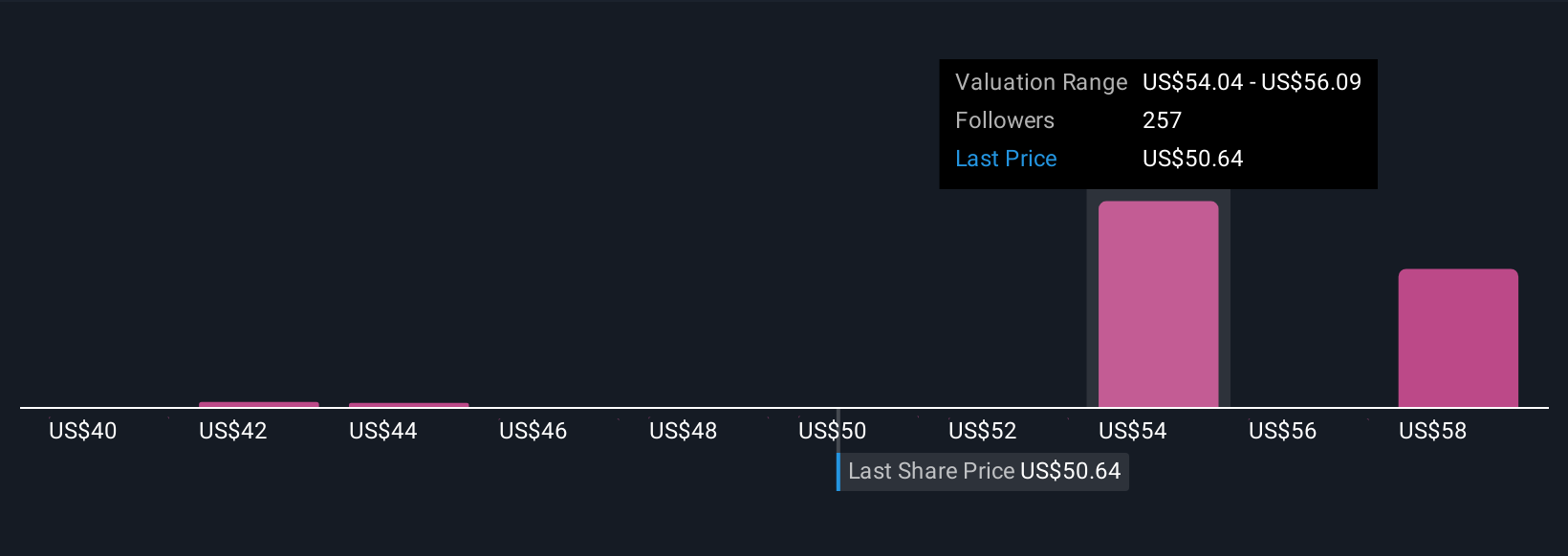

Upgrade Your Decision Making: Choose your Bank of America Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personalized story about a company, connecting your perspective, forecasts for revenue and earnings, and assumed fair value to a real financial outlook. This approach bridges the gap between the numbers and the reasons behind them, allowing you to map a company’s journey from story to forecasts to what you believe it’s worth. Narratives are simple to create and adjust on Simply Wall St’s Community page, where millions of investors compare and refine their views in real time alongside new headlines or earnings. By tracking how your Fair Value stacks up against the live share price, Narratives make it clear when it might be time to buy, hold, or rethink your position. For example, some investors might build a conservative Bank of America narrative capped by low loan growth and squeezed margins, placing their fair value near $43 per share, while a more optimistic peer focused on asset recovery, fee income, and buybacks could estimate fair value above $57. Narratives give you a living, dynamic framework to make better decisions with clarity and confidence.

For Bank of America, however, we'll make it really easy for you with previews of two leading Bank of America Narratives:

Fair Value: $57.23

Current Discount: 10.4%

Projected Revenue Growth: 6.6%

- Ongoing investment in digital engagement and AI is expected to enhance customer retention, drive revenue growth, and improve margins over time.

- Strategic management of assets and interest rates, combined with a high-quality and diversified credit portfolio, supports robust earnings growth and credit stability.

- Analysts see a modest upside from current prices, but note that risks such as economic uncertainty and rising litigation costs could weigh on future results.

Fair Value: $43.34

Current Premium: 18.4%

Projected Revenue Growth: 10.6%

- Despite strong brand, deposit growth, and digital transformation, Bank of America is vulnerable to rapid interest rate shifts and regulatory headwinds that could compress profitability.

- Berkshire Hathaway's recent measured reduction in its stake raises questions about long-term confidence and could influence market sentiment if selling accelerates.

- The current share price stands substantially above calculated fair value, suggesting the market may be too optimistic relative to sector risks and earnings prospects.

Do you think there's more to the story for Bank of America? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives