- United States

- /

- Banks

- /

- NYSE:BAC

Bank of America Shares Rise in 2025 as CEO Stability Calms Market Valuations

Reviewed by Bailey Pemberton

Wondering if it is finally a good time to buy, sell, or just hold on to those Bank of America shares? You are far from alone. Investors have been keeping a close eye on BAC, especially after a year that has seen its stock price flex some serious muscle. While there have been some recent bumps, such as a 3.3% decline over the last week, the stock still managed a positive 0.8% move over the past month, and it is up 14.0% year-to-date. Looking at a longer period, you’ll see a remarkable 28.8% return over the past year, and an impressive 77.7% and 124.8% gain over the past three and five years, respectively. Those kinds of numbers inevitably draw attention, and for good reason.

Some of this momentum traces back to headline-grabbing news. Whether it is speculation over CEO Brian Moynihan's timeline or involvement in major overseas investments, there is never a dull moment with Bank of America. The company continues to be a core player in both domestic and international finance, which means every boardroom move and government meeting can nudge the stock. Lately, hints of leadership transition and policy-level conversations have kept risk perceptions evolving.

But past performance is one thing; valuation is another. For investors trying to decide what comes next, the real question is whether Bank of America is truly undervalued at today’s prices. By standard valuation checks, BAC is scoring a 2 out of 6, meaning it only ticks two clear boxes for being undervalued right now. So, is the market overlooking something, or are the price gains justified? Up next, we will dive deeper into these valuation approaches, and later, share an even more insightful way to think about what BAC is really worth.

Bank of America scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bank of America Excess Returns Analysis

The Excess Returns model focuses on how much value a company creates over and above its cost of capital. Unlike other valuation models, it highlights whether management is delivering strong returns for shareholders. This makes it a particularly insightful fit for large financial institutions such as Bank of America.

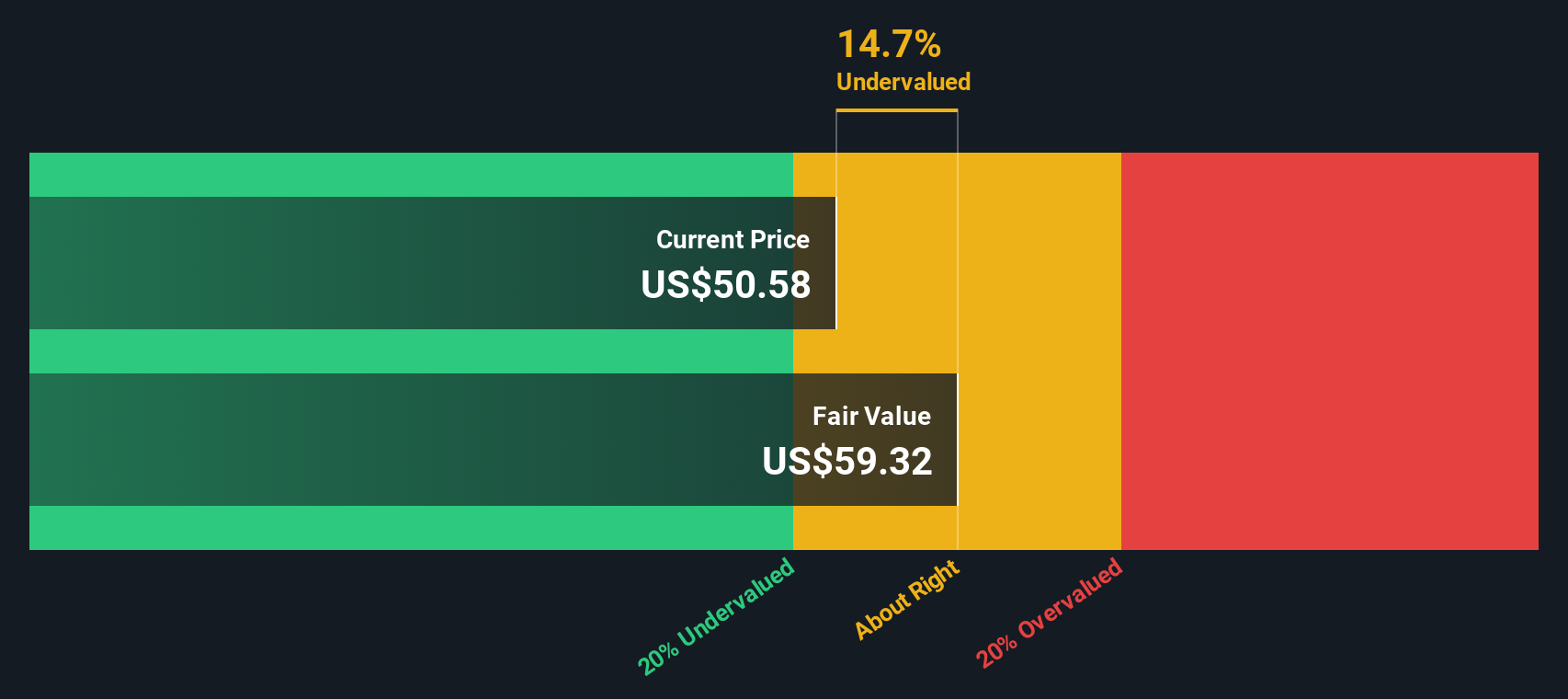

For Bank of America, the critical metrics tell a clear story. The company’s book value stands at $37.13 per share, while long-term projections estimate future book value to reach $40.41 per share. Analysts anticipate a stable Earnings Per Share (EPS) of $4.33, based on weighted future Return on Equity (ROE) estimates from 11 analysts. The cost of equity is $3.32 per share, resulting in an annual excess return of $1.02 per share. The average ROE is 10.72%, indicating the bank is generating healthy returns on its equity base.

Based on this excess returns methodology, the estimated intrinsic value of Bank of America is $60.26 per share. Currently, the stock trades at a level that implies a 16.2% discount to this valuation, suggesting it is undervalued at today’s prices.

Result: UNDERVALUED

Our Excess Returns analysis suggests Bank of America is undervalued by 16.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Bank of America Price vs Earnings

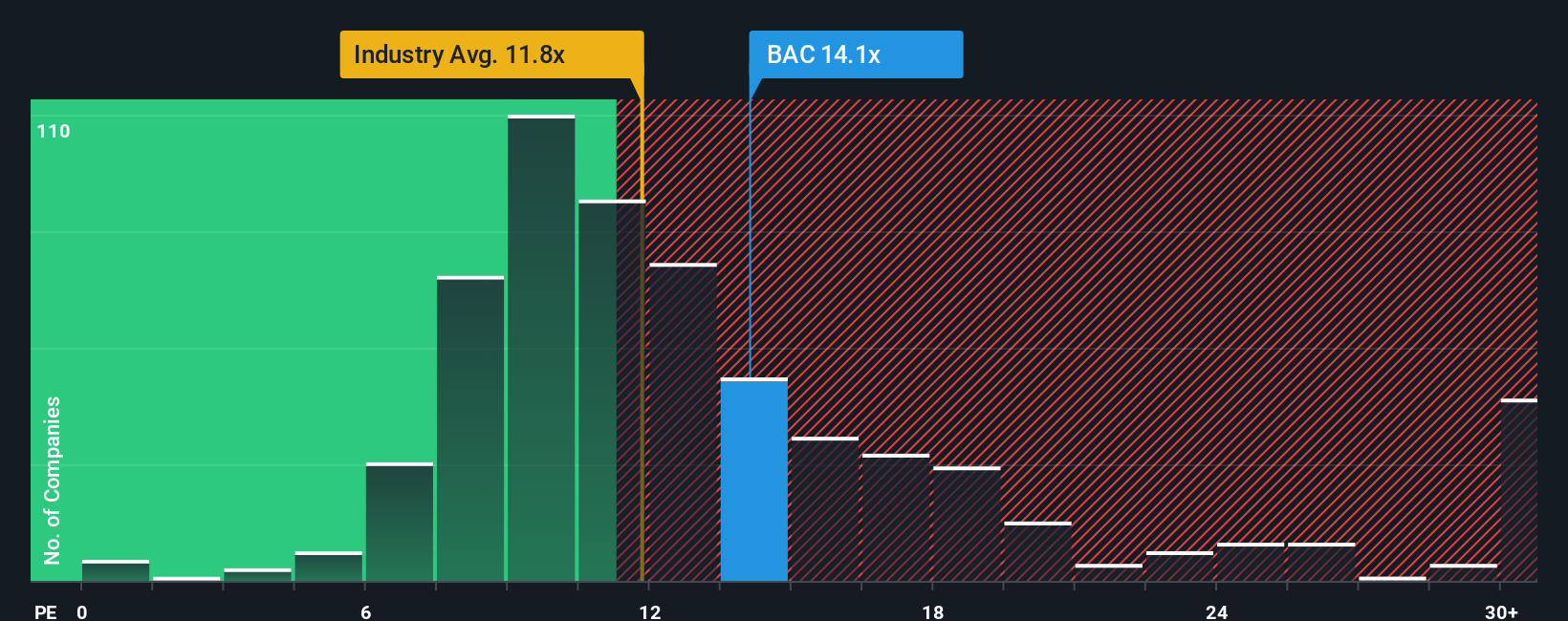

The Price-to-Earnings (PE) ratio is a reliable valuation metric for profitable companies like Bank of America because it directly ties the company’s share price to its underlying earnings. When a company generates steady profits, the PE ratio offers investors a clear sense of what they are paying for each dollar of current earnings.

A “fair” PE ratio can vary depending on both the anticipated growth of those earnings and the level of risk tied to the business. Higher growth rates justify higher PE ratios, while greater risks should bring that number down. Context is key.

Bank of America currently trades at a PE ratio of 14.06x. For perspective, the average PE among its peers is 13.96x, while the banks industry as a whole averages 11.68x. Simply Wall St’s proprietary “Fair Ratio” for Bank of America is estimated at 15.99x. This figure takes into account not just peer and industry metrics, but also the company’s earnings growth outlook, risk profile, margins, and market cap.

Relying on the Fair Ratio provides a more holistic picture, as it reflects the unique factors influencing Bank of America rather than just how it compares to competitors or broad industry standards. Since Bank of America’s current PE is about 1.93x below its Fair Ratio, the shares appear somewhat undervalued using this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

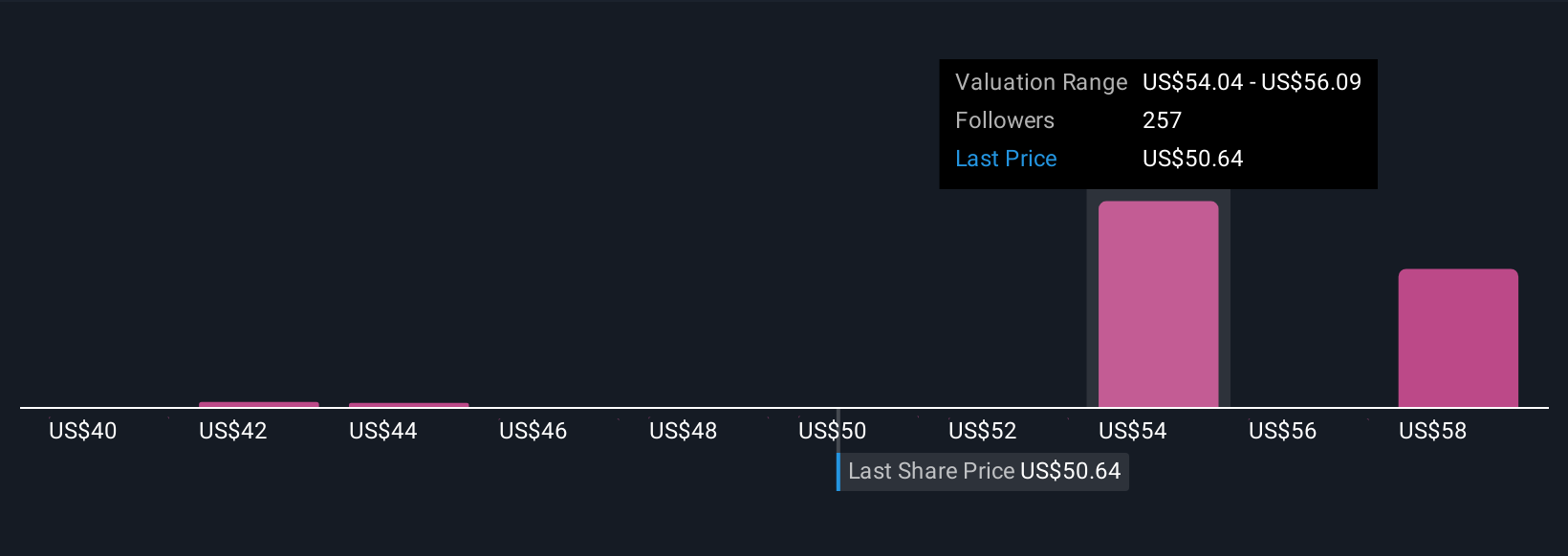

Upgrade Your Decision Making: Choose your Bank of America Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, dynamic story you create to capture your perspective on a company. Think of it as connecting the dots between a company’s future (like revenue and profit forecasts), your assumptions, and the resulting fair value estimate. Rather than getting lost in endless numbers, Narratives let you easily articulate what you believe about Bank of America, see how your views lead to a fair value, and then compare your fair value to the current share price to identify buy or sell opportunities. Narratives on Simply Wall St’s Community page are accessible and interactive, allowing millions of investors to adjust key assumptions and see instant updates when news or earnings arrive. For example, some investors build a “bullish” Bank of America Narrative projecting a fair value as high as $59 per share, while others take a more cautious stance and arrive at $41. This demonstrates how your own outlook and assumptions create a uniquely actionable view. Narratives empower you to make smarter, more personalized investment decisions as the story of Bank of America evolves.

For Bank of America, however, we'll make it really easy for you with previews of two leading Bank of America Narratives:

Fair value: $55.23

Currently 8.6% undervalued

Revenue growth rate: 7.4%

- Investment in digital engagement and AI is positioned to drive customer retention and support future revenue and margin growth.

- Analysts expect revenue to reach $122 billion and earnings to rise, with the share count falling due to buybacks.

- The consensus view is that the stock is fairly valued, with a price target just 6% above the current price. Risks include litigation costs and economic uncertainty.

Fair value: $43.34

Currently 16.5% overvalued

Revenue growth rate: 10.6%

- Although BAC maintains a strong position as a "Big 4" bank, rising valuations and Buffett's ongoing share sales have created mixed sentiment.

- The narrative projects moderate revenue and earnings growth, but also highlights risks from rapid interest rate changes, higher regulatory scrutiny, and potential economic downturns.

- While digital transformation is a positive, the valuation model suggests the current price is above a reasonable estimate. This points to caution on near-term upside.

Do you think there's more to the story for Bank of America? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives