- United States

- /

- Banks

- /

- NYSE:BAC

Bank of America (BAC): Valuation in Focus After Strong Q3 Earnings and Upbeat Guidance

Reviewed by Kshitija Bhandaru

Bank of America (BAC) just posted third-quarter results that outpaced expectations, driven by impressive consumer and investment banking strength. Net interest income climbed year over year, and management raised its guidance for the fourth quarter.

See our latest analysis for Bank of America.

Bank of America’s recent momentum is hard to ignore. After delivering a standout quarter and announcing new preferred dividends, the share price has climbed to $51.28, with a year-to-date share price return of nearly 16%. In the bigger picture, investors have enjoyed a robust 26% total shareholder return over the past year and a remarkable 136% total return over five years. This reinforces confidence even as headlines range from new bond offerings to fresh legal challenges and strategic M&A leadership.

If you’re interested in what else smart money is watching in financials and beyond, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares riding high and analyst targets only moderately above the current price, the central question now is whether Bank of America is still trading at an attractive value, or if the market has already priced in its next leg of growth.

Most Popular Narrative: 10.4% Undervalued

Bank of America’s most widely followed valuation narrative sets a fair value of $57.23, which is meaningfully above its last closing price of $51.28. This price gap highlights the underlying confidence from analysts in Bank of America’s forward growth and execution, even after an impressive run-up in the stock.

Bank of America's continued investment in digital engagement and AI-driven efficiencies is expected to enhance customer acquisition and retention, potentially increasing revenue and net margins over time. The company's focus on growing commercial loans and adding new clients, particularly in sectors like international markets and healthcare, suggests potential future revenue growth as these investments mature.

Want to understand what’s fueling this valuation jump? The narrative hinges on a bold mix of top-line ambition and margin optimism, with a controversial multiple that shows real conviction. Peek behind the curtain to see which assumptions are driving the price target and why analysts believe the future could look very different from today.

Result: Fair Value of $57.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, economic volatility or unexpected litigation costs could quickly shift the outlook. This could challenge growth expectations and put pressure on Bank of America’s future earnings trajectory.

Find out about the key risks to this Bank of America narrative.

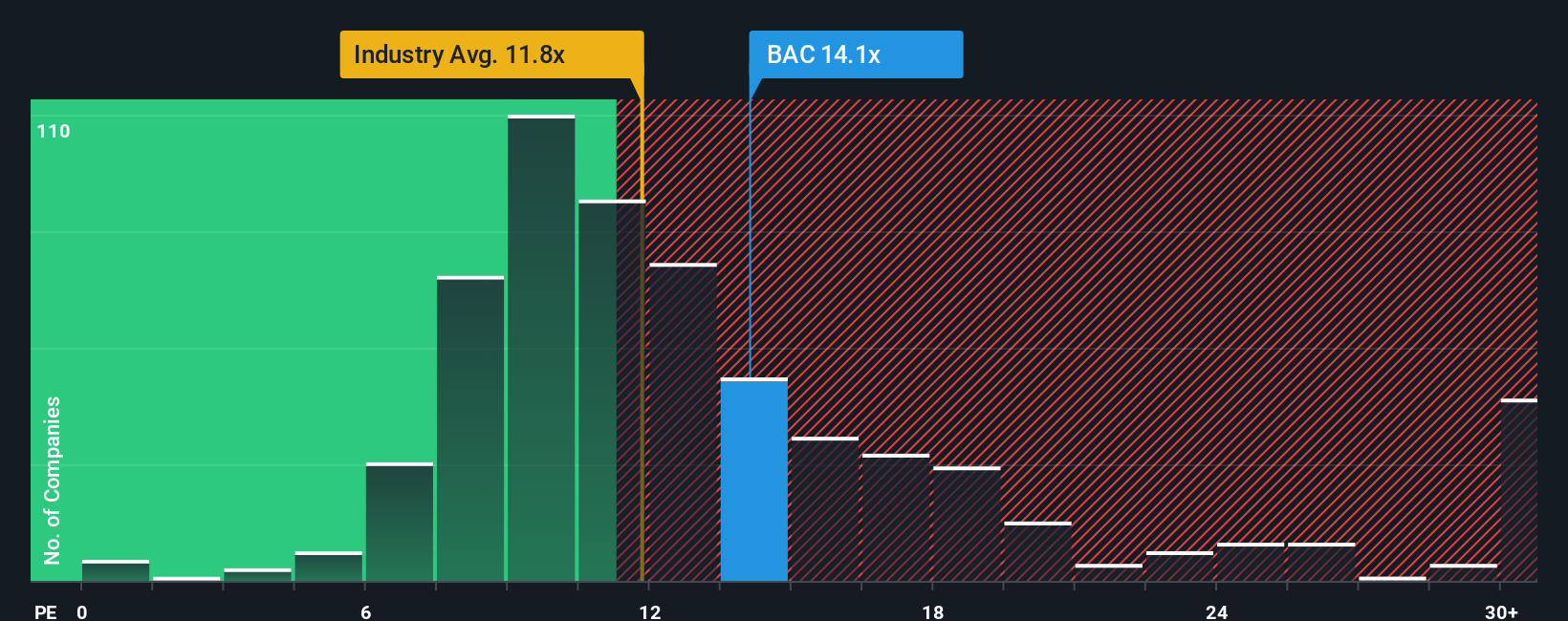

Another View: Measuring Value by Ratios

Looking through the lens of the market’s favored ratio, Bank of America trades at 13.3 times earnings, which is pricier than both its US Banks industry peers at 11.2x and the peer group average of 12.7x. However, it is still below the fair ratio of 15.9x for the business. This mix of signals means the stock carries some valuation risk if market sentiment shifts, but also leaves room for positive re-rating if confidence endures. Which will prove more persuasive as the market digests future results?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bank of America Narrative

If you want to dig deeper or see things differently, you can shape your own view by exploring the numbers yourself. It only takes a few minutes. Do it your way

A great starting point for your Bank of America research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take your investment journey further by targeting opportunities you might otherwise miss. Get ahead of the crowd with a tailored screener for your next move:

- Capitalize on market mispricings by targeting these 868 undervalued stocks based on cash flows that meet rigorous cash flow standards and offer serious upside potential.

- Earn reliable income by selecting these 18 dividend stocks with yields > 3% featuring yields above 3 percent and backed by strong fundamentals.

- Catch the next tech wave by reviewing these 33 healthcare AI stocks, where artificial intelligence intersects with advancements in medical innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives