- United States

- /

- Banks

- /

- NYSE:AUB

Atlantic Union Bankshares (AUB): A Fresh Look at Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

Atlantic Union Bankshares (AUB) stock has seen some movement recently, sparking investor interest as its current price trends nearly 8% below last month’s levels. This shift invites a closer evaluation of the bank’s overall trajectory.

See our latest analysis for Atlantic Union Bankshares.

Looking beyond this month’s dip, Atlantic Union Bankshares has seen its share price ebb and flow with shifting sentiment. Momentum has faded lately, but the stock’s five-year total return of 57.3% shows solid value creation for patient investors.

If bank stocks’ price swings spark your curiosity, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with Atlantic Union Bankshares’ share price now trading at a noticeable discount to analyst targets and solid recent earnings growth, the real question is whether there is hidden value waiting to be unlocked or if the current price already reflects all the future upside.

Most Popular Narrative: 20.8% Undervalued

The widely followed view among analysts suggests that Atlantic Union Bankshares trades well below its narrative fair value, despite recent price softness. This discrepancy has brought increased attention as the company’s fair value calculation sits notably higher than its latest closing price.

The company's geographic expansion into fast-growing markets in North Carolina, Maryland, and Northern Virginia, supported by recent acquisitions and plans to open 10 new branches in the Research Triangle and Wilmington. This positions Atlantic Union to capture increased population and economic growth in the U.S. Southeast, driving above-peer organic loan and deposit growth over the coming years and lifting revenues. The successful integration of Sandy Spring Bank and the sale of $2 billion in commercial real estate loans have reduced risk concentrations, freed up lending capacity, and expanded the company's customer base in markets with the lowest unemployment nationally. These factors support better credit performance, new fee income, and potential future earnings upside.

Want to know what’s fueling this valuation gap? The narrative hinges on bold growth forecasts, aggressive expansion plans, and a financial model that could upend consensus. Dive in to uncover the forward-looking numbers and see what’s really behind the analysts’ price target for AUB.

Result: Fair Value of $41.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, geographic concentration and challenges integrating new acquisitions could quickly undermine optimistic forecasts if local economies stumble or if integration costs escalate.

Find out about the key risks to this Atlantic Union Bankshares narrative.

Another View: Value Through Multiples Tells a Different Story

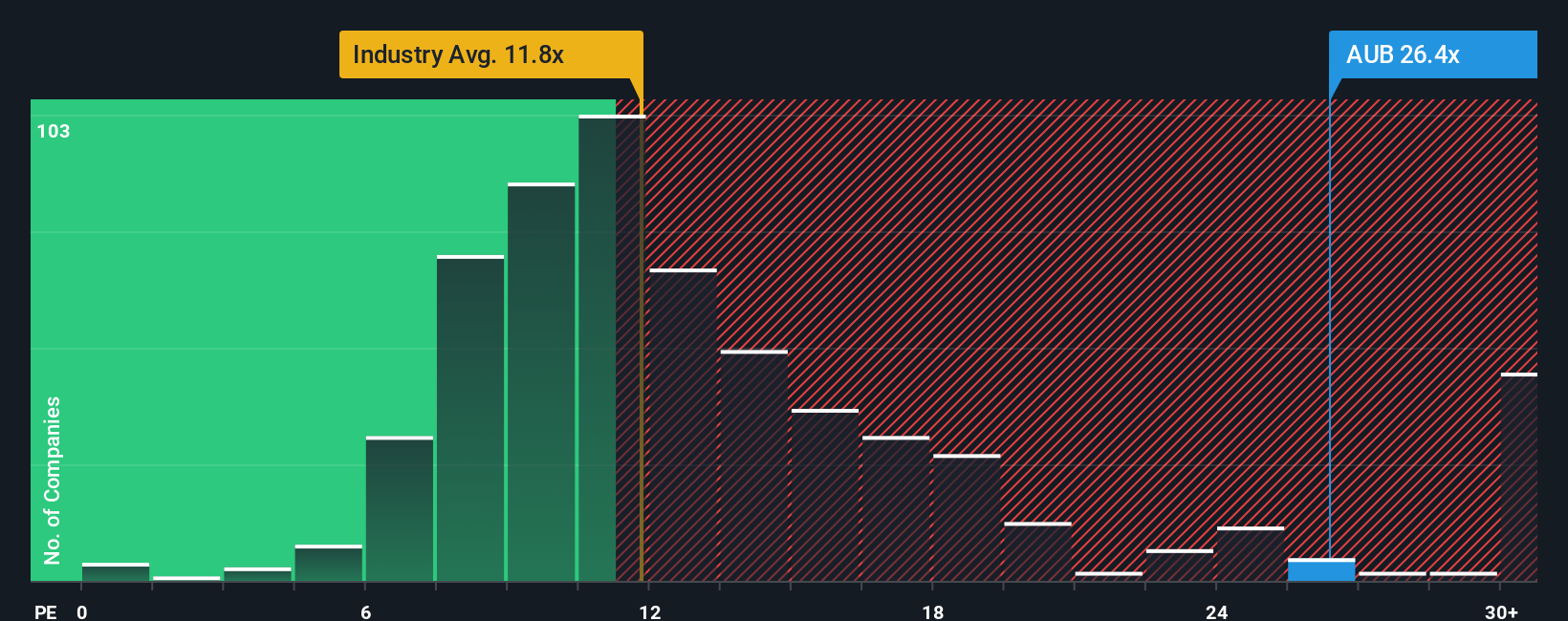

While the fair value method shows Atlantic Union Bankshares trading at a steep discount, its price-to-earnings ratio stands at 24.4x, which is much higher than both the US Banks industry average of 11.3x and the peer average of 12.5x. The fair ratio is estimated to be just 18.6x. This signals that, compared to its peers, AUB looks rather expensive by this metric. Could the premium signal optimism, or is there risk investors should watch out for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atlantic Union Bankshares Narrative

If you see the story differently or want to dig into the numbers yourself, it’s simple to shape your own view in just a few minutes. Do it your way

A great starting point for your Atlantic Union Bankshares research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Ideas?

Skipping the next opportunity could cost you. Unlock tomorrow’s winners now. There are game-changing businesses out there, and the right screener can help you spot them faster.

- Zero in on growth stories by targeting these 27 AI penny stocks, paving the way in artificial intelligence and transforming entire industries with innovative solutions.

- Capture potential income by checking out these 17 dividend stocks with yields > 3%, focusing on companies with sustainable yields and strong histories of paying out to shareholders.

- Jump ahead of the crowd with these 80 cryptocurrency and blockchain stocks, putting you in front of dynamic companies benefiting from blockchain technology and digital asset trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AUB

Atlantic Union Bankshares

Operates as the bank holding company for Atlantic Union Bank that provides banking and related financial products and services to consumers and businesses in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives