- United States

- /

- Banks

- /

- NYSE:ASB

Should Investors Rethink Associated Banc-Corp After a 2.3% Monthly Drop?

Reviewed by Bailey Pemberton

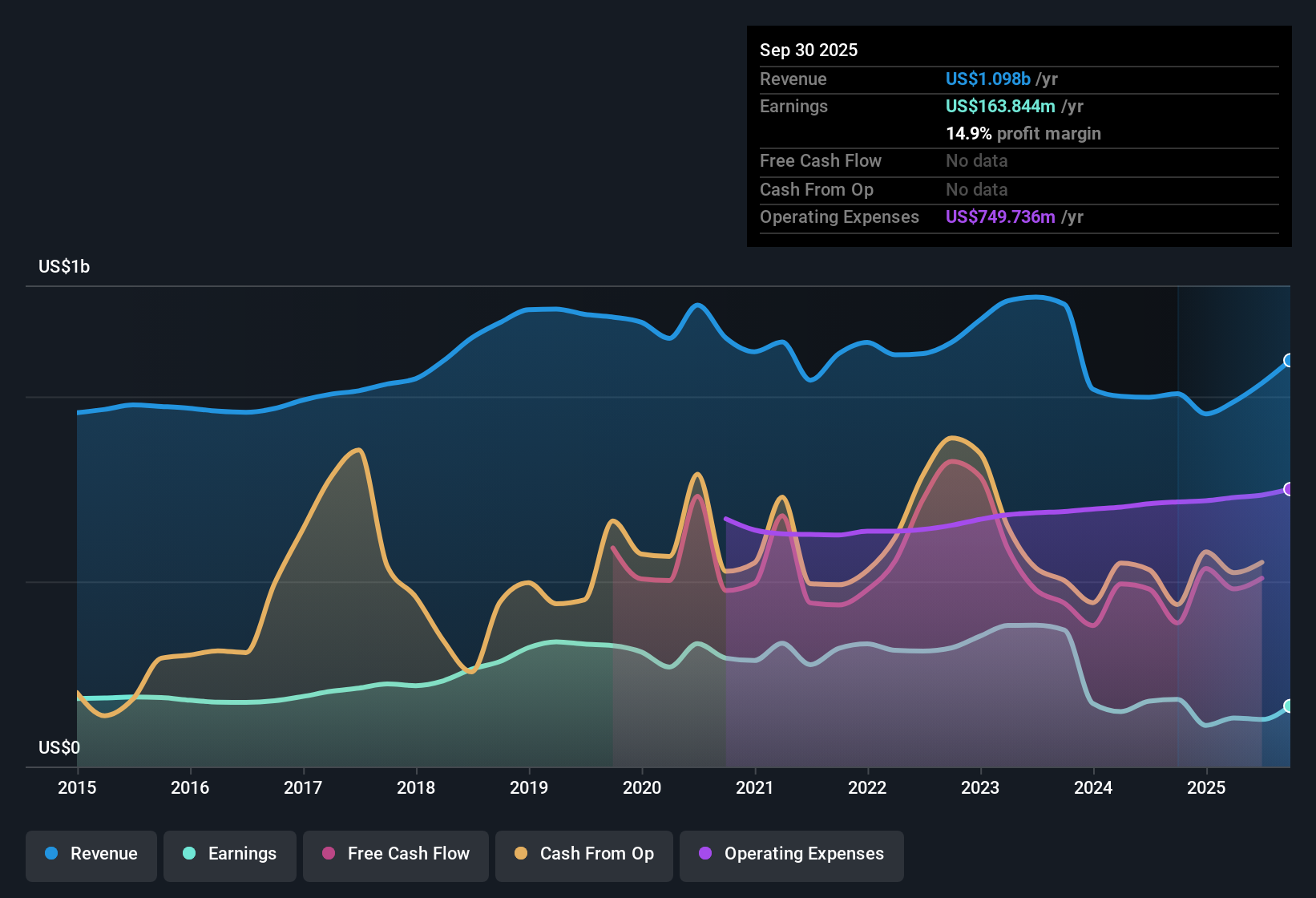

Thinking about what to do with your Associated Banc-Corp stock? You are not alone right now, especially as the share price has seen both its momentum and its story shift in recent months. After all, the company’s five-year return sits at a stunning 126.9%, showing what long-term conviction can yield. Yet, if you have only watched the stock over the past month, the drop of 2.3% may feel far less inspiring. Even so, Associated Banc-Corp is still up 6.9% on the year and an impressive 16.5% over the last twelve months. This suggests many investors are still betting on this regional bank’s continued evolution and resilience.

The market has reacted to changes across the regional banking sector, with policy updates and shifting sentiment weighing on risk perceptions. Associated Banc-Corp, in particular, has garnered attention for strategic initiatives focused on expanding digital services and streamlining operations. This has helped the bank build a reputation for adapting quickly to evolving customer needs, even as the sector overall faces questions about interest rate pressures and regulatory tweaks.

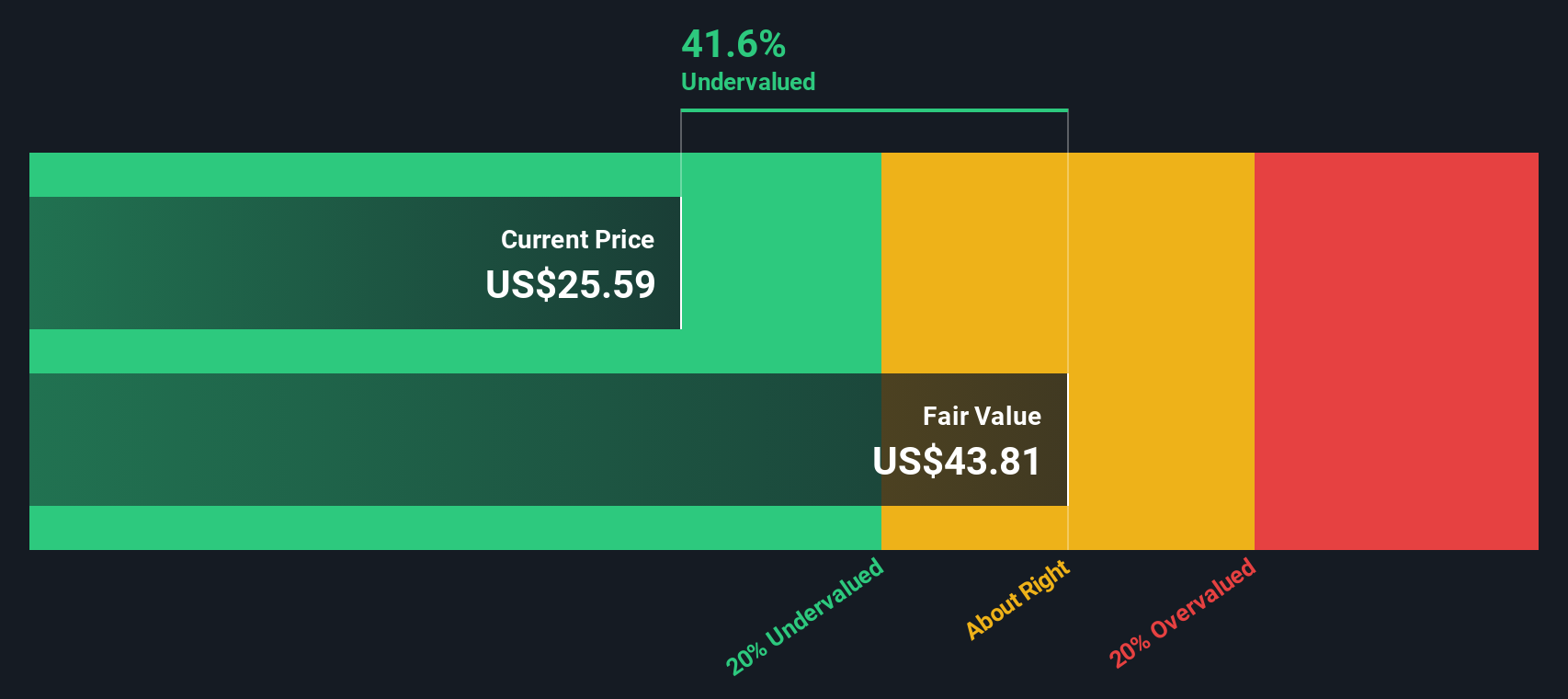

But is the stock truly worth its recent price tag? When we look at Associated Banc-Corp from a valuation perspective, it receives a score of 2 out of 6 possible checks for undervaluation. That means the company only meets two key criteria where it might be labeled undervalued. This is a signal that it might not be a textbook bargain, but also not dramatically expensive either.

Let’s unpack how analysts arrive at this valuation score and compare several different ways of sizing up a company’s worth. For those who want something beyond these checklists, we will also explore a smarter angle for understanding the real value behind Associated Banc-Corp by the end of this article.

Associated Banc-Corp scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Associated Banc-Corp Excess Returns Analysis

The Excess Returns valuation method looks at how much profit a company earns above its cost of equity capital. Simply put, it measures the extra value generated by reinvesting profits back into the business, rather than comparing earnings or cash flows alone.

For Associated Banc-Corp, analysts estimate a book value of $27.26 per share and project stable annual earnings per share at $2.81, based on return on equity forecasts from six different analysts. The cost of equity is calculated at $2.33 per share, so each year, the bank is generating excess returns of $0.49 per share. This represents the difference between what it earns on shareholder equity and the minimum return investors demand. Over the medium term, the average return on equity is expected to be 9.37%. The stable book value, factoring in ongoing performance, is forecast to rise to $30.05 per share.

Based on these figures, the Excess Returns model estimates the intrinsic value of Associated Banc-Corp at $40.44 per share. Compared to the current market price, this model implies the stock is trading at a 37.6% discount, highlighting significant undervaluation.

Result: UNDERVALUED

Our Excess Returns analysis suggests Associated Banc-Corp is undervalued by 37.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Associated Banc-Corp Price vs Earnings

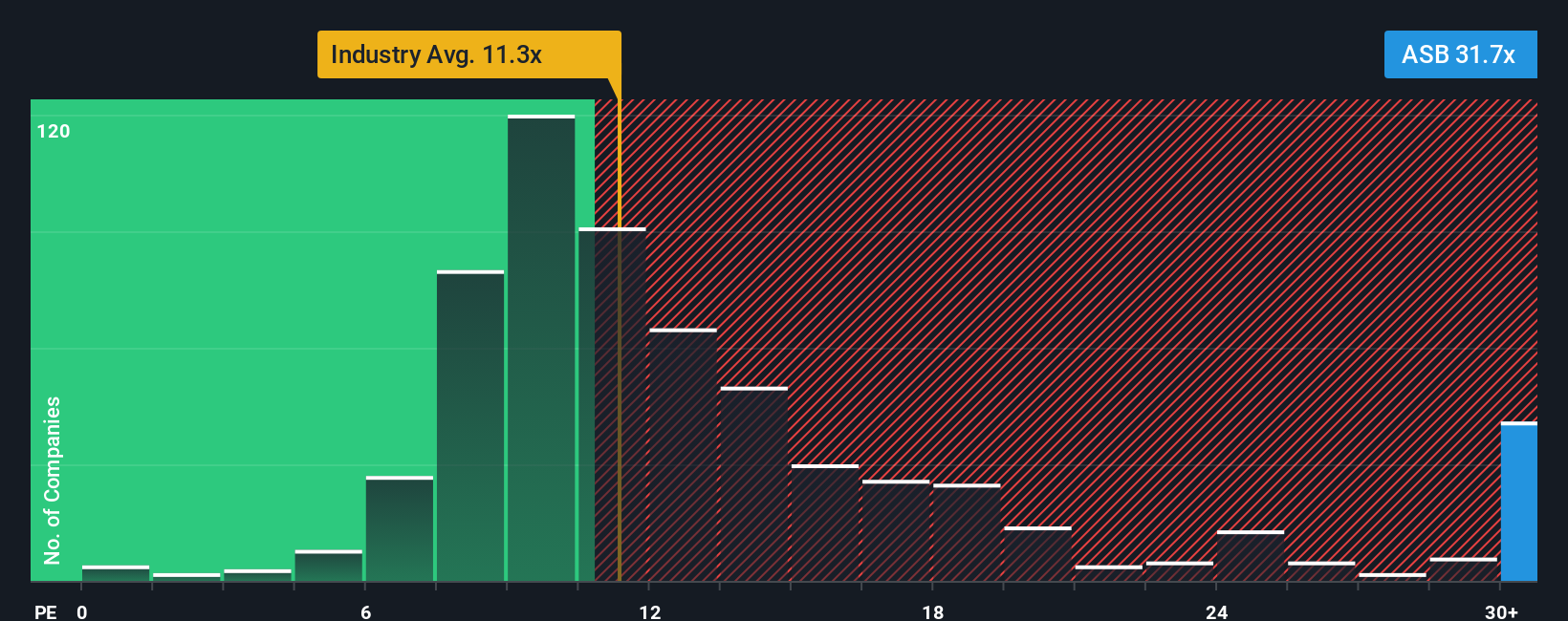

The price-to-earnings (PE) ratio is a well-known tool for valuing profitable companies like Associated Banc-Corp. This ratio makes it easy to compare a company’s market value to its current earnings, offering a quick view of whether investors are optimistic or cautious about future growth. Generally, higher growth expectations or lower risk will justify a higher "normal" or "fair" PE ratio. On the other hand, slower growth or heightened risks will typically drive it lower.

Associated Banc-Corp’s current PE ratio sits at 32.4x, well above both the average for banks in its industry (11.3x) and its peer group average (26.5x). At first glance, this could suggest the stock is somewhat expensive compared to other banks.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair PE Ratio of 19.6x is calculated by factoring in company-specific details such as earnings growth potential, profit margins, underlying business risks, and even its market cap. Unlike broad industry benchmarks, this approach makes the Fair Ratio more precise because it accounts for the bank’s unique strengths or vulnerabilities.

Comparing the actual PE of 32.4x to the Fair Ratio of 19.6x shows that the market is pricing the stock at a significant premium to what would be justified by the company’s fundamentals and sector outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Associated Banc-Corp Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. Simply put, a Narrative is your own story or perspective about a company. It ties together your view on Associated Banc-Corp’s future, including fair value and forecasts for revenue, earnings, and margins.

Rather than just following numbers or ratios, Narratives connect a company’s story to a financial forecast and then to a fair value. This approach makes investing more personal and adaptive to evolving information.

Narratives are quick and accessible on Simply Wall St’s Community page, where millions of investors regularly share their convictions, compare Fair Value to the current Price, and see when buying or selling makes most sense for them.

Because they automatically update with news, earnings, or major business developments, Narratives let you refine your thesis in real time as things change.

For instance, among Associated Banc-Corp’s live Narratives, one sees future growth in digital technology and disciplined management driving the stock toward $28.60. Another is more cautious and sees ongoing risks capping fair value below the current price.

Do you think there's more to the story for Associated Banc-Corp? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASB

Associated Banc-Corp

A bank holding company, provides various banking and nonbanking products and services to individuals and businesses in Wisconsin, Illinois, Missouri, and Minnesota.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives