- United States

- /

- Banks

- /

- NYSE:ABCB

What Ameris Bancorp (ABCB)'s Expanded $200 Million Buyback Program Means For Shareholders

Reviewed by Sasha Jovanovic

- Ameris Bancorp recently announced an expansion of its share repurchase program, increasing its authorization to US$200 million and extending the buyback period through October 31, 2026.

- This move underscores management’s confidence in the company’s balance sheet and aligns with ongoing efforts to enhance long-term shareholder value.

- We'll explore how this substantial share repurchase authorization reflects Ameris Bancorp’s emphasis on returning capital while pursuing regional growth.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Ameris Bancorp Investment Narrative Recap

To be an Ameris Bancorp shareholder today, you need to believe in the power of strong Southeastern market growth and the bank’s ability to convert that momentum into improving revenue and shareholder value. While the expanded share repurchase program highlights management’s confidence, it does not materially change the short-term catalyst, continued loan and deposit growth, nor does it offset the most immediate risk: the ongoing pressure on net interest margins from increased competition and volatile interest rates.

One recent development that connects closely to the repurchase news is Ameris Bancorp’s pattern of dividend increases throughout 2025, signaling a sustained commitment to direct capital returns. Both the enhanced buyback authorization and consistent dividend growth reflect a focus on rewarding shareholders, but sustaining these actions will continue to depend on Ameris's success in navigating margin pressures and maintaining their impressive earnings momentum.

However, in contrast to these returns, investors should also be aware of the heightened competition for deposits that could...

Read the full narrative on Ameris Bancorp (it's free!)

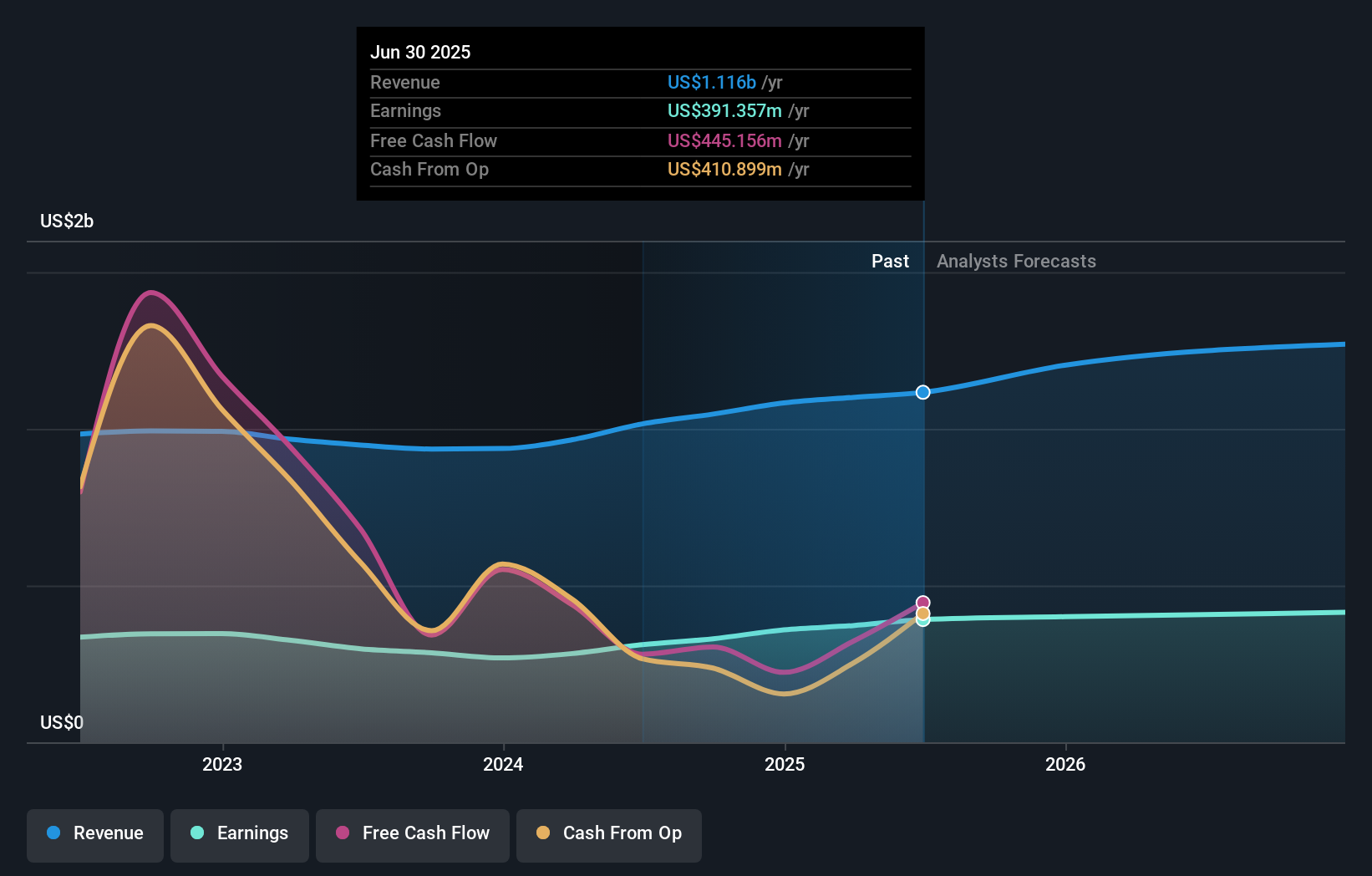

Ameris Bancorp's narrative projects $1.4 billion revenue and $438.2 million earnings by 2028. This requires 8.8% yearly revenue growth and a $46.8 million earnings increase from $391.4 million today.

Uncover how Ameris Bancorp's forecasts yield a $77.67 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Just one member of the Simply Wall St Community has set a fair value estimate of US$116.31 for Ameris Bancorp. This compares with consensus concerns about margin compression, highlighting how individual investor outlooks can vary widely even for a well-followed stock.

Explore another fair value estimate on Ameris Bancorp - why the stock might be worth just $116.31!

Build Your Own Ameris Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ameris Bancorp research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Ameris Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ameris Bancorp's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABCB

Ameris Bancorp

Operates as the bank holding company for Ameris Bank that provides range of banking services to retail and commercial customers.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives