- United States

- /

- Banks

- /

- NasdaqGS:ZION

Is Zions Bancorporation a Bargain After Recent 16% Drop?

Reviewed by Bailey Pemberton

If you are puzzling over what to do with Zions Bancorporation National Association stock, you are definitely not alone. The past month has been a bumpy ride, with the stock sliding 15.9% in just a week and 16.9% over the last 30 days. On the year, it is down a hefty 13.2%. For many investors, moves like these spark a closer look at what is really happening under the hood, whether the risk is rising or perhaps opportunity is quietly growing.

Despite those short-term dips, it is important to zoom out. Over the last five years, Zions stock is actually up an impressive 72.6%. Even the last three years show a solid 12.0% gain, hinting at longer-term resilience. Shifts in the broader banking sector and some market jitters have likely played into the recent volatility, but the fundamentals of Zions Bancorporation demand more attention.

Here is where things get interesting for the valuation-minded. The company earns a value score of 6, meaning that it is considered undervalued in each of the six standard valuation checks. For anyone who cares about catching quality at a discount, that number stands out.

But what do those six checks really mean, and are they enough for a confident decision? Let us walk through each approach, and then look at a way to assess value that might change how you view the whole idea of stock valuation.

Why Zions Bancorporation National Association is lagging behind its peers

Approach 1: Zions Bancorporation National Association Excess Returns Analysis

The Excess Returns model provides a focused way to evaluate how well a company generates value above the cost of its equity capital. Instead of just looking at profits or growth, this method zeroes in on how efficiently the management puts shareholders' money to work, measuring sustainable returns versus what investors require as a minimum return.

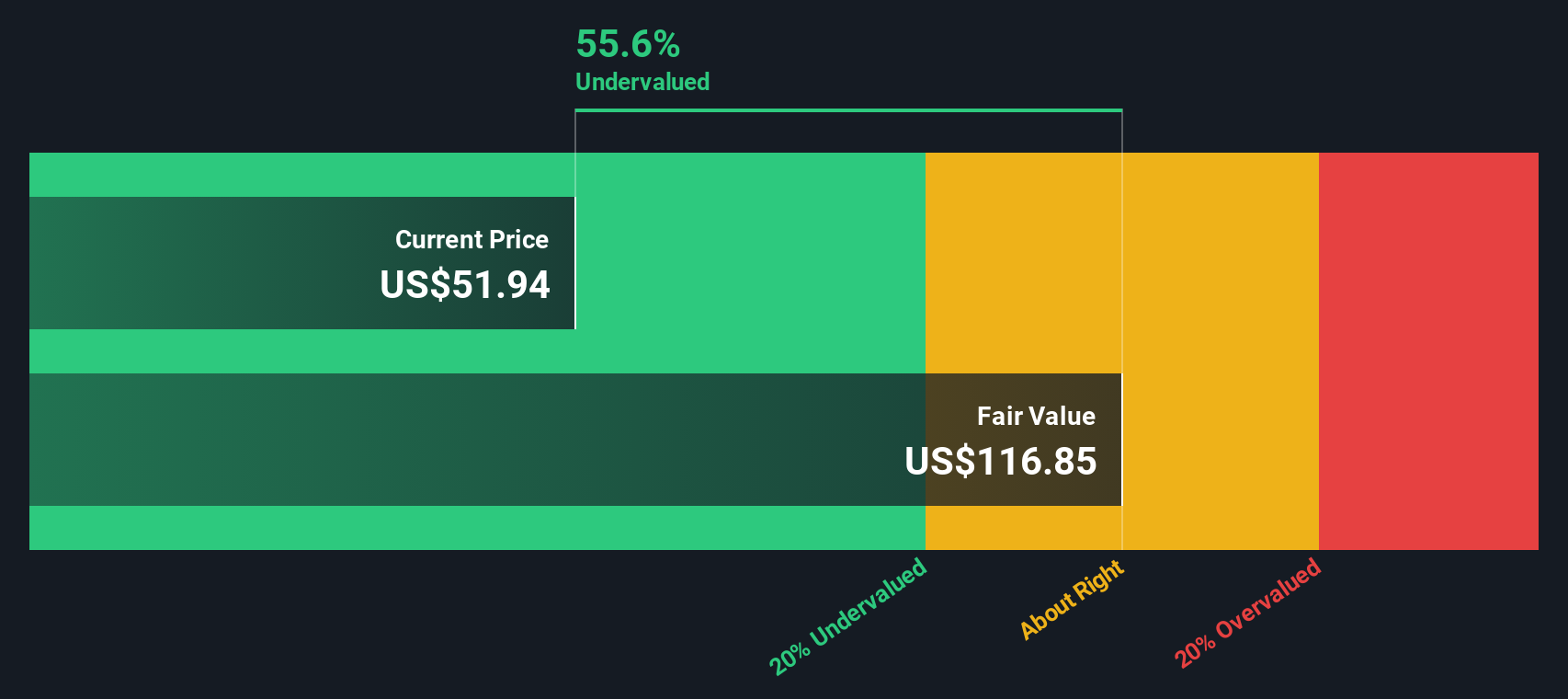

For Zions Bancorporation National Association, the numbers paint a compelling picture. The company has a Book Value of $44.24 per share and a Stable Book Value projection of $51.28 per share, based on future estimates from 11 analysts. The key earnings metric, Stable EPS, sits at $6.29 per share, informed by anticipated Return on Equity from 16 analysts. With a Cost of Equity of $3.87 per share, Zions achieves an Excess Return of $2.41 per share and an average Return on Equity of 12.26%.

This steady outperformance above the cost of equity signals that Zions is not just earning profits, but doing so more efficiently than required to reward shareholders. According to the Excess Returns analysis, the estimated intrinsic value for the stock is $105.26 per share, suggesting it is currently 55.4% undervalued compared to the market price.

Result: UNDERVALUED

Our Excess Returns analysis suggests Zions Bancorporation National Association is undervalued by 55.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Zions Bancorporation National Association Price vs Earnings

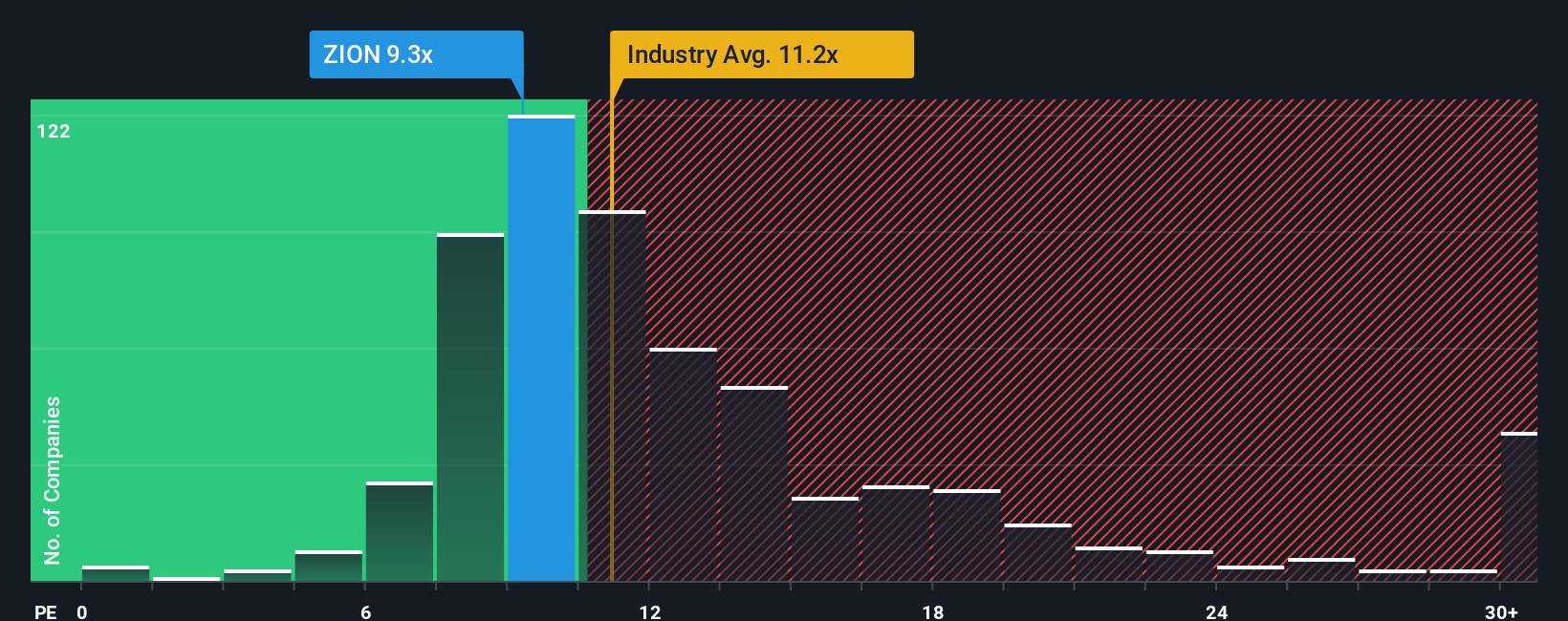

For profitable companies like Zions Bancorporation National Association, the Price-to-Earnings (PE) ratio is a classic and widely-used valuation metric. It shows how much investors are willing to pay for each dollar of company earnings, offering a quick sense of whether the stock is priced for growth, risk, or compelling value.

Typically, a "normal" or "fair" PE ratio will shift based on the company’s expected earnings growth and the risks the business faces. Higher anticipated growth or lower risk justifies a higher multiple. Slower growth or greater uncertainty should mean a lower ratio.

Right now, Zions Bancorporation National Association trades at a PE of 8.60x. That is noticeably below both the industry average PE of 11.25x and the peer average of 12.13x, which may suggest the market is cautious or overlooking something.

However, Simply Wall St's "Fair Ratio" gives a more refined view. This Fair Ratio, calculated at 12.60x for Zions, is tailored to reflect its individual earnings growth, industry backdrop, profit margins, market cap, and unique risk profile. Instead of a broad comparison with peers or the industry, the Fair Ratio provides a custom-fit multiple designed for the company’s real prospects.

Comparing the Fair Ratio of 12.60x to Zions’ actual PE of 8.60x implies the stock is currently undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Zions Bancorporation National Association Narrative

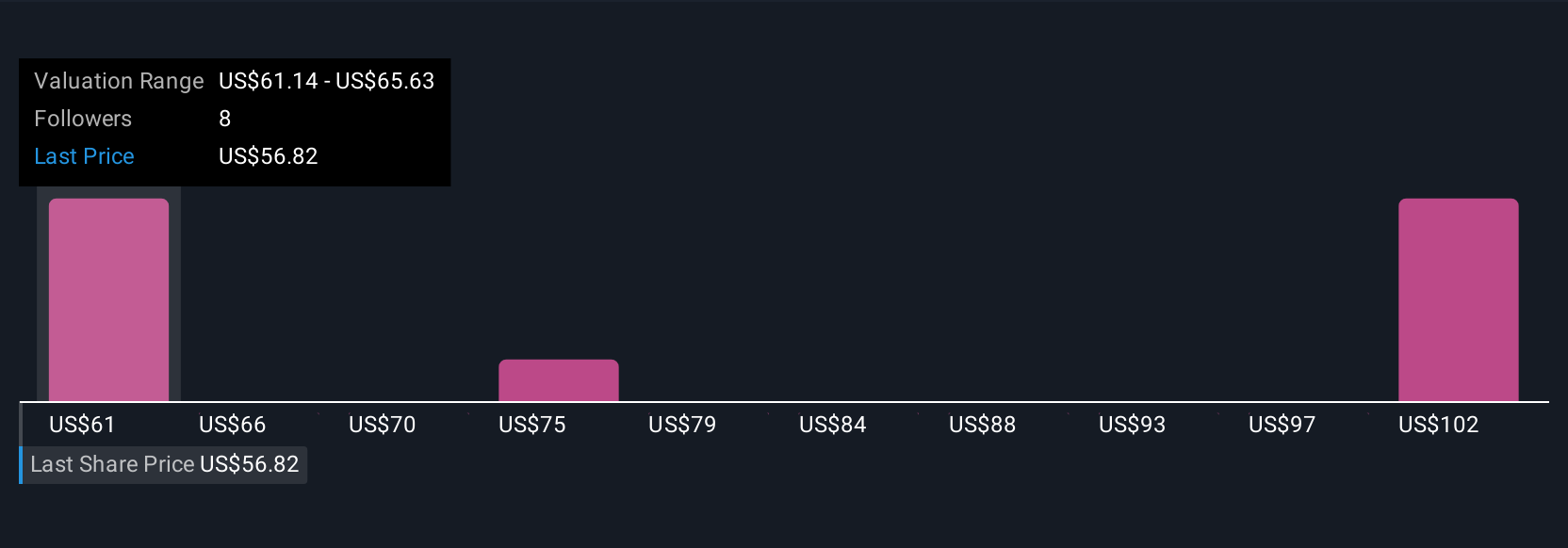

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives take investing beyond the numbers, allowing investors to define their own story about a company by pairing their expectations for fair value, revenue growth, and margins with their view of Zions Bancorporation National Association’s future.

In simple terms, a Narrative carefully connects the full story, from what is happening in the business and industry, through to financial forecasts, and finally to a fair value you believe is reasonable. On Simply Wall St’s Community page, investors can easily publish or explore Narratives, making this tool accessible and collaborative for millions of users.

Narratives help clarify exactly when a stock looks attractive. By comparing your estimated fair value against the current price, you can quickly see if there is a buy or sell signal. Because these Narratives update automatically whenever new news or earnings data arrive, your outlook stays current in a fast-moving market.

For example, with Zions Bancorporation National Association, some investors now argue the stock is worth as much as $69 per share, while others see fair value as low as $57. This is evidence that perspectives can vary widely depending on the story you believe and the forecasts behind your valuation.

Do you think there's more to the story for Zions Bancorporation National Association? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zions Bancorporation National Association might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZION

Zions Bancorporation National Association

Provides various banking products and related services primarily in the states of Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives