- United States

- /

- Banks

- /

- NasdaqGS:WTFC

What Wintrust Financial (WTFC)'s Dividend and Rising Charge-Offs Reveal About Its Credit Discipline

Reviewed by Sasha Jovanovic

- Wintrust Financial Corporation announced a quarterly dividend of US$0.5000 per share to be paid on November 20, 2025, with an ex-date and record date of November 6, 2025.

- Recently, the company disclosed that its net charge-offs rose to US$24.6 million in the third quarter ended September 30, 2025, reflecting a meaningful increase in credit-related losses compared to the previous quarter.

- We'll explore how the rising net charge-offs may influence Wintrust Financial's investment narrative in the context of ongoing credit trends.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

What Is Wintrust Financial's Investment Narrative?

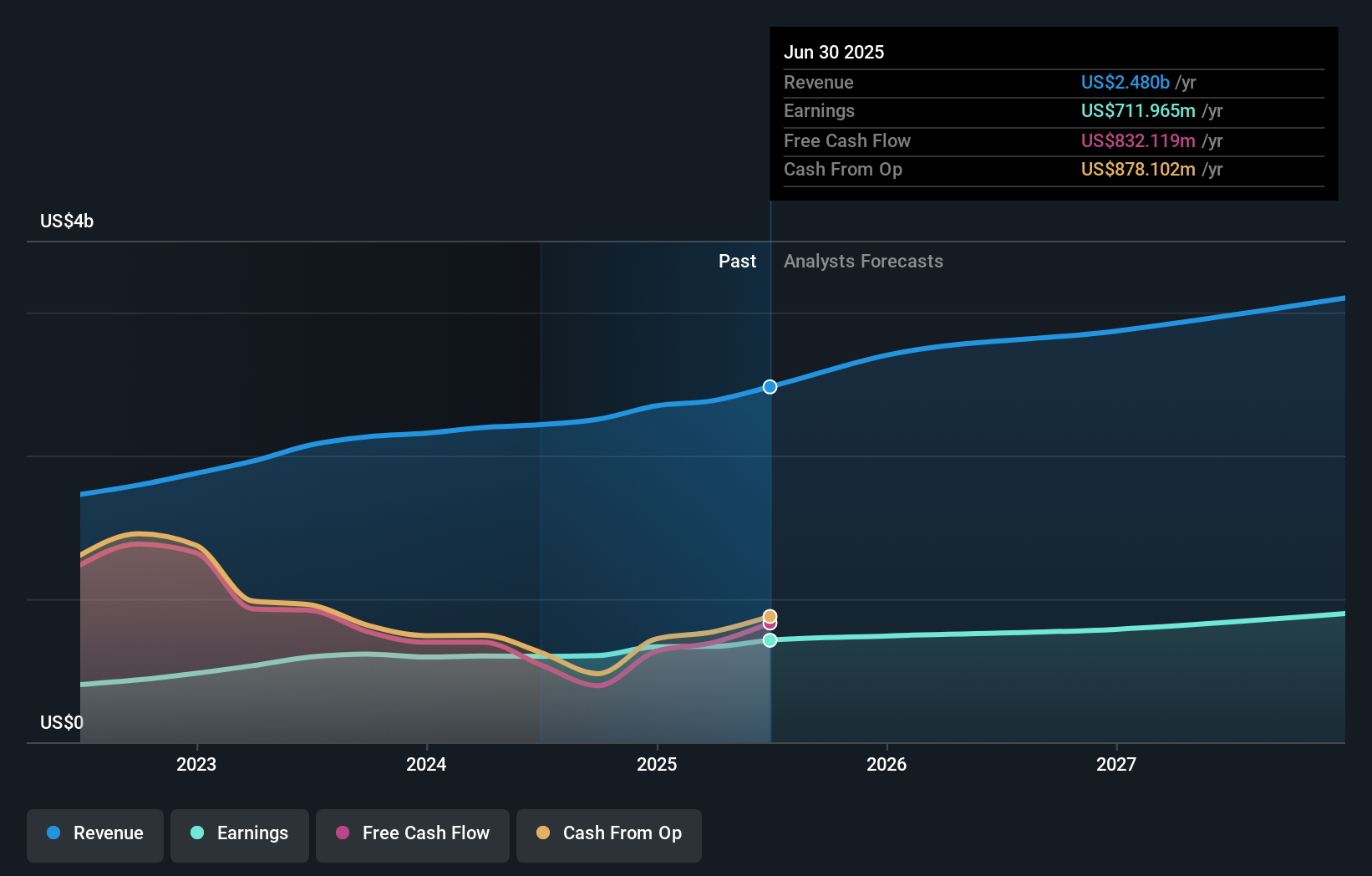

For shareholders of Wintrust Financial, the story typically revolves around steady earnings growth, consistent dividends, and a valuation that has been considered attractive compared to analyst fair value estimates. However, the recent jump in net charge-offs to US$24.6 million in the third quarter introduces a new wrinkle that may alter underlying risk assumptions. While previous analysis praised profit expansion and quality metrics, this significant rise in credit losses could challenge those views if it signals a broader trend in asset quality. The latest dividend affirmation suggests management remains confident, but in the near term, investors may need to watch for further deterioration in loan performance or management commentary signaling a shift in underwriting or loss reserves. If these issues persist or worsen, today’s catalysts for upside, such as analyst price target discount and historical profit growth, may take a back seat to renewed concerns over credit costs and earnings resilience.

Yet beneath the strong earnings, the spike in credit losses could have deeper roots worth understanding.

Wintrust Financial's shares have been on the rise but are still potentially undervalued by 44%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Wintrust Financial - why the stock might be worth just $153.55!

Build Your Own Wintrust Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wintrust Financial research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Wintrust Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wintrust Financial's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wintrust Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTFC

Wintrust Financial

A financial holding company, provides community-oriented, personal, and commercial banking services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives