- United States

- /

- Banks

- /

- NasdaqGS:WTBA

West Bancorporation (WTBA) Earnings Rebound Reinforces Bull Case on Value and Margin Recovery

Reviewed by Simply Wall St

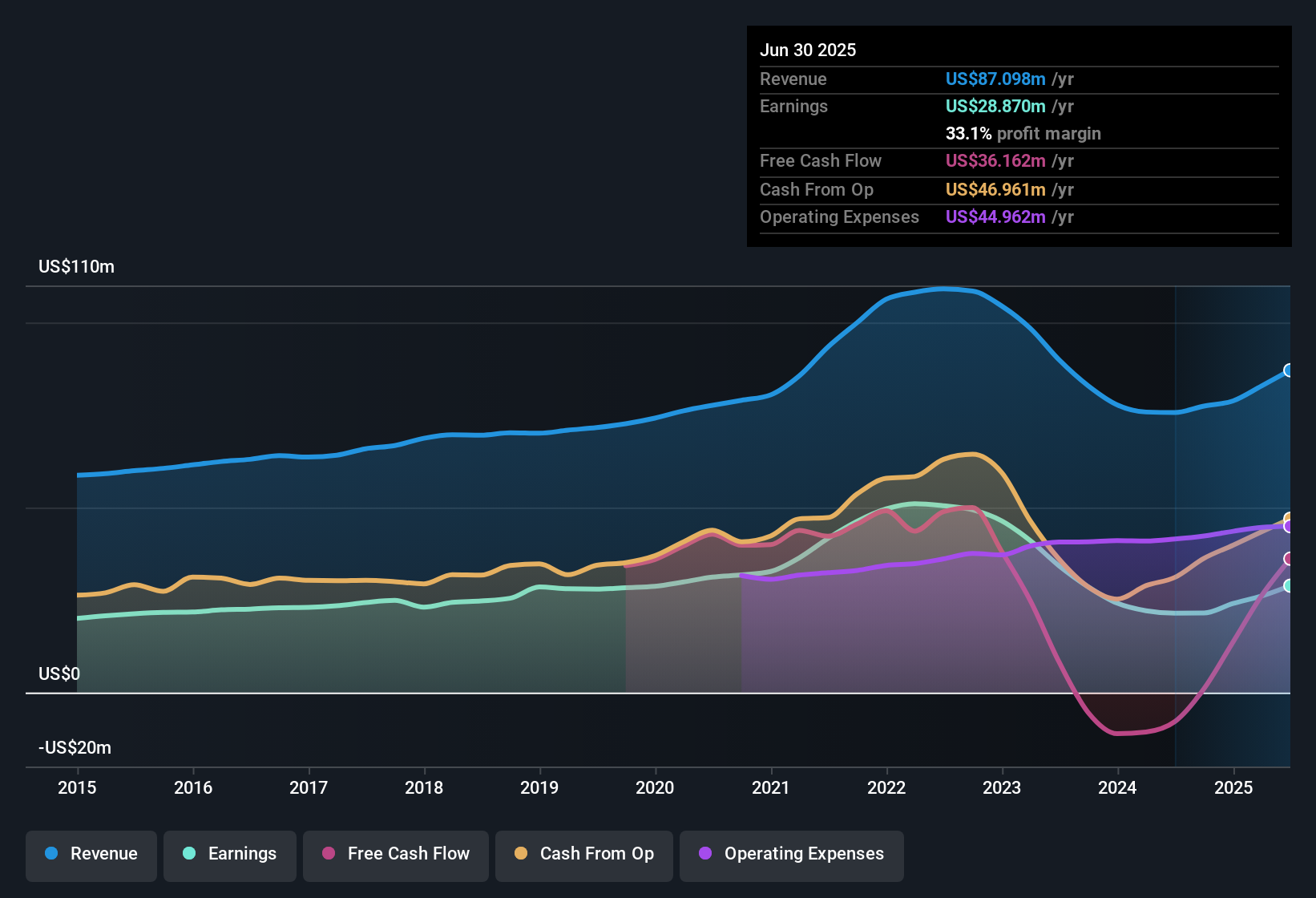

West Bancorporation (WTBA) posted a sharp turnaround this period with earnings growth of 34.7%, reversing a five-year average earnings decline of 12.6%. The company’s net profit margin rose to 33.1%, up from 28.3% last year. Shares trade at $20.52, below the estimated fair value of $25.38. Investors are likely to take note of the combination of improved earnings quality, attractive valuation, and a solid dividend. However, the absence of clear forward revenue and earnings growth expectations serves as the main risk in an otherwise rewarding setup.

See our full analysis for West Bancorporation.Next up, we’re putting these headline results side by side with the community narratives to see which stories hold up against the new numbers and where expectations might need a reset.

See what the community is saying about West Bancorporation

Deposit Growth Driven By Midwest Expansion

- Analysts forecast annual revenue growth of 14.5% for West Bancorporation over the next three years as the bank continues to attract deposit-rich clients in key Midwest urban markets.

- Analysts' consensus view highlights that client wins from new Midwest expansions and ongoing digital banking improvements are the main fuel for projected increases in both deposit balances and operational efficiency.

- Consensus narrative notes these regional and technological moves are expected to support revenue and balance sheet gains, helping offset slower growth in legacy segments.

- This aligns with ongoing stability in profit margins, currently at 33.1%, giving management room to invest in further branch efficiency and client acquisition efforts.

See how the latest earnings connect to analyst expectations and the full narrative for West Bancorporation. 📊 Read the full West Bancorporation Consensus Narrative.

Asset Quality Holds Despite Loan Pullback

- Loan balances decreased by about $50 million in the second quarter as fewer lending opportunities materialized, which carries risks for future revenue if the trend continues.

- Analysts' consensus view flags concerns that ongoing conservative lending and regional concentration could expose West Bancorporation to shocks, especially from distressed commercial real estate in Des Moines and reliance on temporary municipal deposits.

- Consensus narrative outlines that strong credit quality and conservative underwriting are mitigating factors, stabilizing near-term earnings even as certain office property portfolios face pressure.

- Ultimately, any sustained downturn in the local economy or exodus of deposits could challenge the bank’s resilience and test its track record of steady margins and low credit losses.

Attractive Valuation Versus Peers, But Upside May Be Limited

- Shares trade at a price-to-earnings ratio of 12x, below the peer average of 14.7x, but at a slight premium to the US Banks industry average of 11.3x. The current share price of $20.52 sits just 2% below the analyst consensus target of $20.50 and nearly 19% under the DCF fair value of $25.38.

- Analysts' consensus view suggests that while valuation looks favorable against direct competitors, the narrow gap between the share price and analyst target reflects an expectation that most near-term upside is already priced in.

- Consensus narrative points to current profits and dividends supporting sentiment for value-focused investors but cautions that further gains would likely depend on continued margin improvements or stronger core deposit growth.

- This evidence-based stance encourages investors to sense check consensus targets and revisit their own valuation assumptions, especially considering recent profit trends and industry benchmarks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for West Bancorporation on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh angle on the numbers? Take a couple of minutes to shape your own story and get your view into the mix. Do it your way

A great starting point for your West Bancorporation research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While West Bancorporation benefits from margin stability and an improved valuation, conservative lending and concentrated regional exposure put future growth and resilience at risk.

If you’d rather focus on companies delivering consistent expansion across cycles, try stable growth stocks screener (2088 results) to find those with proven long-term revenue and earnings stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTBA

West Bancorporation

Operates as the financial holding company provides community banking and trust services to individuals and small- to medium-sized businesses in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives