- United States

- /

- Banks

- /

- NasdaqGS:WSBC

What WesBanco (WSBC)'s Nineteenth Dividend Increase Reveals About Its Shareholder Value Strategy

Reviewed by Sasha Jovanovic

- WesBanco, Inc. announced that its Board of Directors approved a 2.7% increase in the quarterly cash dividend to US$0.38 per share, along with the declaration of a preferred stock dividend, both payable in early January 2026 to shareholders of record in December 2025.

- This marks the nineteenth increase in WesBanco’s quarterly dividend since 2010, reflecting a consistent track record of returning value to shareholders over the past fifteen years.

- Given this latest common dividend increase, we’ll examine how shareholder returns are shaping the WesBanco investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

WesBanco Investment Narrative Recap

To be a WesBanco shareholder, you need to believe in the bank’s ability to balance stable income with expansion into high-growth markets, amid risks from commercial real estate exposure and regional concentration. The recent 2.7% dividend increase reflects confidence in ongoing cash generation, but does not materially shift the biggest short-term catalyst, continued revenue growth from market expansions, or the main risk, which is ongoing refinancing and payoff pressure in the CRE portfolio.

One recent announcement closely related to the dividend news is WesBanco’s entry into the Tennessee market, with new loan production and retail banking centers in Knoxville and Chattanooga. This expansion supports the current revenue growth trajectory that underpins dividend increases, bolstering the case for long-term value creation if market trends remain favorable.

However, investors should also keep in mind that, despite these positive signals, ongoing CRE risks remain a key area of concern if payoff rates stay elevated and local market softness persists...

Read the full narrative on WesBanco (it's free!)

WesBanco's outlook anticipates $1.7 billion in revenue and $821.3 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 35.2% and an increase in earnings of $696.1 million from current earnings of $125.2 million.

Uncover how WesBanco's forecasts yield a $37.43 fair value, a 23% upside to its current price.

Exploring Other Perspectives

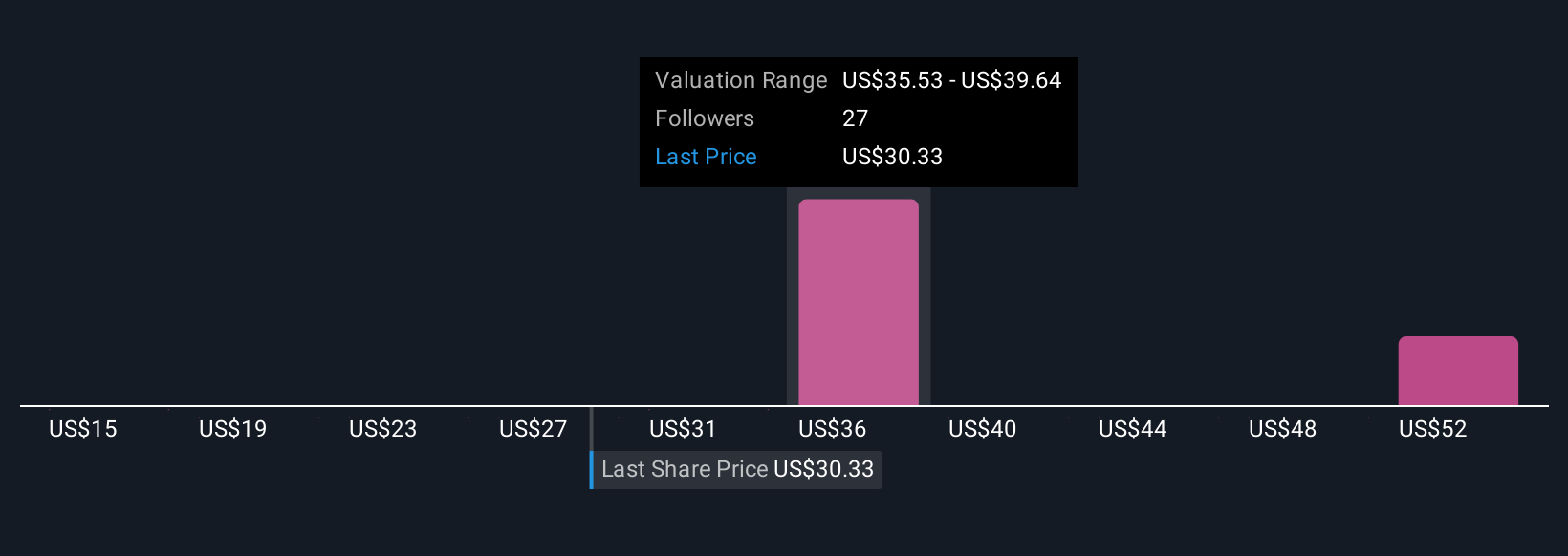

Simply Wall St Community members have offered five fair value estimates for WesBanco stock, ranging from US$14.98 to US$56.15 per share. While recent market expansion is supporting the revenue outlook, these diverse views show just how widely expectations for the company’s performance can vary.

Explore 5 other fair value estimates on WesBanco - why the stock might be worth less than half the current price!

Build Your Own WesBanco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WesBanco research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WesBanco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WesBanco's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WesBanco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WSBC

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives