- United States

- /

- Banks

- /

- NasdaqGS:WSBC

Did WesBanco's (WSBC) Preferred Stock Redemption and Tennessee Expansion Signal a Strategic Capital Shift?

Reviewed by Sasha Jovanovic

- WesBanco, Inc. recently announced the upcoming redemption of all 150,000 shares of its 6.75% Series A Preferred Stock, along with related depositary shares, effective November 15, 2025, as well as business expansion into new Tennessee markets and the change of its auditing firm to Deloitte for 2026.

- This realignment of WesBanco’s capital structure and geographical footprint reflects both a focus on funding optimization and pursuit of long-term growth opportunities beyond its core markets.

- We'll explore how WesBanco's Series A Preferred Stock redemption highlights evolving capital priorities and impacts its longer-term investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

WesBanco Investment Narrative Recap

To be a WesBanco shareholder today, you need to believe in the company's ability to achieve reliable loan and deposit growth by expanding into new markets while closely managing funding costs. The recent preferred stock redemption, funded by the issuance of a higher-yielding Series B, reflects only a modest shift in funding costs and does not meaningfully alter the near-term catalyst of organic growth powered by market expansion; risks from concentration in regional commercial real estate and cost pressures remain the key concern. Among recent announcements, WesBanco’s move into the Tennessee markets with new loan production offices and the appointment of a dedicated regional president stands out, as it directly supports their catalyst of diversifying loan growth and reducing geographic concentration risk. Successful execution on regional expansion could help offset pressures facing legacy Midwest and Appalachian operations. Yet, contrasting this progress, investors should be aware that despite the momentum from new markets, risks tied to elevated payoff rates and softness in commercial real estate could still...

Read the full narrative on WesBanco (it's free!)

WesBanco's narrative projects $1.7 billion in revenue and $821.3 million in earnings by 2028. This requires 35.2% yearly revenue growth and a $696.1 million increase in earnings from the current $125.2 million.

Uncover how WesBanco's forecasts yield a $37.43 fair value, a 25% upside to its current price.

Exploring Other Perspectives

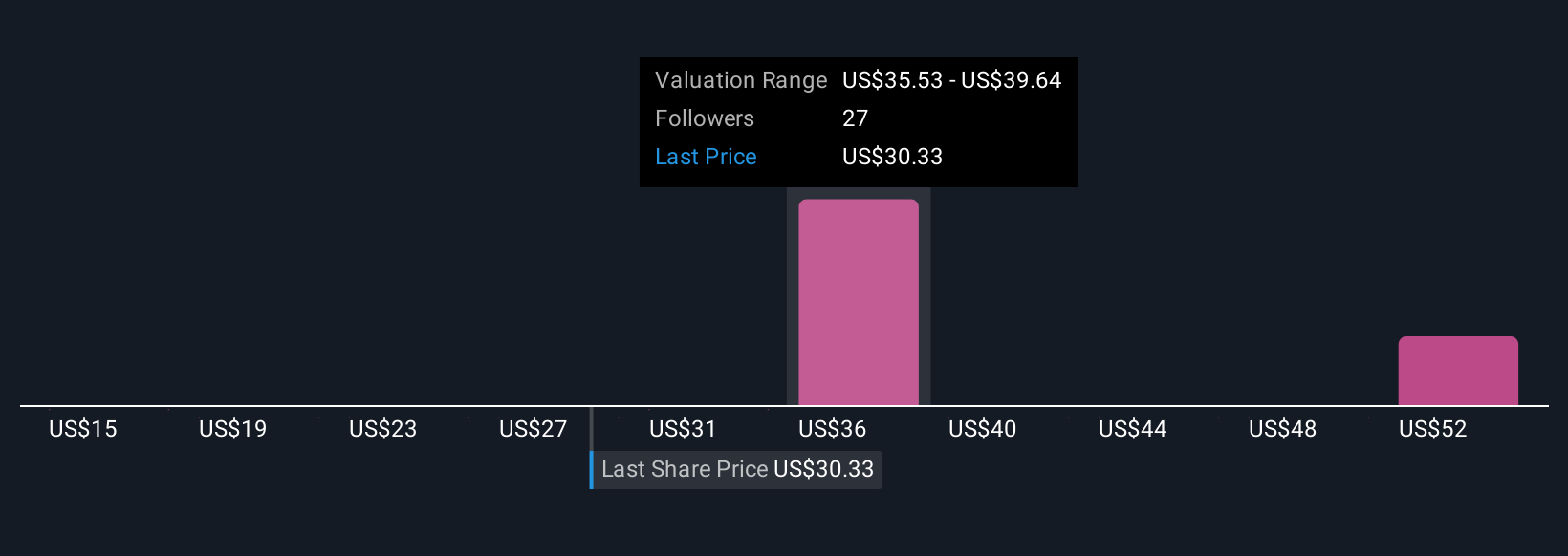

Five members of the Simply Wall St Community have valued WesBanco from US$14.98 to US$57.77 per share, showing a wide range of views. While expansion into new markets has fueled recent growth, shifting regional loan performance may continue to affect business stability; consider how these differences of opinion can impact your own analysis.

Explore 5 other fair value estimates on WesBanco - why the stock might be worth as much as 92% more than the current price!

Build Your Own WesBanco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WesBanco research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WesBanco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WesBanco's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WesBanco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WSBC

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives