- United States

- /

- Banks

- /

- NasdaqGS:WASH

Washington Trust Bancorp (WASH) Losses Worsen 35.3% Annually, Challenging Turnaround Narrative

Reviewed by Simply Wall St

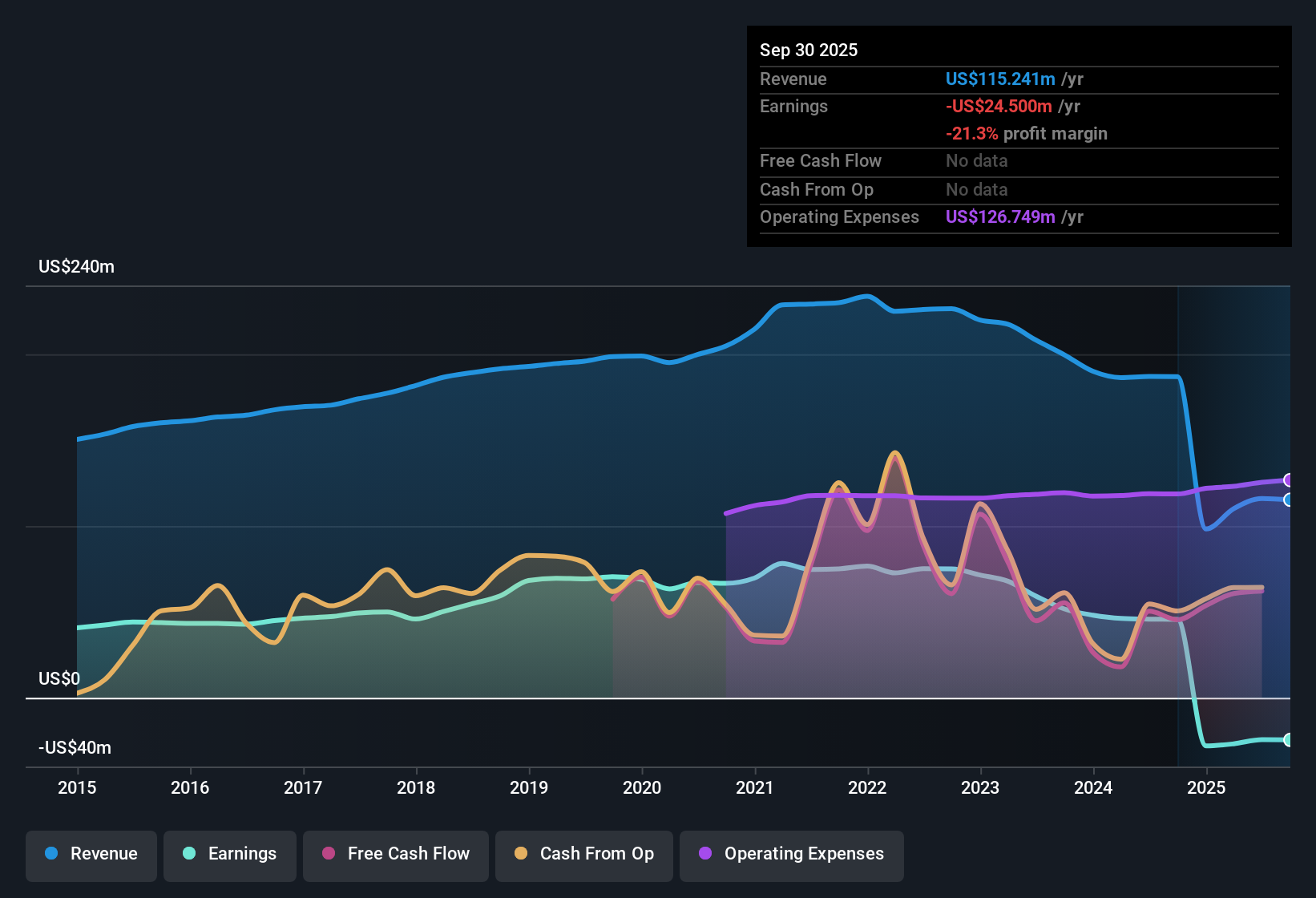

Washington Trust Bancorp (WASH) reported ongoing losses, with net losses worsening at a 35.3% annual rate over the past five years. Despite the negative net profit margin and declining recent earnings, the company is forecast to deliver a substantial turnaround, with expected earnings growth of 81.26% per year and revenue growth of 21.8%, both outpacing the broader US market. Shares currently trade at $27.55, which is below the estimated fair value of $36.94 per share. Investors remain mindful that the dividend is not sustainable at present.

See our full analysis for Washington Trust Bancorp.Next up, we will see how these headline results measure against the market’s main narratives for WASH and where expectations might shift.

See what the community is saying about Washington Trust Bancorp

Margins Under Pressure From Credit Risks

- Net profit margin has remained negative, with continued losses growing at a rate of 35.3% annually over the past five years. This highlights that persistent expense growth is weighing on profitability even as revenue is forecast to rise.

- Analysts' consensus view spotlights rising expense levels and unresolved commercial real estate loans as material risks for future margin recovery.

- Ongoing increases in general expenses and lingering $10.5 million commercial real estate loan exposure may lead to higher provisions and further pressure on net income.

- Consensus narrative notes any continued increase in office space credit risk could trigger additional write-offs, keeping net profit margins negative for longer than forecast.

Conservative Lending Puts a Cap on Commercial Loan Growth

- Management’s reduction in loan origination and a focus on conservative credit management may hold back short-term revenue expansion, even as the broader business is forecast for 21.8% annual revenue growth.

- The consensus view contends that this pullback could limit near-term loan segment growth but reduce credit losses, potentially stabilizing net interest margins.

- Analysts expect that revenue in the commercial segment could be constrained specifically because of this credit tightening, especially while Fed rate cuts remain delayed.

- What is notable is that while more prudent credit standards slow loan growth, they are expected to improve credit quality over time and support earnings durability into the next market cycle.

Valuation Sits at a Discount to DCF Fair Value

- Shares are trading at $27.55, a 25% discount to the DCF fair value estimate of $36.94 per share. The price-to-book of 1x matches the banking industry average but stands above the peer group average of 0.7x.

- Consensus narrative flags that analysts’ price target is only slightly above the current share price, signaling broad agreement that the stock is fairly priced relative to its near-term earnings outlook.

- Analysts value the company based on an earnings forecast of $52.6 million by 2027 and a price-to-earnings ratio of 14.5x, which is above the industry’s 13.1x but may be justified if forecast growth materializes.

- The minimal 3.3% gap between current share price and analyst price target spotlights how expectations of a turnaround are already largely reflected in today’s share price.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Washington Trust Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another angle on the latest results? In just a few minutes, you can draft your own narrative and add your take to the story. Do it your way

A great starting point for your Washington Trust Bancorp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Washington Trust Bancorp has struggled with consistent losses, rising expenses, and unresolved credit risks. These challenges have put pressure on both margins and earnings quality.

If you want to focus on companies with stronger financial health and more robust balance sheets, use our solid balance sheet and fundamentals stocks screener (1985 results) to find quality alternatives built to weather uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Washington Trust Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WASH

Washington Trust Bancorp

Operates as the bank holding company for The Washington Trust Company, of Westerly that provides various banking and financial services to individuals and businesses.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives