- United States

- /

- Banks

- /

- NasdaqGS:WAFD

WaFd (WAFD): Revisiting Valuation After a Recent Share Price Rebound

Reviewed by Simply Wall St

WaFd (WAFD) has quietly outperformed many regional peers over the past month, with the stock up about 8%, even as its 1 year return still sits roughly 7% lower.

See our latest analysis for WaFd.

That recent 1 month share price return of around 7.5% looks like investors are slowly warming back up to WaFd, even though the 1 year total shareholder return is still modestly negative and longer term holders remain comfortably ahead.

If WaFd's steady reset in sentiment has you thinking more broadly about financials, this could be a good moment to explore fast growing stocks with high insider ownership for other under the radar opportunities.

But with shares still trading below some estimates of intrinsic value, while sitting slightly above the average analyst target, is WaFd quietly offering a fresh entry point, or is the market already baking in its next leg of growth?

Price-to-Earnings of 11.7x: Is it justified?

WaFd's current share price of $32.20 implies a price-to-earnings multiple of 11.7 times, which sits slightly below peer averages and close to its estimated fair level.

The price-to-earnings ratio compares what investors pay for each dollar of current earnings, making it a useful shorthand for how the market values a bank's profit stream. For WaFd, the stock is described as good value versus the peer average multiple of 12.5 times, and also well aligned with an estimated fair price-to-earnings ratio of 11.8 times, suggesting the market is not aggressively overpaying for its earnings.

Set against the broader US Banks industry, WaFd screens as marginally expensive, with its 11.7 times multiple sitting just above the sector average of 11.6 times. This difference is small enough that the fair ratio signal could become the stronger anchor if sentiment shifts, nudging the valuation closer to that 11.8 times reference point.

Explore the SWS fair ratio for WaFd

Result: Price-to-Earnings of 11.7x (ABOUT RIGHT)

However, lingering rate sensitivity and a share price already above consensus targets could cap near term upside if credit quality or loan demand unexpectedly weaken.

Find out about the key risks to this WaFd narrative.

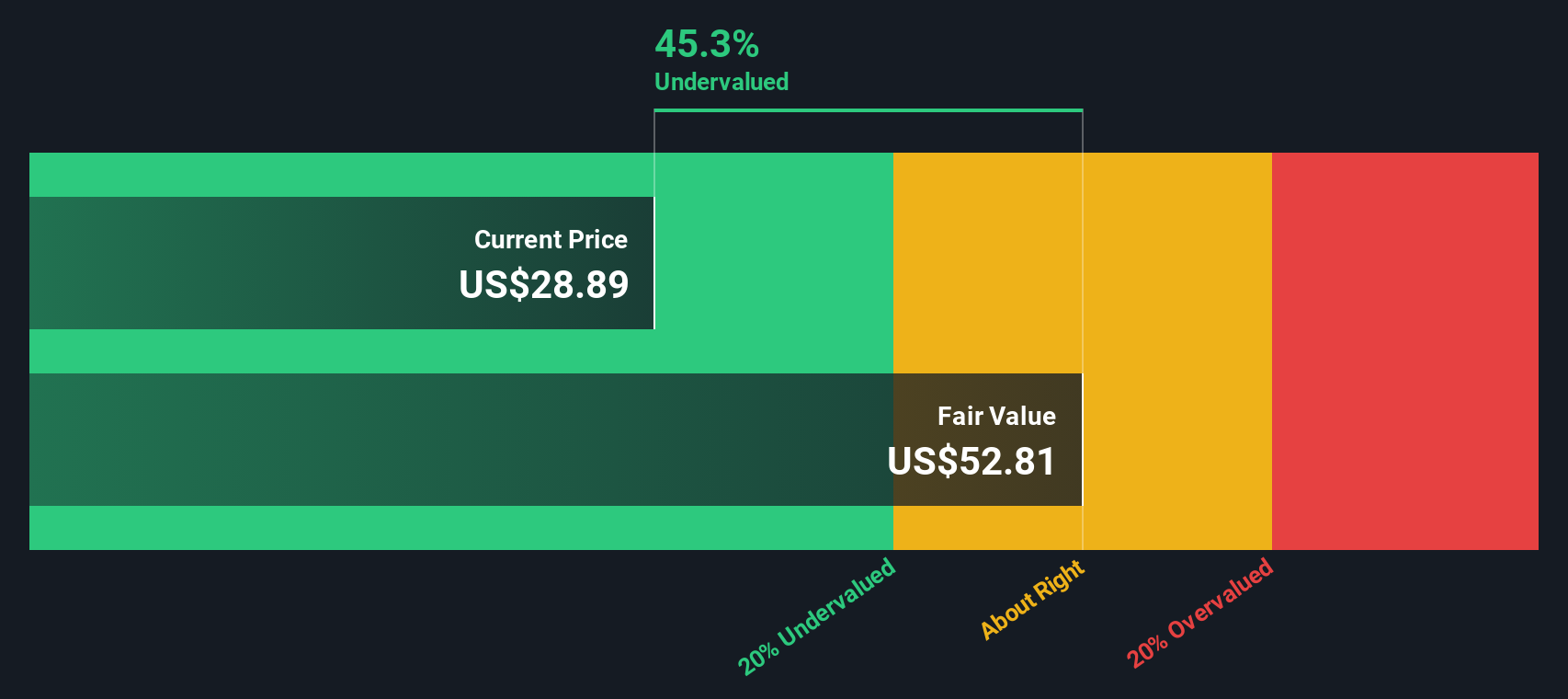

Another View: DCF Points to Deeper Value

While the earnings multiple looks roughly fair, our DCF model presents a stronger value case, with WaFd trading about 10% below an estimated fair value of roughly $35.77 per share. If cash flows provide a more accurate picture than sentiment, is the market underestimating the upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out WaFd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own WaFd Narrative

If you see things differently, or want to dig into the numbers yourself, you can build a personalised view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding WaFd.

Ready for more investing opportunities?

WaFd might set the tone for your portfolio, but you could miss the next standout performer if you stop here. Let the Screener surface your next move.

- Capture potential mispricings by running these 908 undervalued stocks based on cash flows that could offer stronger upside than consensus expects.

- Capitalize on market buzz by scanning these 26 AI penny stocks positioned to benefit from accelerating demand for automation and intelligent software.

- Strengthen your income stream by reviewing these 15 dividend stocks with yields > 3% that balance yield with sustainable payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WaFd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAFD

WaFd

Operates as the bank holding company for Washington Federal Bank that provides lending, depository, insurance, and other banking services in the United States.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026