- United States

- /

- Banks

- /

- NasdaqGS:WAFD

WaFd (WAFD) Margin Expansion Reinforces Bullish Earnings Narrative and Undervalued Stock

Reviewed by Simply Wall St

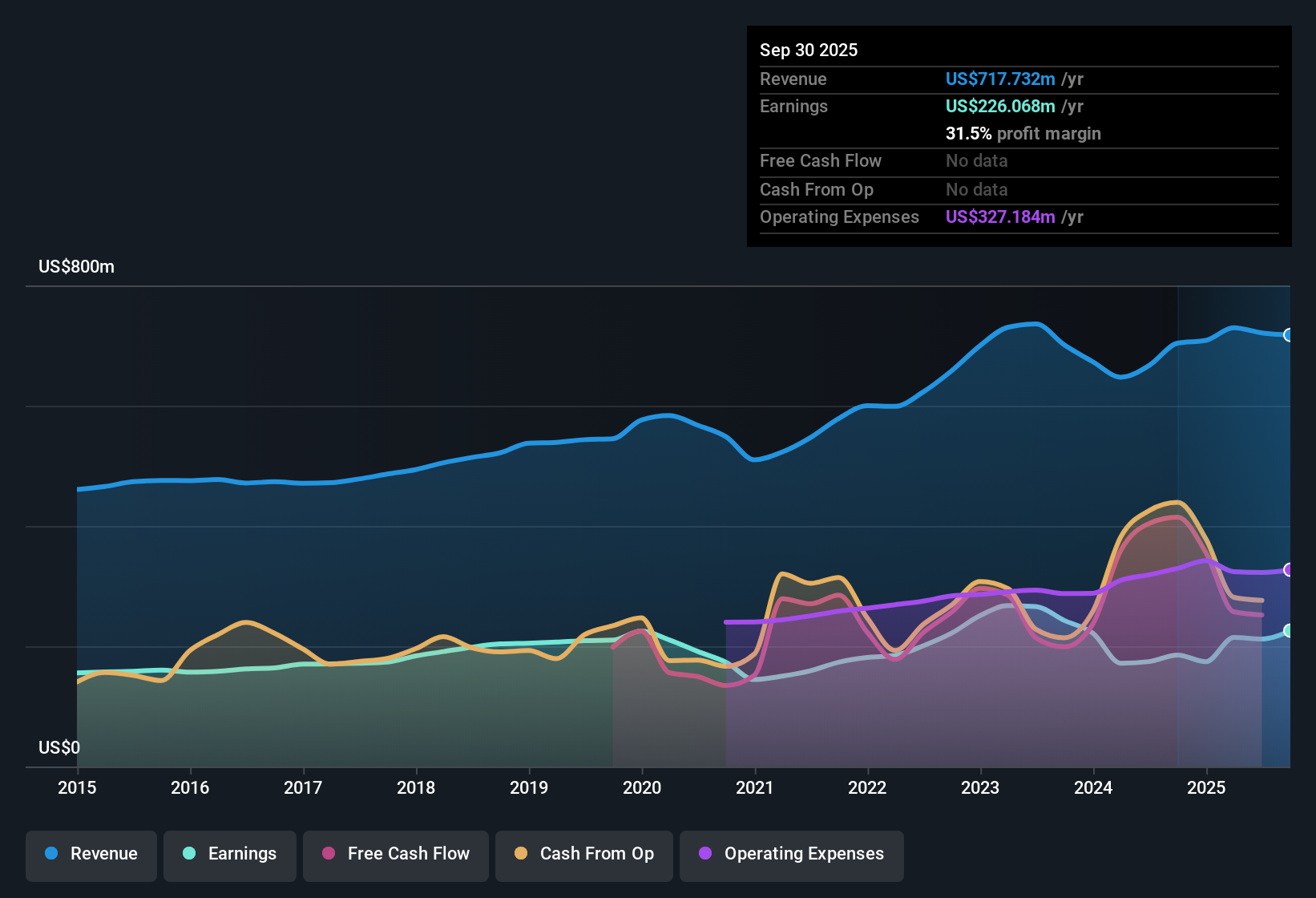

WaFd (WAFD) posted a net profit margin of 29.4%, up from 26.2% a year ago, as EPS climbed with a 21.5% gain over the past year, far outpacing its 5-year average annual earnings growth of 4.3%. The company's Price-to-Earnings ratio is 10.3x, coming in lower than both its peer group average of 12.1x and the broader US banks industry average of 11.6x. Shares currently trade at $28.07, which remains significantly below the estimated fair value of $52.29. With a value-conscious price, an attractive dividend, and robust historic profit growth, investors may view WaFd’s earnings and margin momentum as supportive of bullish sentiment, especially given no flagged material risks.

See our full analysis for WaFd.Now that the headline earnings are in, it's time to see how these results measure up against the most popular narratives about WaFd; some stories could get reinforced while others may be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Outpaces Five-Year Trend

- WaFd’s net profit margin reached 29.4%, a substantial increase from 26.2% one year ago, and well above the company’s five-year average annual earnings growth of 4.3%.

- Challenging the worry that banks might struggle to expand profits in a volatile sector, the narrative highlights how margin improvement at WaFd has helped drive 21.5% growth over the past year instead.

- Investors focusing on margin compression may need to revisit assumptions, as margin upside has been captured in the latest period.

- This positive margin trajectory strongly supports the view that disciplined operations are offsetting broader industry sensitivity to economic conditions.

Dividends and Value Versus Peers Stand Out

- The company’s price-to-earnings ratio of 10.3x remains comfortably below both the peer average of 12.1x and the US banks industry average of 11.6x, supporting the case for relative value.

- The narrative claims WaFd’s combination of a value-conscious price point, high-quality earnings track record, and an attractive dividend yield make it distinct from many peers.

- With shares trading at $28.07 against a DCF fair value of $40.96, the setup presents a clear valuation gap for value-oriented investors.

- Investors prioritizing dividends may find the company’s long-running payouts and recent profit momentum encouraging compared to sector volatility.

No Flagged Risks Amid Sector Jitters

- No material risks were highlighted in the filing or recent data, setting WaFd apart in a banking industry where many regional banks continue to battle headlines around risk and volatility.

- The data-driven narrative notes that this absence of flagged risks, coupled with robust historic profit growth and sector-relative value, could keep WaFd in a favorable position as long as sector headlines remain unsettled.

- Even as some banks face scrutiny for commercial real estate or credit losses, WaFd’s clean filings and margin gains suggest greater resilience than peers under the current backdrop.

- Conservative management and lack of flagged exposures provide the breathing room value investors look for in turbulent market cycles.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on WaFd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Despite WaFd’s margin expansion and solid value case, its earnings growth of 21.5% over the last year is well above its five-year average. However, this may not reflect consistent performance across different market cycles.

If you’re looking for steadier performers, use our stable growth stocks screener (2085 results) to focus on companies that deliver reliable revenue and profit growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WaFd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAFD

WaFd

Operates as the bank holding company for Washington Federal Bank that provides lending, depository, insurance, and other banking services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives