- United States

- /

- Banks

- /

- NasdaqGS:WAFD

WaFd (WAFD): Is the Bank Undervalued After Its Recent Share Price Decline?

Reviewed by Kshitija Bhandaru

WaFd (WAFD) has caught investor attention with its recent stock movement, as shares have tracked a downward path over the past month. This shift provides a fresh opportunity to explore the company’s underlying fundamentals and valuation.

See our latest analysis for WaFd.

Over the past year, WaFd’s share price has declined steadily. Momentum has faded as the year-to-date price return sits at -10.48% and the latest close at $28.61. The total shareholder return over the past twelve months stands at -17.20%, highlighting a tough period despite prior multi-year gains. Recent drops could signal the market reassessing growth prospects or risk in the current environment.

If you’re curious about what other resilient companies are making moves right now, it could be the perfect time to broaden your outlook and discover fast growing stocks with high insider ownership

Given WaFd’s downbeat momentum and discounted valuation, does this suggest an overlooked buying opportunity for patient investors, or is the market accurately valuing the bank’s prospects for future growth?

Price-to-Earnings of 10.6x: Is it justified?

WaFd’s stock currently trades at a price-to-earnings (P/E) ratio of 10.6x based on its recent closing price of $28.61, putting it at a discount to both the US Banks industry average (11.3x) and its peer group (12.6x). This suggests that the market may be undervaluing WaFd’s future earnings relative to similar banks.

The price-to-earnings ratio captures how much investors are willing to pay for each dollar of the company’s current profits. For banks like WaFd, this ratio is a widely used metric to compare value and earnings power within the industry.

Trading below not just the industry and peer averages, but also below the estimated fair P/E of 12.4x, WaFd’s lower multiple implies caution or missed recognition by investors despite its strong earnings growth and robust profit margins. If market sentiment improves or the company continues to deliver, there is room for re-rating toward the fair ratio level indicated by broader financial modeling.

Explore the SWS fair ratio for WaFd

Result: Price-to-Earnings of 10.6x (UNDERVALUED)

However, persistent negative returns and market caution could signal that investor concerns about growth prospects or industry headwinds are not fully priced in.

Find out about the key risks to this WaFd narrative.

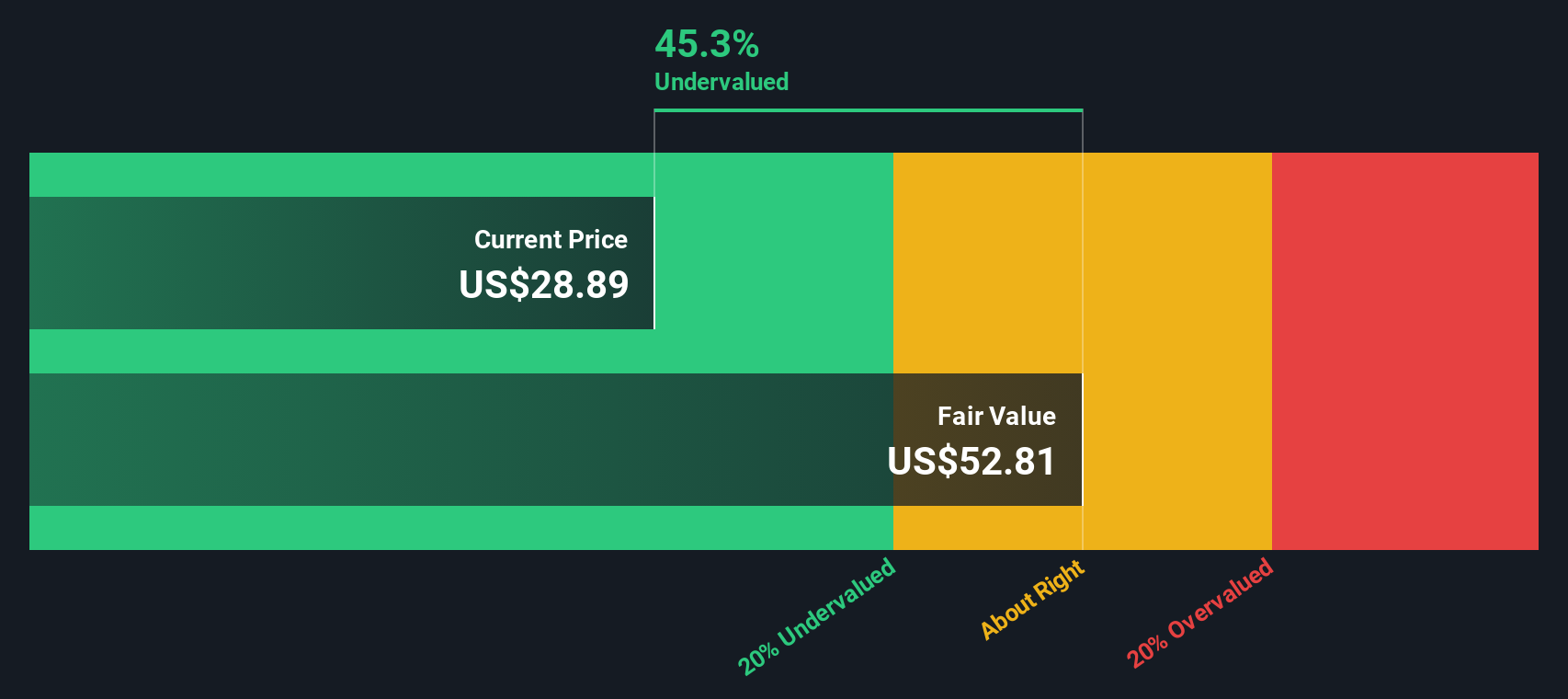

Another View: Discounted Cash Flow Model Suggests Deeper Value

Our SWS DCF model offers a different perspective. It estimates WaFd’s fair value at $52.88, which is significantly higher than the current share price of $28.61. This suggests WaFd could be undervalued by a substantial margin. Could the market be overlooking something with this much potential upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out WaFd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own WaFd Narrative

If you have a different viewpoint or enjoy digging into the numbers yourself, you can craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding WaFd.

Looking for more investment ideas?

Your next standout opportunity could be waiting right now, if you know where to look. Tap into smart tools, seize potential, and stay ahead with curated lists built for real investors who want results.

- Capture impressive yields and target steady financial growth by checking out these 19 dividend stocks with yields > 3%, which offers robust and reliable income streams above 3%.

- Spark your portfolio’s next breakthrough with these 24 AI penny stocks, a selection transforming multiple industries with advanced artificial intelligence capabilities.

- Position yourself for growth at compelling valuations through these 892 undervalued stocks based on cash flows, focused on possibilities priced below their true potential based on underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WaFd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAFD

WaFd

Operates as the bank holding company for Washington Federal Bank that provides lending, depository, insurance, and other banking services in the United States.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion