- United States

- /

- Banks

- /

- NasdaqGS:WABC

Westamerica Bancorporation (WABC): Assessing Valuation After Recent Shift in Investor Sentiment

Reviewed by Simply Wall St

Westamerica Bancorporation (WABC) shares edged higher in recent trading, prompting some investors to take a closer look at the bank’s stock performance and valuation. As market sentiment shifts, WABC’s track record and financials are once again under review.

See our latest analysis for Westamerica Bancorporation.

After a challenging stretch for regional banks, Westamerica Bancorporation’s recent uptick suggests sentiment may be slowly shifting. While its 1-year total shareholder return is down 15.2%, the stock’s recent price momentum hints that risk perceptions could be stabilizing as investors reassess the outlook.

If you’re seeking other opportunities beyond traditional banks, now is a great moment to discover fast growing stocks with high insider ownership.

With shares still trading below many analyst targets and growth metrics under pressure, the question remains: Is Westamerica Bancorporation undervalued in today's market, or is future growth already reflected in the current price?

Price-to-Earnings of 9.9x: Is it justified?

Westamerica Bancorporation currently trades at a price-to-earnings (P/E) ratio of 9.9x, while its last close price stood at $47.58. This level is lower than both the US banks industry average and its peer average, indicating that the market may be discounting the stock relative to sector peers.

The P/E ratio compares a company's share price to its earnings per share, providing a quick snapshot of market expectations for future growth and profitability. For banks, which tend to have more stable earnings, the P/E ratio helps investors gauge whether the current valuation appropriately reflects the company’s recent and expected financial performance.

Westamerica’s P/E of 9.9x is below the industry average of 11x and well under the peer group’s 15.1x level. This suggests that the market is valuing its current earnings more conservatively than others in the sector. However, it is worth noting that against an estimated “fair” P/E ratio of 7.4x, the stock appears a bit more expensive than what fundamental measures might suggest and could experience re-rating if market sentiment changes.

Explore the SWS fair ratio for Westamerica Bancorporation

Result: Price-to-Earnings of 9.9x (UNDERVALUED)

However, ongoing declines in annual revenue and net income growth could put pressure on future performance and investor confidence, challenging the notion of undervaluation.

Find out about the key risks to this Westamerica Bancorporation narrative.

Another View: What Does the SWS DCF Model Suggest?

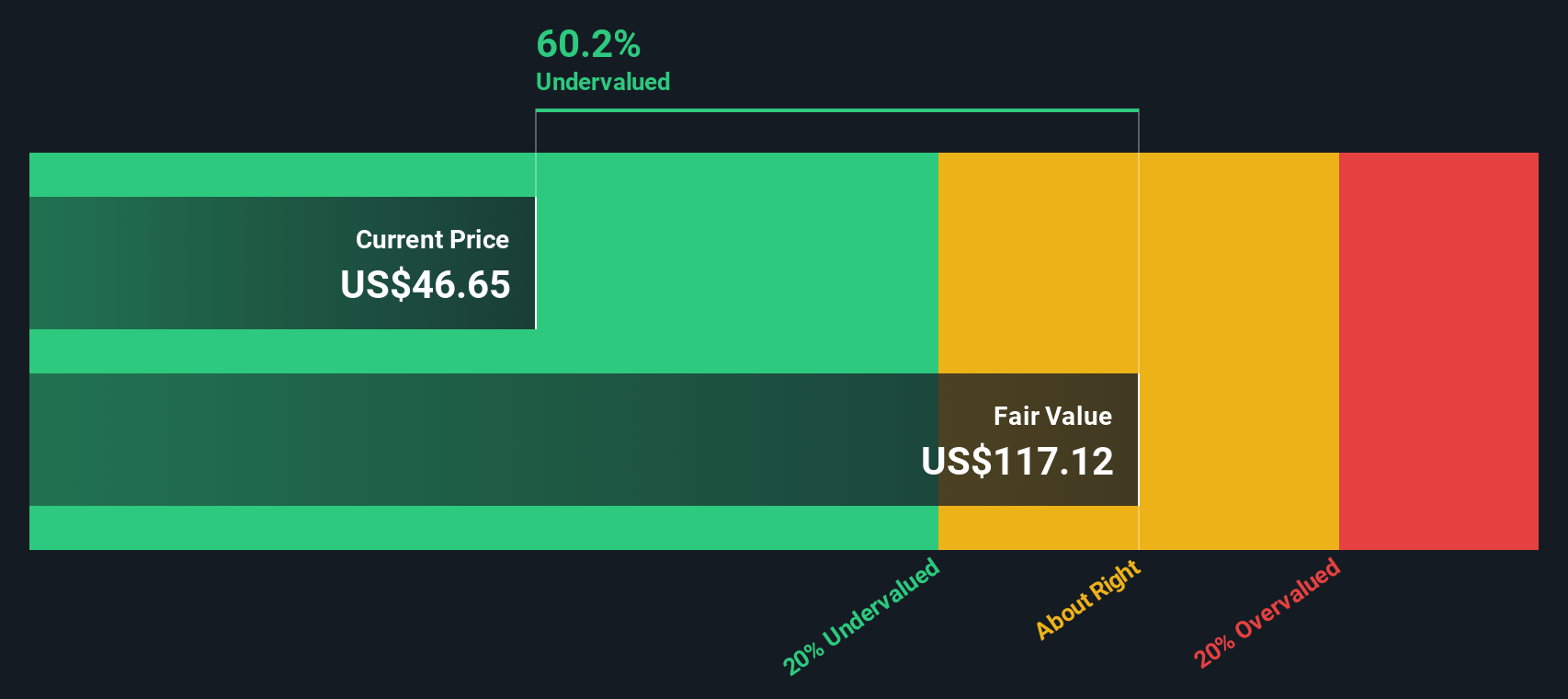

Taking a different approach, the SWS DCF model suggests Westamerica Bancorporation could be trading at a significant discount to its estimated fair value. Shares are currently 59% below the model's calculated figure of $117.12. This assessment points to a much greater upside than current market pricing implies.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Westamerica Bancorporation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 845 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Westamerica Bancorporation Narrative

If you have a different perspective or prefer hands-on research, it takes just a few minutes to build your own perspective and narrative. Do it your way.

A great starting point for your Westamerica Bancorporation research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let smart opportunities pass you by when there is a world of standout stocks waiting for you. See which ones deliver real potential using the Simply Wall Street Screener.

- Tap into the potential of small but mighty companies and review these 3607 penny stocks with strong financials offering robust financials and unique growth stories that larger players cannot match.

- Accelerate your portfolio’s innovation edge with these 26 AI penny stocks fueling advancements across industries, before they become mainstream headlines.

- Capture greater value by searching for these 845 undervalued stocks based on cash flows that the market has overlooked and discover where your money could work harder for you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westamerica Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WABC

Westamerica Bancorporation

Operates as a bank holding company for the Westamerica Bank that provides various banking products and services to individual and commercial customers in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives