- United States

- /

- Banks

- /

- NasdaqGS:WABC

Could Lower Rates Shift Westamerica Bancorporation’s (WABC) Margin Pressures or Is Profitability Still at Risk?

Reviewed by Sasha Jovanovic

- In recent days, comments from New York Federal Reserve President John Williams raised market expectations for an interest rate cut at the central bank’s December meeting, sparking renewed optimism among investors.

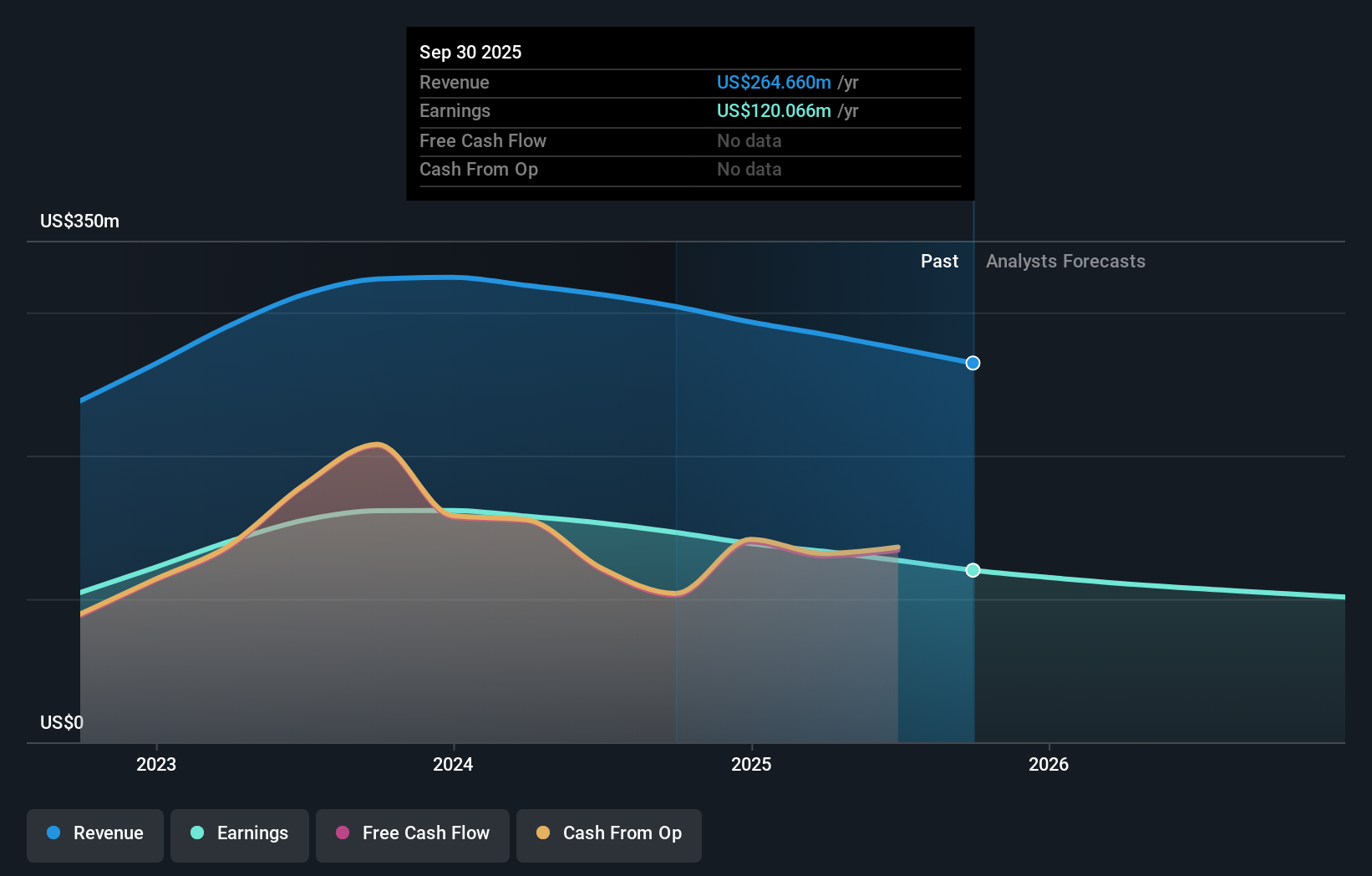

- This shift comes at a time when Westamerica Bancorporation is facing ongoing net interest margin pressures, which have negatively affected its profitability over the past two years.

- We'll explore how increased expectations for lower interest rates could affect Westamerica Bancorporation’s investment story amid margin contraction concerns.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Westamerica Bancorporation's Investment Narrative?

For investors considering Westamerica Bancorporation, the big picture typically centers on its ability to defend earnings and dividends as profit pressures persist. The recent optimism around potential Federal Reserve rate cuts has come at a key moment, as shrinking net interest margins and forecast declines in both revenue and net income have been weighing on sentiment. Last week’s rate-cut speculation fueled a 2.6% jump in shares, suggesting markets see lower rates as a positive catalyst, potentially easing some of the margin contraction fears for now. However, it’s important to note that these broader expectations only slightly shift the biggest risks: earnings and revenue remain in decline and forward profit forecasts are still headed lower. The short-term boost from policy optimism helps, but it does not fully offset structural profitability challenges and ongoing margin pressure.

But dividend reliability depends on more than a hopeful turn in interest rates. Westamerica Bancorporation's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Westamerica Bancorporation - why the stock might be worth as much as $42.00!

Build Your Own Westamerica Bancorporation Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Westamerica Bancorporation research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Westamerica Bancorporation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Westamerica Bancorporation's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westamerica Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WABC

Westamerica Bancorporation

Operates as a bank holding company for the Westamerica Bank that provides various banking products and services to individual and commercial customers in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success