- United States

- /

- Banks

- /

- NasdaqGS:VLY

Valley National Bancorp (VLY) Profit Margins Rise to 26.6%, Reinforcing Bullish Narratives

Reviewed by Simply Wall St

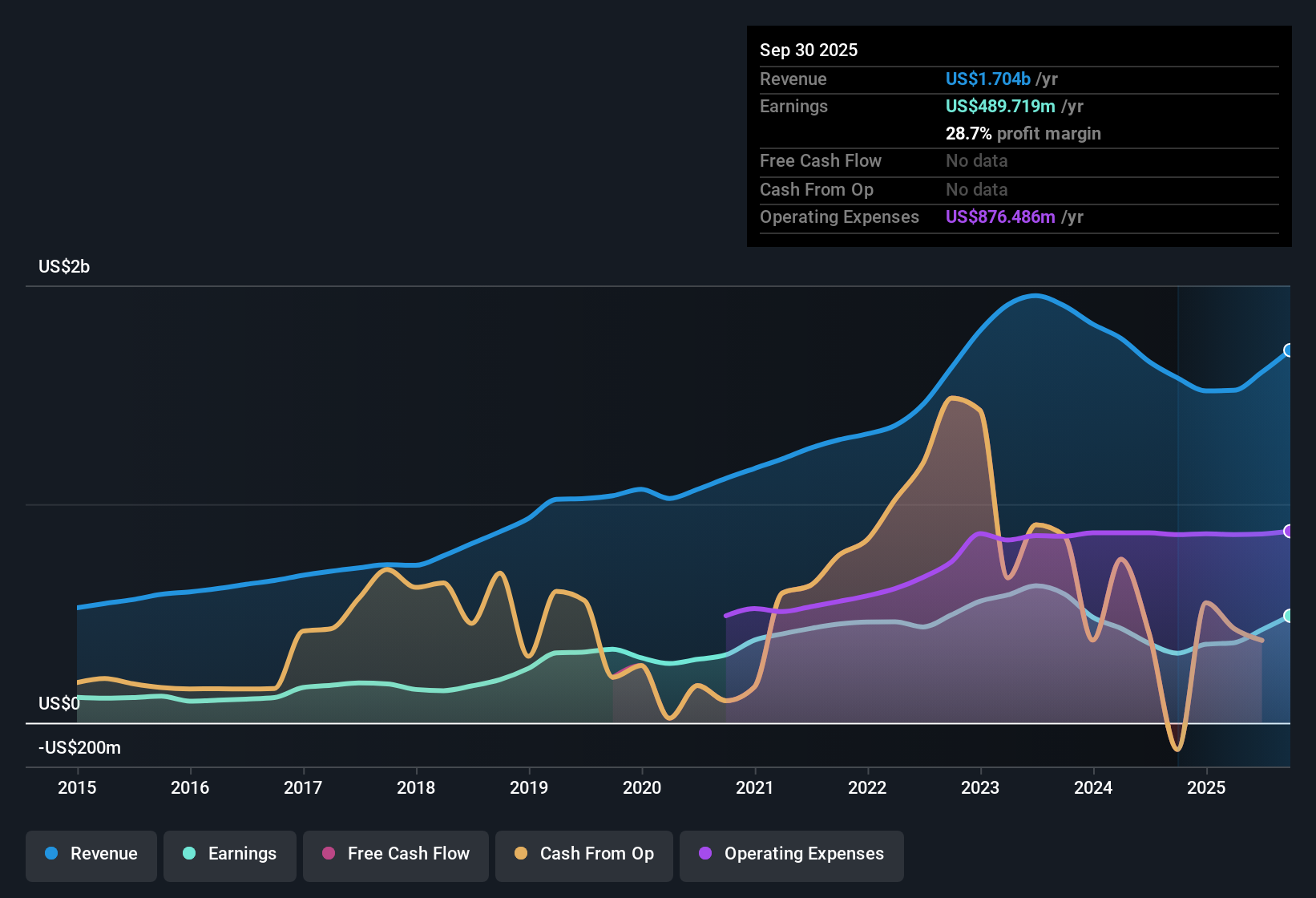

Valley National Bancorp (VLY) posted a notable uptick in profitability, with current profit margins at 26.6%, up from 22% a year ago. Earnings are forecast to grow 17.01% per year, outpacing the US market’s 15.5% annual rate. Revenue is expected to increase at 7.6% per year, which trails the 10% US average. With high-quality earnings, attractive dividends, and a recent 17.2% acceleration in earnings growth over the past year, the recent results signal continued momentum but leave investors weighing margin gains against a price-to-earnings ratio that sits above industry averages.

See our full analysis for Valley National Bancorp.The next step is to see how these fresh results compare with the leading market narratives. This helps in spotting where consensus holds and where the numbers offer a new perspective.

See what the community is saying about Valley National Bancorp

Profit Margin Moves Higher, Operational Efficiency in Focus

- Profit margins improved to 26.6% from 22% in the previous year. This significant increase strengthens Valley National's bottom line and provides potential for further expansion if cost controls continue.

- Analysts' consensus view highlights that operational discipline and digitalization are expected to lower the cost-to-income ratio and further lift net margins, supported by ongoing technology investment and improved delivery channels.

- This margin expansion aligns with the view that targeted technology upgrades are helping reduce funding costs as legacy deposits are replaced by lower-cost core deposits.

- However, rising compliance and cybersecurity spending remain a watchpoint. Consensus cautions these ongoing costs could erode improvements if not managed carefully.

- Consensus expects further upside if margin gains continue, with forecasts for profit margins to reach 31.8% in the next three years as efficiencies build.

Share Issuance and Growth Ambitions

- Analysts project the number of shares outstanding will rise 7.0% per year over the next 3 years, signaling Valley’s intent to fund growth and expansion through new equity issuance.

- Consensus narrative points out that this share growth is tied to Valley’s strategic investment in high-growth markets and specialized verticals, which should diversify revenues and boost long-term earnings resilience.

- Analysts foresee market expansion into Florida and Sun Belt regions fueling higher loan demand and fee-based income, a move designed to benefit from demographic and migration trends.

- Sustained investment in verticals like healthcare banking and treasury management is expected to offset dilution effects by enhancing fee and net interest income over time.

Valuation: Premium to Industry, Close to Analyst Target

- The current price-to-earnings ratio of 13.9x puts Valley National above the US Banks industry average of 11.3x and near its peer group, so investors are paying a premium for its profitability momentum and perceived quality.

- The analysts’ consensus view is that, with the current share price at $10.56 and the official analyst target at $12.73, Valley National appears fairly valued by the market, with minimal upside implied by the present gap.

- The consensus contends that unless profit margins reach the 31.8% target and earnings grow as forecast, the current premium may come under pressure from investor scrutiny.

- However, attractive dividends and high-quality earnings support the belief that Valley’s premium is justified if operational improvements sustain.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Valley National Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these numbers? Share your insights and craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Valley National Bancorp.

See What Else Is Out There

While Valley National Bancorp boasts profit margin gains, its valuation premium and slower revenue growth versus peers suggest a less compelling growth outlook than top performers.

If you want companies with more consistent expansion and steady fundamentals, compare your options through stable growth stocks screener (2090 results) to find those that deliver reliability across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VLY

Valley National Bancorp

Operates as the holding company for Valley National Bank that provides various commercial, private banking, retail, insurance, and wealth management financial services products.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives