- United States

- /

- Banks

- /

- NasdaqGS:VLY

Valley National Bancorp (VLY): Assessing Valuation After Analyst Top Pick Nod and Strong Earnings Results

Reviewed by Simply Wall St

Valley National Bancorp (VLY) is in the spotlight after being named a top pick for 2026 by analysts. The recognition follows its latest quarterly earnings, which surpassed expectations and contributed to a wave of positive sentiment.

See our latest analysis for Valley National Bancorp.

Momentum has been building for Valley National Bancorp, with the stock’s 26.8% share price return year-to-date reflecting increased optimism following its well-received earnings and a recent executive appointment. Despite a slight dip today, the company’s 11.5% total shareholder return over the past year suggests solid progress, even as short interest remains elevated.

If you’re interested in uncovering what else is gaining traction in the market, now is the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

With strong recent gains and upbeat analyst forecasts, investors now face a pivotal question: is Valley National Bancorp’s rapid climb fueled by genuine undervaluation, or has the market already priced in its next leg of growth?

Most Popular Narrative: 16.7% Undervalued

With Valley National Bancorp's narrative fair value estimated at $13.58, compared to a recent close of $11.32, the story centers on margin expansion and future growth. The following quote from the most widely followed narrative highlights a major driver behind this view.

Valley's accelerating growth in commercial & specialty deposit accounts, driven by technology investments and targeted market penetration, is likely to yield structurally lower funding costs and enhanced net interest margin as legacy brokered deposits are replaced with lower-cost core deposits. This directly supports revenue and margin expansion.

Want to know what’s fueling this premium? This narrative is built on aggressive revenue expansion and an ambitious margin boost. Get the inside scoop on the projected leaps in earnings, the profit assumptions, and the lower future earnings multiple that sets this valuation apart. See why the market's next big move might already be in the numbers.

Result: Fair Value of $13.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, especially Valley's commercial real estate exposure and regional concentration. Either of these factors could quickly disrupt the bullish outlook if conditions worsen.

Find out about the key risks to this Valley National Bancorp narrative.

Another View: Market Multiples Weigh In

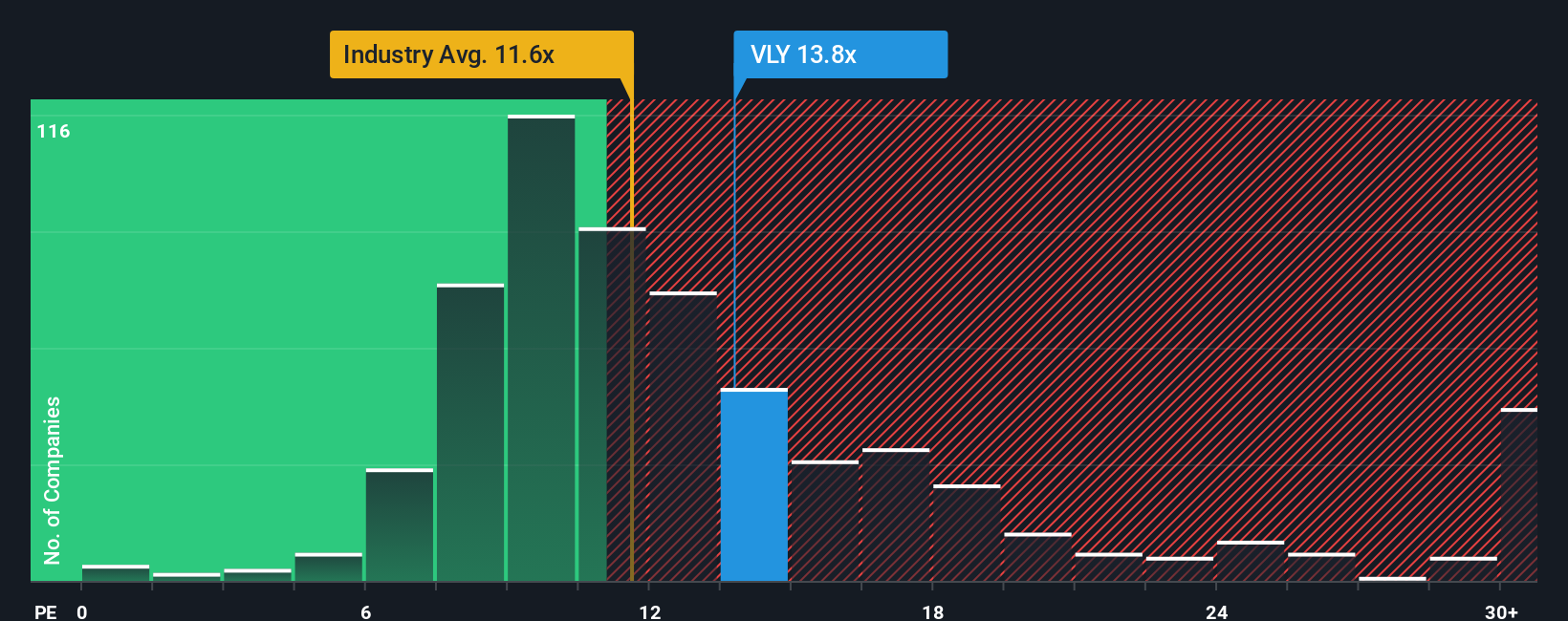

Taking a step back from the narrative of fair value, a look at Valley National Bancorp’s price-to-earnings ratio offers a more measured interpretation. The company trades at 12.9 times earnings, which is higher than the US Banks industry average of 11.4, but below the peer average of 13.5 and the fair ratio of 14.6. This suggests the stock could still have upside if investors become more optimistic, but it also highlights a valuation risk if expectations reset. Which lens do you trust more: narratives of rapid growth or the numbers markets use every day?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valley National Bancorp Narrative

If this viewpoint doesn't match your expectations, or you'd rather rely on your own analysis, you can easily shape your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Valley National Bancorp.

Looking for More Investment Ideas?

Don’t wait for the next opportunity to pass you by. Take charge of your research and fuel your portfolio with forward-thinking strategies from our expert screeners below.

- Uncover hidden value by checking out these 914 undervalued stocks based on cash flows, where smart money spots potential bargains overlooked by the market.

- Lock in impressive income streams as you browse these 15 dividend stocks with yields > 3% stocks delivering generous yields above 3% to reward your portfolio.

- Position yourself ahead of the curve with these 25 AI penny stocks, packed with innovators riding the artificial intelligence wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VLY

Valley National Bancorp

Operates as the holding company for Valley National Bank that provides various commercial, private banking, retail, insurance, and wealth management financial services products.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026