- United States

- /

- Banks

- /

- NasdaqGS:VLY

Is Valley National Bancorp Stock Offering Opportunity After Recent 12% Rally in 2025?

Reviewed by Bailey Pemberton

If you’re following Valley National Bancorp and wondering what to do next, you’re not alone. Investors have been keeping a close eye on this regional banking name, and the stock has delivered some attention-grabbing moves lately. After a steady climb so far this year, with a return of 23.0% year-to-date and a 24.1% gain over the past year, it's clear that something has sparked renewed optimism.

In just the last week, shares surged 12.0%. This short-term rally arrived in the wake of sector-wide confidence returning to regional banks, as regulators signaled support for smaller institutions and helped ease recent fears. While big headlines were rare, the improved backdrop has had a tangible impact on risk perception, letting Valley National’s underlying strengths come to the fore. Over the past five years, the stock has nearly doubled, up 78.9%, and this performance invites a closer look at what’s driving the company’s current valuation.

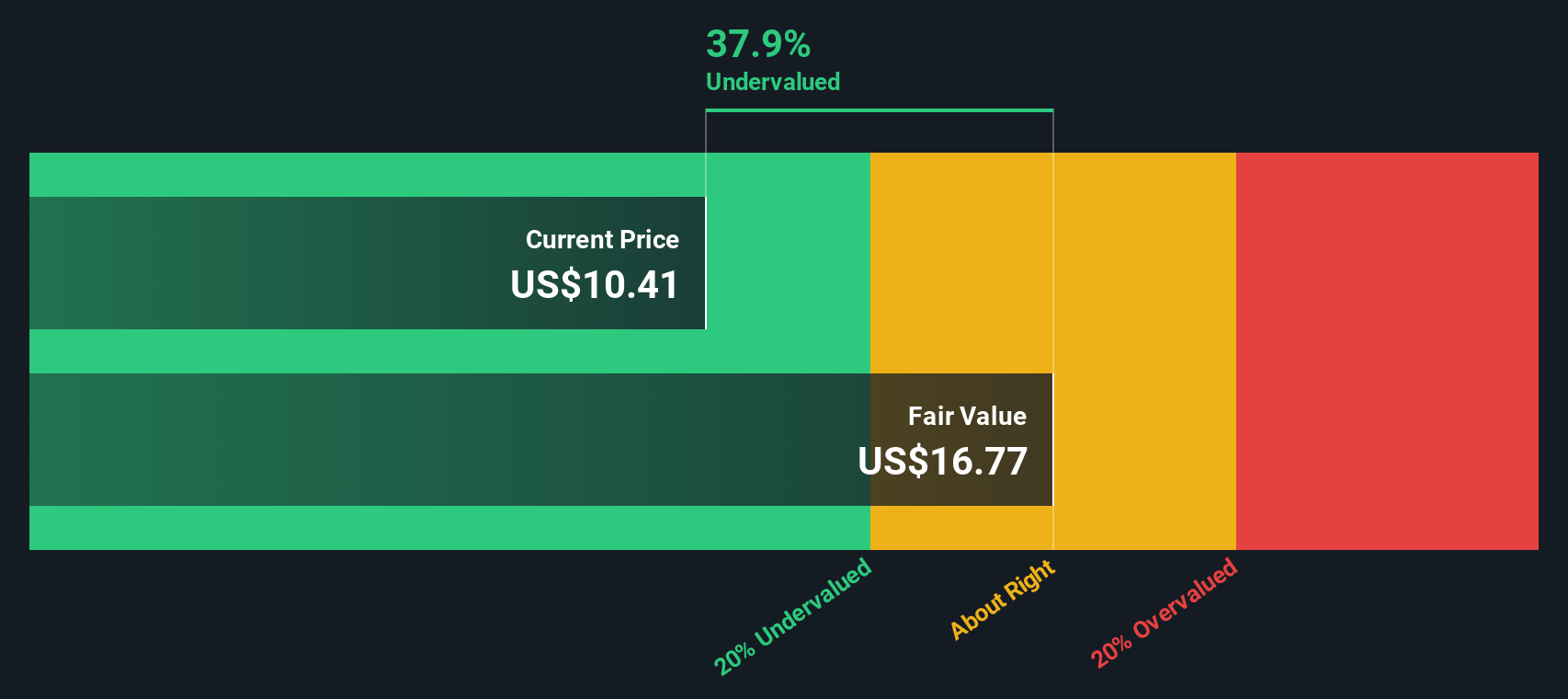

For investors trying to size up whether Valley National Bancorp is undervalued, a glance at its value score is revealing. Out of six valuation checks, the company passes four and earns a value score of 4. That’s a solid start; but what do these checks actually tell us, and how should we interpret the numbers in the context of today’s market?

Next, let’s break down the main valuation methods analysts use to evaluate companies like Valley National Bancorp. Also, stay tuned for the end, because there is an even more insightful way of thinking about valuation that could help you make smarter investing decisions.

Why Valley National Bancorp is lagging behind its peers

Approach 1: Valley National Bancorp Excess Returns Analysis

The Excess Returns Model evaluates how much value a company creates beyond what shareholders require by comparing the profitability of invested capital against its cost. In Valley National Bancorp’s case, this approach sheds light on the company’s ability to generate sustainable profits from its equity base while factoring in the risk-adjusted cost for investors.

Key figures for Valley National include a Book Value of $13.09 per share and a stable Earnings Per Share (EPS) estimate of $1.20, based on consensus from nine analysts. The calculated Cost of Equity is $0.99 per share, which means the company requires this amount per share to compensate investors for risk. The bank is generating an excess return of $0.21 per share, with an average Return on Equity of 8.5%. Analysts also expect a slight growth in stable book value to $14.14 per share going forward.

With an intrinsic value per share calculated at $19.36, the Excess Returns Model indicates Valley National Bancorp is currently trading at a 43.3% discount to its projected worth. This signals that the stock is meaningfully undervalued on this basis.

Result: UNDERVALUED

Our Excess Returns analysis suggests Valley National Bancorp is undervalued by 43.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

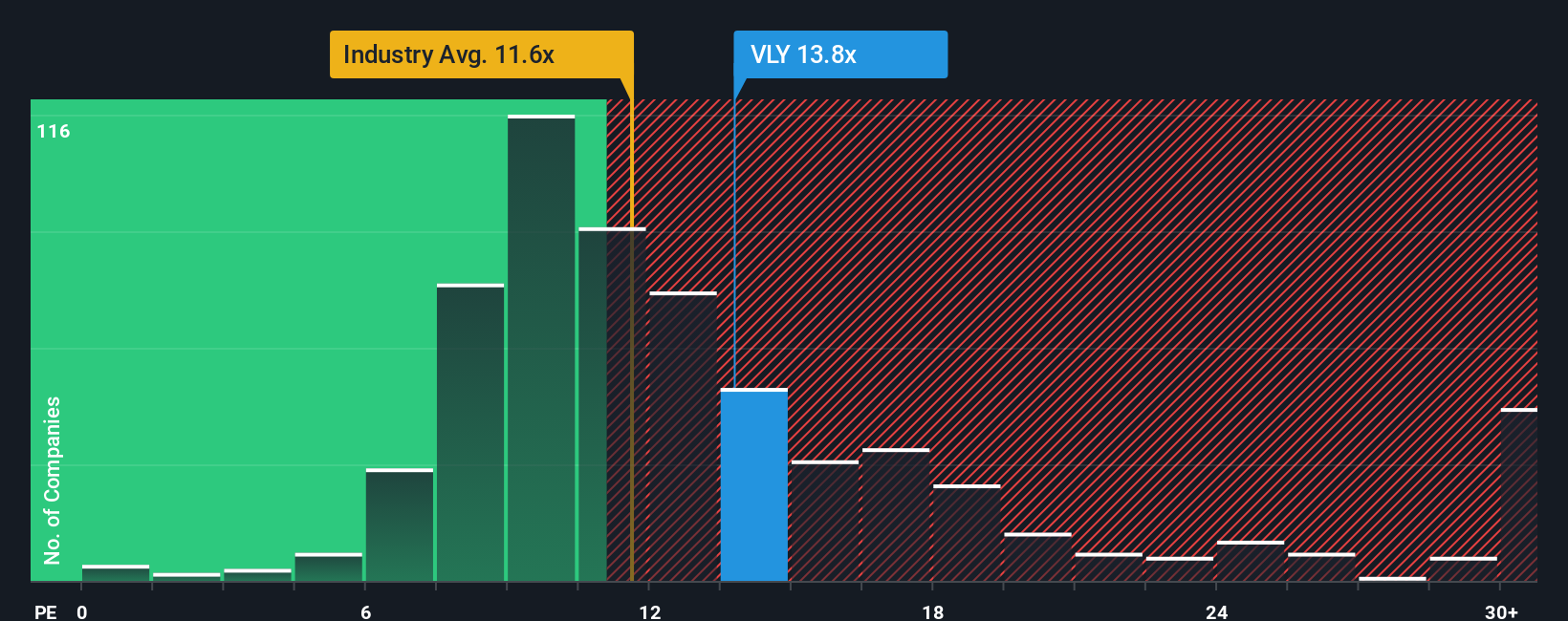

Approach 2: Valley National Bancorp Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used tools for valuing profitable companies like Valley National Bancorp. It gives investors a quick sense of how much they are paying for each dollar of current earnings. Generally, a higher PE signals elevated growth expectations or reduced risk, while a lower PE might point to investor concerns about future prospects or profitability. The “right” PE ratio depends not just on the company's own growth, but also on its risk profile, margins, and its standing compared to similar businesses.

Valley National currently trades at a PE ratio of 12.6x. For context, this figure stacks up favorably against the broader banks industry average of 11.2x, and is slightly below the average of direct peers at 13.9x. While these benchmarks are useful, they do not capture all the factors that drive a “fair” valuation.

This is where Simply Wall St’s Fair Ratio comes in. Unlike traditional PE comparisons, the Fair Ratio blends multiple drivers such as Valley National’s expected earnings growth, industry specifics, profit margins, market capitalization and unique risk factors to estimate what would be a fair multiple for the stock. For Valley National Bancorp, the Fair Ratio stands at 15.4x, suggesting the stock deserves a premium over both its current PE and peer averages due to its underlying strengths.

Given that Valley National’s actual PE (12.6x) is noticeably lower than the Fair Ratio (15.4x), the shares appear undervalued on this metric, indicating there may be room for upside if the company delivers as expected.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Valley National Bancorp Narrative

Earlier we mentioned there is a more insightful way to understand valuation, so let's introduce you to Narratives, an approach that connects a company’s story with its financial forecasts and ultimately its fair value. A Narrative is your perspective on a company, combining what you believe about Valley National Bancorp’s competitive position, catalysts, risks, future revenue, earnings, and margins into a single, coherent investment case.

Narratives serve as a bridge between numbers and real-world context, letting you articulate why you think the stock should be worth more or less than its current price. On Simply Wall St’s Community page, you can easily build, publish, and update your Narrative. Millions of investors already use this tool to compare their fair value and expectations to the market's view. Narratives are automatically updated when important news, earnings announcements, or analyst target changes occur, ensuring your forecasting stays relevant.

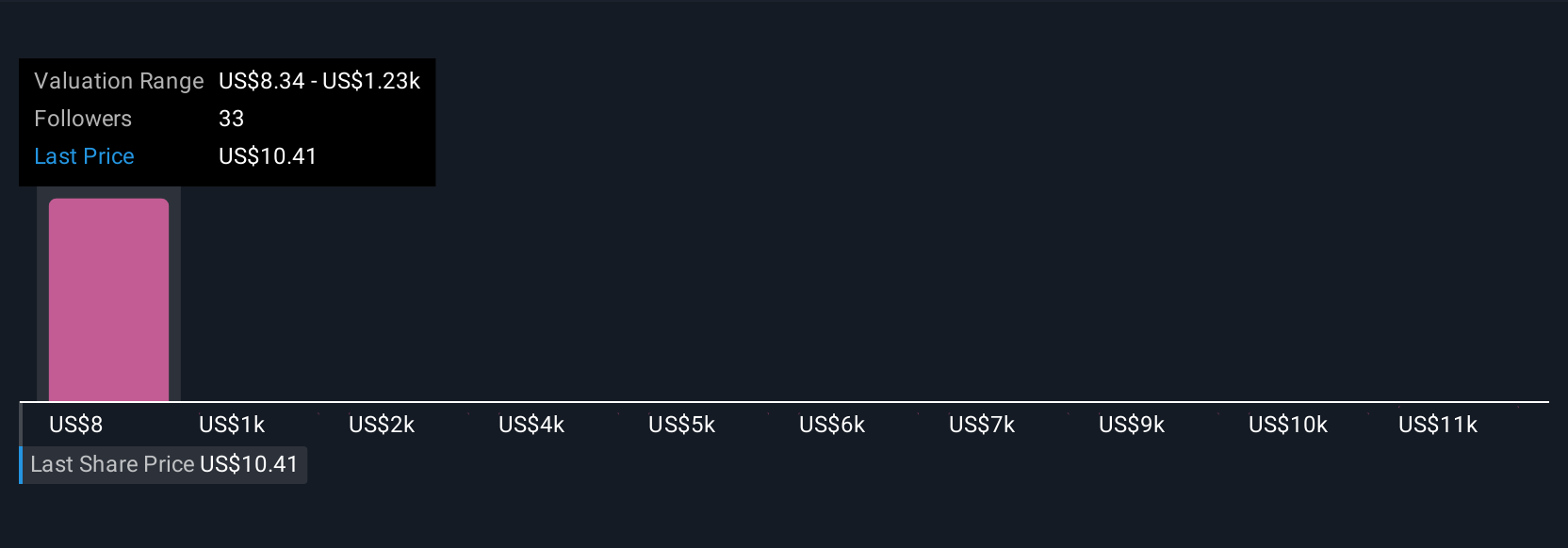

This makes investment decisions more dynamic. If your Narrative’s calculated Fair Value exceeds the current share price, it might be a buying opportunity; if it falls below, it may signal to consider selling or holding. For example, some Valley National Bancorp Narratives anticipate robust revenue growth and margin expansion, setting a fair value as high as $13.00 per share, while others focus on regional risks and set a more cautious value of $10.00 per share. This demonstrates how different stories lead investors to different decisions.

Do you think there's more to the story for Valley National Bancorp? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VLY

Valley National Bancorp

Operates as the holding company for Valley National Bank that provides various commercial, private banking, retail, insurance, and wealth management financial services products.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives