- United States

- /

- Banks

- /

- NasdaqCM:VABK

We Think Shareholders Are Less Likely To Approve A Pay Rise For Virginia National Bankshares Corporation's (NASDAQ:VABK) CEO For Now

Shareholders of Virginia National Bankshares Corporation (NASDAQ:VABK) will have been dismayed by the negative share price return over the last three years. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 24 June 2021. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

View our latest analysis for Virginia National Bankshares

How Does Total Compensation For Glenn Rust Compare With Other Companies In The Industry?

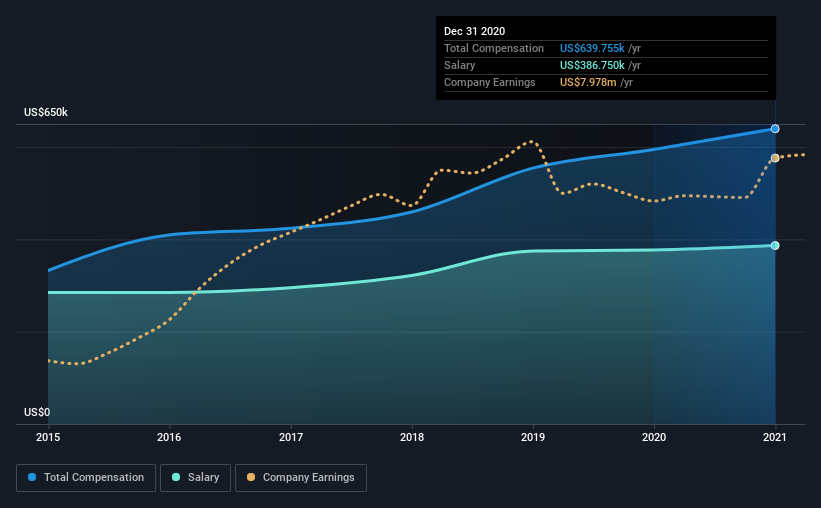

According to our data, Virginia National Bankshares Corporation has a market capitalization of US$196m, and paid its CEO total annual compensation worth US$640k over the year to December 2020. That's just a smallish increase of 7.6% on last year. Notably, the salary which is US$386.8k, represents most of the total compensation being paid.

On comparing similar companies from the same industry with market caps ranging from US$100m to US$400m, we found that the median CEO total compensation was US$772k. From this we gather that Glenn Rust is paid around the median for CEOs in the industry. Furthermore, Glenn Rust directly owns US$1.2m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$387k | US$377k | 60% |

| Other | US$253k | US$218k | 40% |

| Total Compensation | US$640k | US$595k | 100% |

Talking in terms of the industry, salary represented approximately 43% of total compensation out of all the companies we analyzed, while other remuneration made up 57% of the pie. Virginia National Bankshares is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Virginia National Bankshares Corporation's Growth

Virginia National Bankshares Corporation has seen its earnings per share (EPS) increase by 1.2% a year over the past three years. It achieved revenue growth of 12% over the last year.

This revenue growth could really point to a brighter future. And the improvement in EPSis modest but respectable. Although we'll stop short of calling the stock a top performer, we think the company has potential. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Virginia National Bankshares Corporation Been A Good Investment?

Given the total shareholder loss of 18% over three years, many shareholders in Virginia National Bankshares Corporation are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 2 warning signs (and 1 which is significant) in Virginia National Bankshares we think you should know about.

Switching gears from Virginia National Bankshares, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Virginia National Bankshares, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:VABK

Virginia National Bankshares

Operates as the holding company for Virginia National Bank that provides a range of commercial and retail banking services.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives