- United States

- /

- Banks

- /

- NasdaqCM:VABK

Top Dividend Stocks To Consider In November 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a downturn with major indices like the Dow Jones, S&P 500, and Nasdaq all declining due to concerns over AI-related valuations, investors are increasingly turning their attention to more stable investment options such as dividend stocks. In this environment of volatility, a good dividend stock is one that not only offers consistent payouts but also demonstrates resilience amid broader market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 5.40% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.77% | ★★★★★★ |

| OceanFirst Financial (OCFC) | 4.65% | ★★★★★★ |

| Interpublic Group of Companies (IPG) | 5.27% | ★★★★★★ |

| Heritage Commerce (HTBK) | 5.10% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 6.33% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.26% | ★★★★★★ |

| Ennis (EBF) | 6.11% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.59% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.89% | ★★★★★★ |

Click here to see the full list of 139 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

Virginia National Bankshares (VABK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Virginia National Bankshares Corporation, with a market cap of $215.83 million, operates as the holding company for Virginia National Bank, offering a variety of commercial and retail banking products and services in Virginia.

Operations: Virginia National Bankshares Corporation generates its revenue primarily through its banking segment, which accounts for $55.61 million, complemented by $0.91 million from VNB Trust & Estate Services.

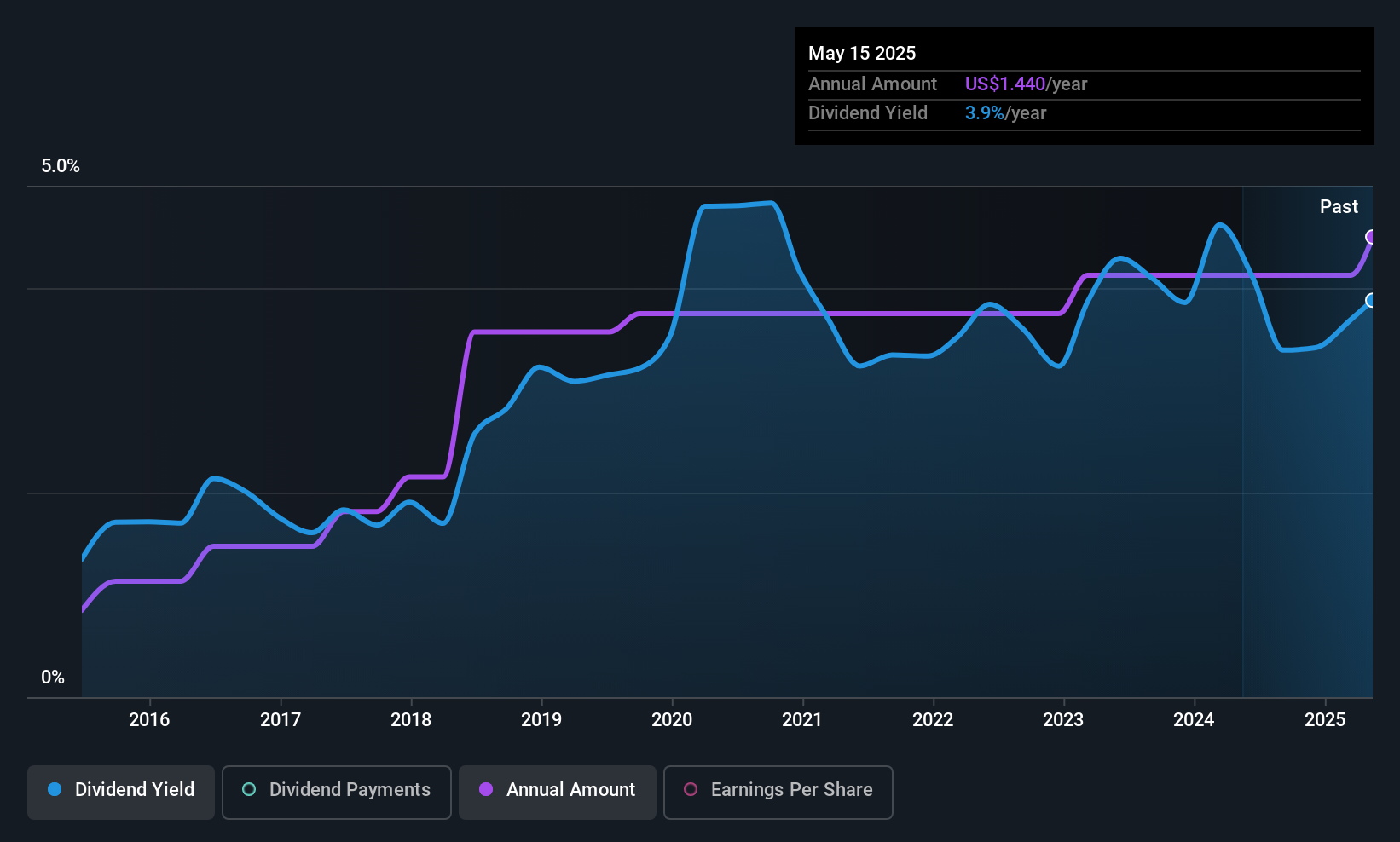

Dividend Yield: 3.7%

Virginia National Bankshares offers a stable dividend yield of 3.66%, supported by a low payout ratio of 41.6%, indicating dividends are well-covered by earnings. Despite being dropped from the S&P Global BMI Index, the company has consistently increased its dividend over the past decade with little volatility. Recent earnings show steady growth in net interest income, while quarterly dividends remain attractive to investors seeking reliable income streams, though not among the highest in the market.

- Click here to discover the nuances of Virginia National Bankshares with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Virginia National Bankshares is priced lower than what may be justified by its financials.

CareTrust REIT (CTRE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CareTrust REIT is a self-administered, publicly-traded real estate investment trust focused on owning, acquiring, developing, and leasing seniors housing and healthcare-related properties, with a market cap of $8.01 billion.

Operations: CareTrust REIT generates revenue primarily from its investments in healthcare-related real estate assets, totaling $428.48 million.

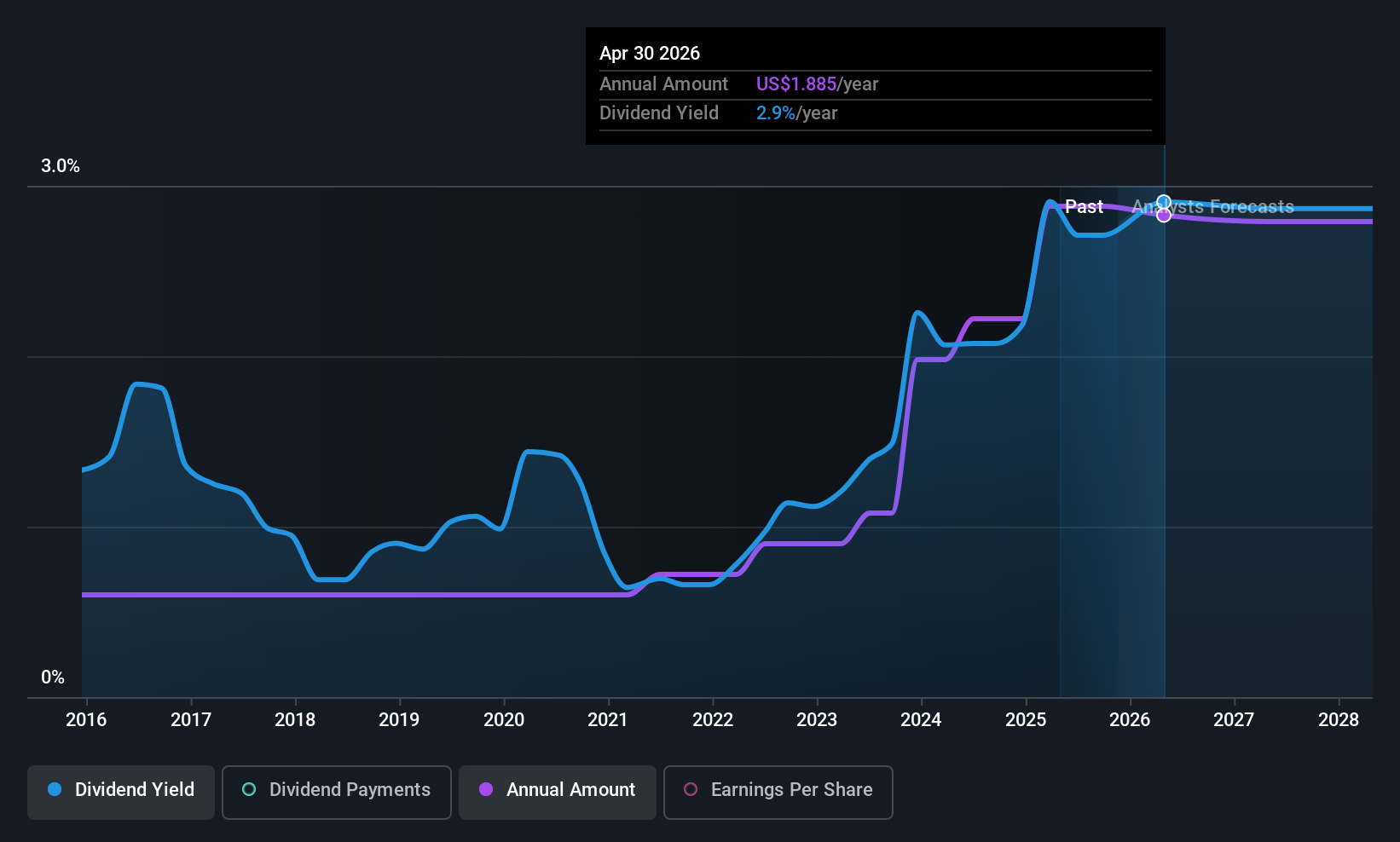

Dividend Yield: 3.7%

CareTrust REIT's dividend yield of 3.68% is reliable and has grown over the past decade, yet it remains below the top tier in the US market. The dividend is not well covered by earnings due to a high payout ratio, though cash flows do cover it. Recent earnings show significant growth, with Q3 net income rising to US$74.9 million from US$33.44 million year-over-year, indicating strong operational performance despite sustainability concerns for dividends based on earnings alone.

- Unlock comprehensive insights into our analysis of CareTrust REIT stock in this dividend report.

- The valuation report we've compiled suggests that CareTrust REIT's current price could be quite moderate.

Korn Ferry (KFY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Korn Ferry, with a market cap of $3.41 billion, provides organizational consulting services globally through its subsidiaries.

Operations: Korn Ferry generates revenue through various segments, including RPO ($356.91 million), Digital ($364.55 million), Executive Search across EMEA ($201.89 million), Asia Pacific ($91.46 million), Latin America ($27.66 million), and North America ($540.82 million), as well as Consulting excluding Digital services ($664.80 million) and Professional Search & Interim excluding RPO services ($515.68 million).

Dividend Yield: 3%

Korn Ferry's dividend yield of 3.02% is reliable and has grown steadily over the past decade, although it sits below the top tier in the US market. The dividend is well covered by earnings, with a payout ratio of 35.6%, and cash flows, with a cash payout ratio of 36%. Recent earnings growth supports this stability, as Q1 net income rose to US$66.64 million from US$62.6 million year-over-year, reflecting strong financial health.

- Get an in-depth perspective on Korn Ferry's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Korn Ferry is trading behind its estimated value.

Seize The Opportunity

- Access the full spectrum of 139 Top US Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VABK

Virginia National Bankshares

Operates as the holding company for Virginia National Bank that provides a range of commercial and retail banking products and services in Virginia.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives