- United States

- /

- Banks

- /

- NasdaqGM:USCB

USCB Financial Holdings (USCB) Profit Margins Surpass 33%, Reinforcing Bullish Community Narratives

Reviewed by Simply Wall St

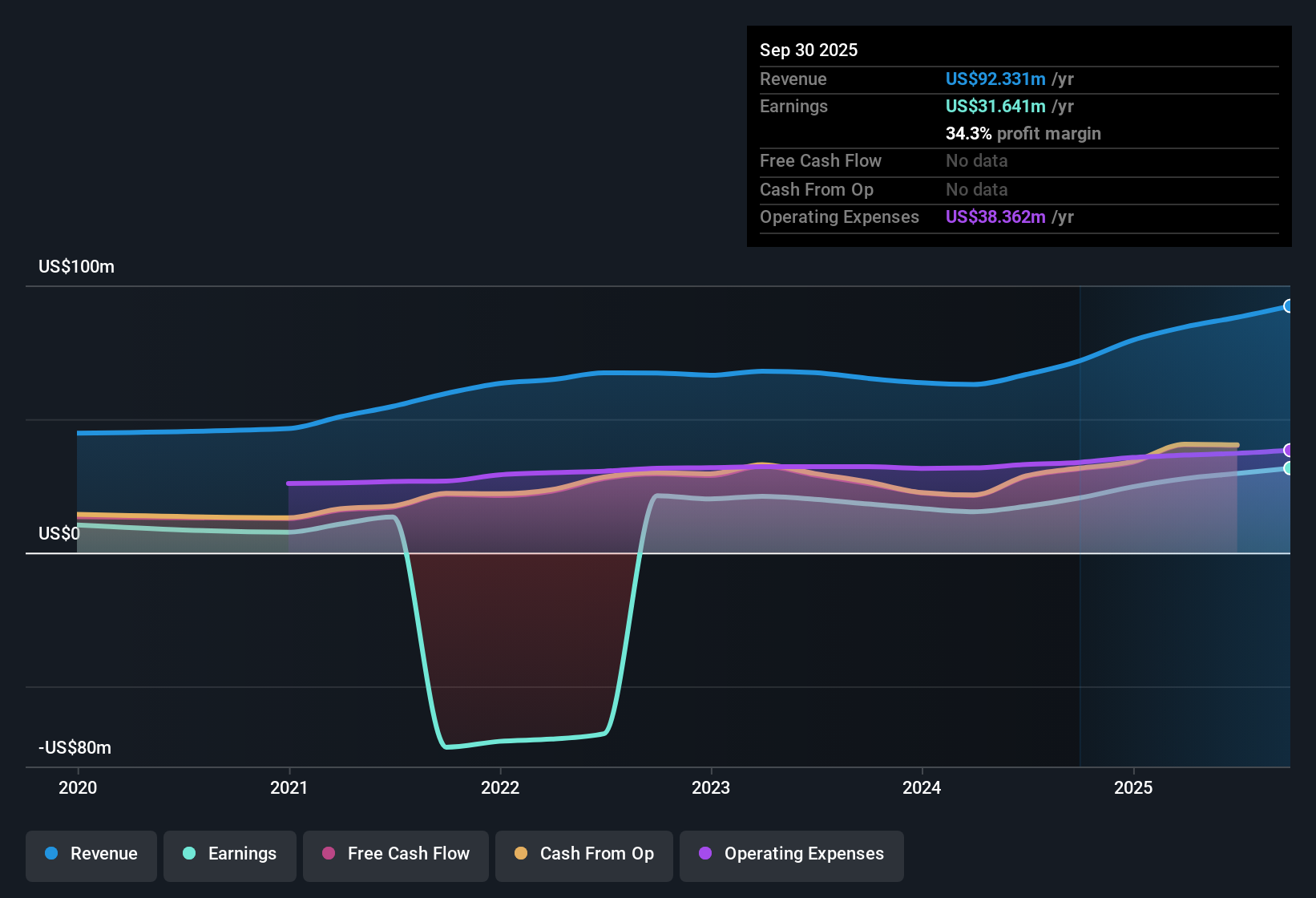

USCB Financial Holdings (USCB) posted robust numbers this period, forecasting earnings growth of 11.84% per year and annual revenue growth of 10.9%. Net profit margins surged to 33.7%, up from 26% last year, and the company averaged a striking 47.1% earnings growth annually over the past five years, with a standout 70.8% jump in the latest year. With high quality earnings, improved profitability, and a Price-To-Earnings ratio of 10.6x that sits below peers and the US Banks industry average, the setup points towards favorable sentiment for investors, especially with no notable risks highlighted.

See our full analysis for USCB Financial Holdings.Next up, we’ll see how these strong results compare with the prevailing narratives in the market. Some expectations may be confirmed, while others could get a reality check.

See what the community is saying about USCB Financial Holdings

Profit Margins Climb to 33.7%

- Net profit margin reached 33.7%, advancing from 26% in the prior year. This indicates meaningful improvement in efficiency and profitability.

- Analysts' consensus view sees expanding digital banking capabilities and a diversified funding base as core drivers behind margin gains.

- The bank’s push into digital banking and ongoing investments in efficiency are expected to further lower operating costs, improving its efficiency ratio and adding support to net margins.

- Consensus calls for margins to rise to 34.8% in three years, based on both revenue growth and balance sheet expansion.

Consensus sees room for digital investments and stable funding to push margins even higher next year. 📊 Read the full USCB Financial Holdings Consensus Narrative.

Aggressive Growth Outpaces Peers

- Over the past five years, USCB has averaged 47.1% annual earnings growth, with the most recent year reaching 70.8%. This is well above typical sector trends.

- Consensus narrative points to several catalysts fueling this growth, including high-opportunity South Florida markets and readiness for M&A.

- The bank’s strong positioning in fast-growing geographic markets and ongoing business formation in Florida are supporting loan demand and driving robust profit expansion.

- Preparedness for future acquisitions and targeting deposit-rich verticals are viewed as ways to accelerate growth beyond organic trends.

Attractive Valuation versus Industry

- The price-to-earnings ratio stands at 10.6x, which is below both the peer average of 15.7x and the industry average of 11.2x. The current share price of $17.29 is materially below analysts’ only allowed price target of $20.75.

- Consensus narrative underscores that at these levels, investors are paying below both peer and analyst fair value estimates, with future profits and margins expected to improve.

- The 15.3% discount to the price target, together with ongoing revenue and margin growth, supports a favorable valuation story for long-term investors.

- With DCF fair value assessed at $45.41, there is additional upside potential recognized beyond near-term analyst expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for USCB Financial Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your perspective and shape your story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding USCB Financial Holdings.

See What Else Is Out There

While USCB Financial Holdings boasts rapid earnings growth and improving margins, its results have shown significant variability year to year. This signals less predictable performance than some peers.

If you want steadier returns from your investments, target companies showing consistent track records and dependable expansion with our stable growth stocks screener (2099 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:USCB

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives