- United States

- /

- Banks

- /

- NasdaqGM:UNTY

Unity Bancorp (UNTY) Earnings Surge 35.9%, Reinforcing Bullish Narratives on Profitability and Value

Reviewed by Simply Wall St

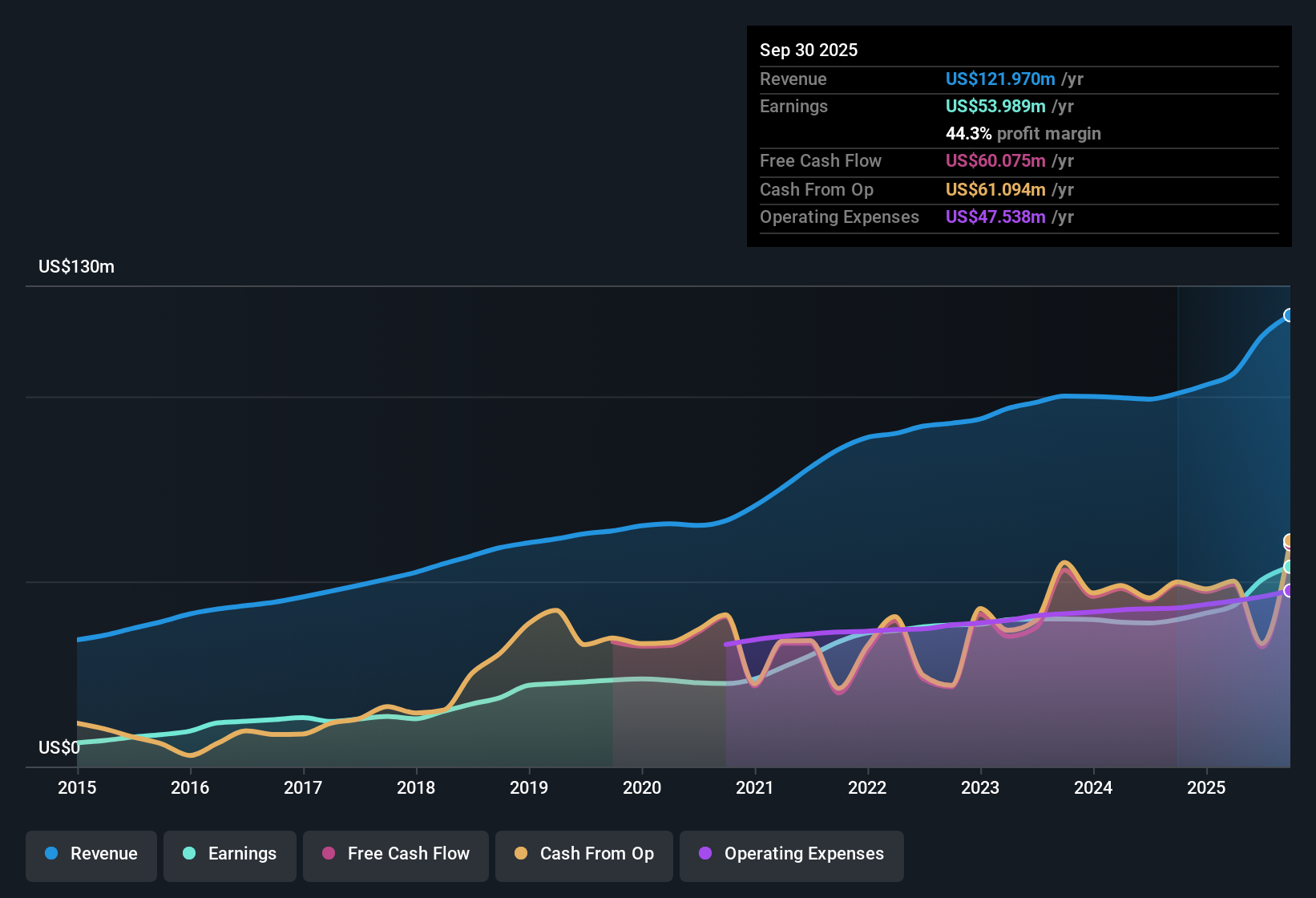

Unity Bancorp (UNTY) posted standout performance for the year, reporting annual earnings growth of 35.9%, which sharply outpaces its average 11.6% trend over the last five years. Net profit margins reached 44.3%, up from the previous year’s 39.4%, highlighting greater operational efficiency and profitability. With the stock trading at a P/E of 9.2x and a share price notably below estimated fair value, investors are likely to view these results as confirmation of both strong fundamentals and an attractive risk-reward setup.

See our full analysis for Unity Bancorp.Next, we will see how these fresh results compare to the prevailing market narratives and community perspectives, revealing which stories hold up under the latest numbers and which receive a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Climb to 44.3%

- Net profit margins for Unity Bancorp rose from 39.4% to 44.3% year-on-year, marking a notable improvement in operational efficiency and profitability.

- The prevailing market view is that this margin strength heavily supports the argument for core banking resilience and high-quality earnings, especially since such levels outpace most peers.

- Improved profitability at this scale stands out against the broader U.S. banking industry, where average margins are typically lower.

- The lack of flagged operating risks further reinforces the positive interpretation of these results for investors seeking durable returns.

Revenue Growth Set to Trail Market

- Forecasts call for Unity's earnings to grow by 3.2% per year and revenue by 9.8% per year going forward, both slightly behind the broader U.S. market expectations.

- Prevailing market analysis suggests that, while recent growth is impressive, the tempered guidance may moderate investor enthusiasm, setting a more measured outlook.

- Expectations for future earnings growth are now lower than its five-year 11.6% annual average, indicating that recent gains may not be sustainable without new growth catalysts.

- The consensus is that this softer forward pace realigns Unity more closely with sector norms, making big earnings surprises less likely in coming years.

Valuation at a Deep Discount to Peers

- Unity shares trade at a P/E of 9.2x, well under both the US Banks industry average of 11.5x and the peer group’s 12.3x. The $49.31 share price is materially below a DCF fair value of $112.50.

- Prevailing market perspective highlights that this substantial valuation gap offers a compelling risk-reward profile, especially given Unity’s track record of strong profit growth.

- Investors may see meaningful upside potential if Unity closes even part of its valuation gap versus sector benchmarks.

- The absence of newly disclosed risks in regulatory filings further bolsters the attractiveness of this discount.

See our latest analysis for Unity Bancorp.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Unity Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Unity’s projected earnings and revenue growth now trail the broader market. This signals that its recent momentum may not persist without new drivers.

If you want steadier expansion and fewer surprises, use stable growth stocks screener (2090 results) to find companies consistently delivering reliable growth, quarter after quarter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:UNTY

Unity Bancorp

Operates as the bank holding company for Unity Bank that provides commercial and retail banking services.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives