- United States

- /

- Banks

- /

- NasdaqGS:UMBF

UMB Financial (UMBF) Margin Expansion Reinforces Bullish Narratives Despite Premium Valuation

Reviewed by Simply Wall St

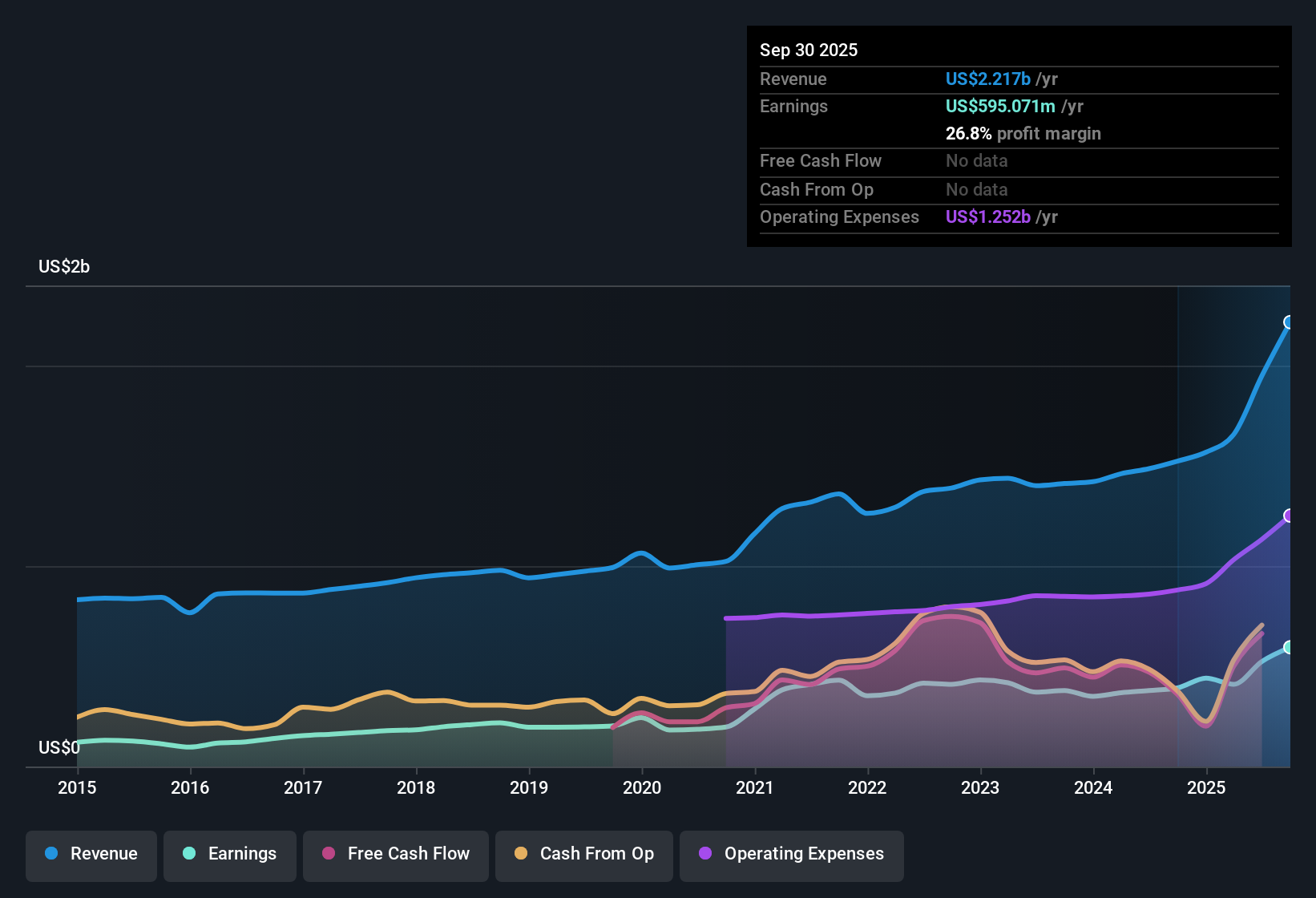

UMB Financial (UMBF) posted net profit margins of 26.8%, a gain from 25.7% last year, with annual EPS growth averaging 8.1% over five years. Recent results show annual earnings up 51.7%, well above the longer-term average, and the company is guiding for 24.6% annual earnings growth compared to the US market’s slower pace. Robust profit and revenue growth, improving margins, and five reward signals stand out as key positives for investors this quarter.

See our full analysis for UMB Financial.Now, let’s see how these headline numbers measure up against the prevailing narratives on Simply Wall St. We will review which assumptions hold up and which ones get put to the test.

See what the community is saying about UMB Financial

Cost Savings from Heartland Deal Show Up in Margins

- UMB Financial is targeting $124 million in cost savings from the Heartland (HTLF) acquisition, with most of these savings expected to be realized by early 2026. This could materially boost operating leverage and expand net profit margins.

- According to analysts' consensus view, integrating Heartland, streamlining vendors, and investing in technology should deliver:

- Significant margin improvement. Net profit margins are projected to rise from 26.9% today to 36.6% within three years, which would place UMB well ahead of most regional bank peers.

- Operational efficiency gains enabled by platform consolidation and digital adoption, with expectations for increased earnings stability and retention of new clients won through these changes.

- After recent margin expansion, the consensus narrative points to operational efficiencies from the Heartland deal as a key driver to watch, especially as management executes further branch and workforce integration.

See what’s fueling the consensus bull and bear case in full detail. 📊 Read the full UMB Financial Consensus Narrative.

Share Dilution and Regional Concentration Flagged as Risks

- Analysts expect the number of UMB shares outstanding to grow by 7.0% annually over the next three years, which could dilute per-share earnings as the bank absorbs Heartland and funds new growth initiatives.

- Bears highlight that:

- UMB’s regional concentration in the Midwest and Plains states exposes it to risks from local economic slowdowns or static population. This could potentially undermine the bank’s outperformance if its core markets weaken relative to national peers.

- The Heartland acquisition brings integration and execution risks. Unexpected delays or elevated costs could prevent the realization of the expected $124 million in cost synergies, keeping expense ratios higher for longer and reducing targeted margin gains.

Valuation Stays Above Peers Despite Limited Price Upside

- UMB’s current price-to-earnings ratio of 13.9x stands above both the US bank peer average (11.8x) and the industry (11.2x). This indicates the market already reflects expectations for above-average margin and revenue growth, even with its latest share price at $108.68.

- Taking the analysts' consensus narrative, the consensus price target of $139.38 is only about 28% higher than today’s price. This suggests the market sees UMB as fairly valued rather than poised for a major re-rating.

- This fair value gap could narrow further if integration risks materialize or if projected cost savings do not fully boost margins and earnings as forecasted.

- However, ongoing outperformance in non-interest income and long-term diversification into asset servicing offer a potential upside if these businesses continue to grow faster than the market expects.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for UMB Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the data? In just a few minutes, you can share your outlook and shape the conversation with your personal view: Do it your way

A great starting point for your UMB Financial research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

UMB Financial’s elevated valuation and integration risks could limit upside if cost savings or earnings expansion do not materialize as expected.

If you want to find companies trading at more attractive prices with strong upside potential, check out these 854 undervalued stocks based on cash flows where you’ll discover those undervalued by the market right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UMBF

UMB Financial

Operates as the bank holding company that provides banking services and asset servicing in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives