- United States

- /

- Banks

- /

- NasdaqGS:UMBF

A Closer Look at UMB Financial (UMBF) Valuation After Recent Share Price Rebound

Reviewed by Simply Wall St

UMB Financial (UMBF) shares have edged higher over the past week, rising around 4%. This comes even as the stock dipped nearly 5% over the past month, which shows some renewed investor interest lately.

See our latest analysis for UMB Financial.

Zooming out, UMB Financial’s recent gains have helped offset losses from earlier in the month, with momentum now picking up after a subdued stretch. Over the past year, shareholders have enjoyed a total return of nearly 11%. The overall long-term trend remains strong, which suggests renewed confidence in the bank’s growth story.

If you’re interested in finding other companies catching investors’ attention, now is the perfect time to discover fast growing stocks with high insider ownership

But with yearly returns outpacing many peers and shares still trading around 23% below the average analyst target, the key question remains: Is UMB Financial undervalued, or has the market already factored in its future growth potential?

Most Popular Narrative: 18.5% Undervalued

The most widely followed narrative sets a fair value well above UMB Financial’s closing price, driven by optimism around new efficiencies and expansion. This perspective rests on the belief that recent improvements are more structural than short-term, and that the upside is not fully recognized in the market yet.

The successful integration of the Heartland (HTLF) acquisition, including vendor consolidation and conversion to the UMB platform, is expected to unlock substantial cost savings ($124 million targeted, most of which will be realized by early 2026). This should materially improve operating leverage and expand net margins. UMB continues to benefit from robust loan and deposit growth, driven by strategic expansion in high-growth Midwest and Southwest markets and an expanded branch network. This performance outpaces regional peers and supports long-term revenue and earnings growth.

Curious what assumptions make analysts so bullish? The full narrative hides bold growth targets in revenue, profits, and even market share. Is there a game-changing forecast behind that high fair value? Find out what’s driving such confidence in the company’s transformation and efficiency plan. One key number could surprise you.

Result: Fair Value of $139.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including potential integration challenges after the Heartland acquisition and UMB’s reliance on regional growth in the Midwest and Plains.

Find out about the key risks to this UMB Financial narrative.

Another View: Are Earnings Ratios Sending a Different Signal?

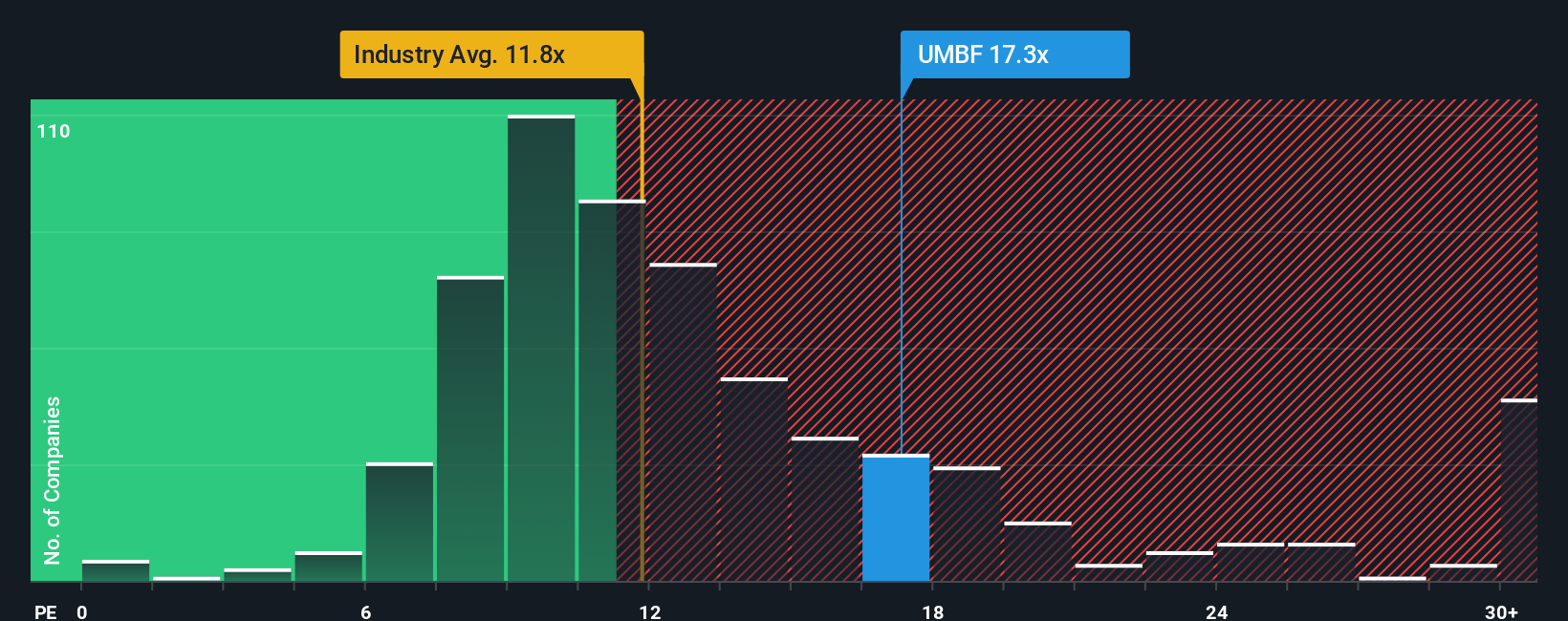

Switching perspectives, some investors focus on earnings ratios versus peers and industry benchmarks. UMB Financial trades at a price-to-earnings ratio of 16.4x, which is higher than both its peer average of 12.2x and the US Banks industry average of 11.2x. Even when compared to its fair ratio of 17x, shares are not far off. This suggests there may be less room for upside if market sentiment changes. Does this indicate the market has already priced in much of UMB’s growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UMB Financial Narrative

If you want to dig into the data or follow your own insights, it takes just a few minutes to build your personal perspective. Do it your way.

A great starting point for your UMB Financial research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step outside the familiar and power up your portfolio with unique strategies you might be missing. Seize the momentum before others catch on and tap into fresh sectors primed for growth.

- Supercharge your potential returns by checking out these 876 undervalued stocks based on cash flows, where stocks are priced well below their intrinsic value and could be tomorrow’s standout performers.

- Boost your income stream as you review these 17 dividend stocks with yields > 3%, featuring companies paying attractive yields above 3%, perfect for those who want more from their investments.

- Ride the innovation wave by researching these 27 AI penny stocks, showcasing cutting-edge businesses leading breakthroughs in artificial intelligence and transforming global industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UMBF

UMB Financial

Operates as the bank holding company that provides banking services and asset servicing in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives