- United States

- /

- Banks

- /

- NasdaqGS:TRMK

Trustmark (TRMK) Margin Surge Reinforces Bull Narratives Despite Muted Growth Forecasts

Reviewed by Simply Wall St

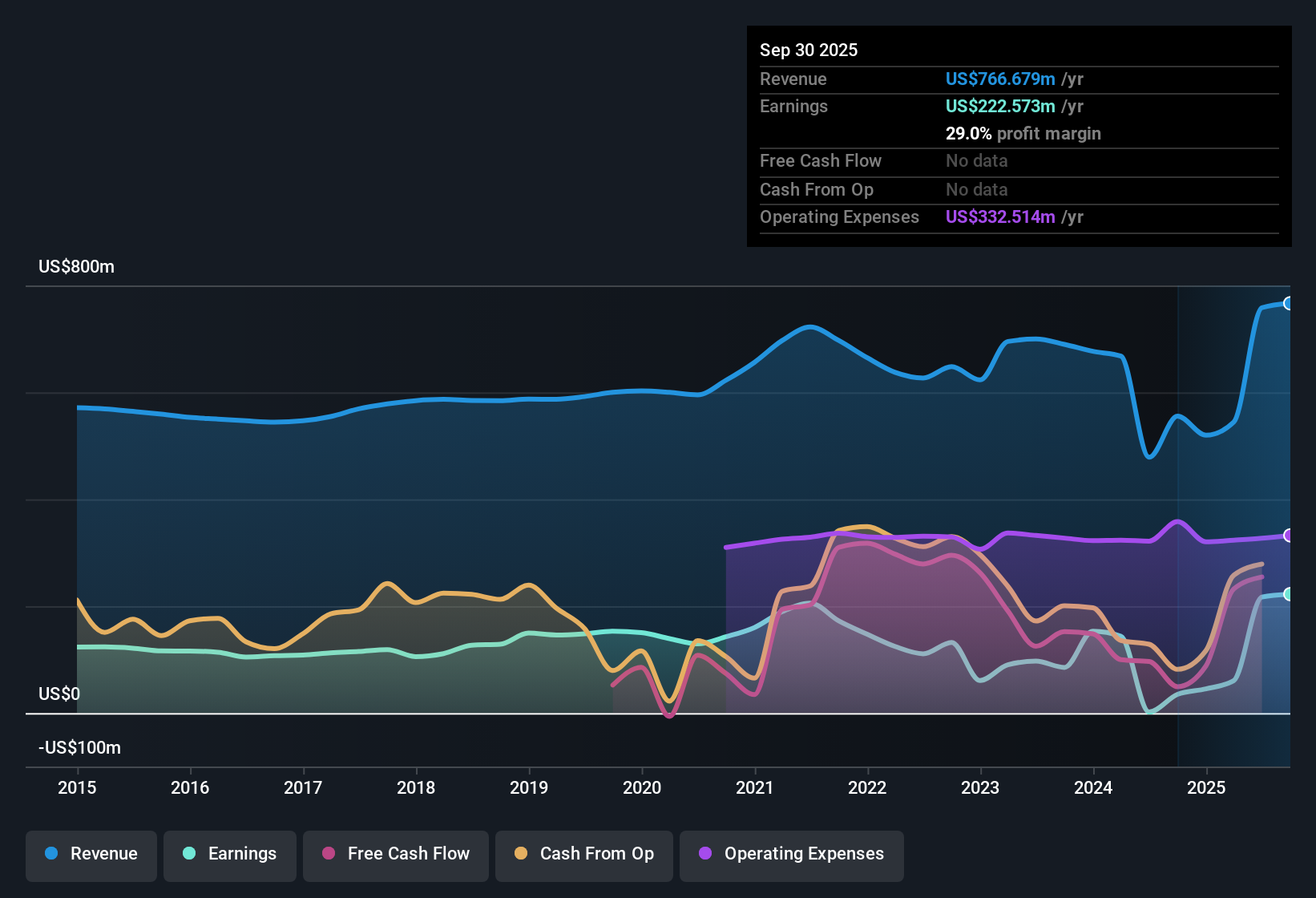

Trustmark (TRMK) reported a standout year, with earnings leaping 536.2% compared to last year, a dramatic turnaround from its five-year average decline of 9.4% per year. Net profit margins also surged to 28.9% from just 6.3% twelve months ago. While future growth expectations are more muted, with forecasted EPS set to grow at 1.5% per year and revenue at 5.5% per year, both trailing the US market averages, investors will pay close attention to the company’s improved profitability, attractive valuation, and reliable dividend, especially at a share price ($37.95) above fair value ($23.60).

See our full analysis for Trustmark.Now, let’s see how these results stack up against the broader market narratives and investor sentiment. Some long-held views might be confirmed, while others could be up for debate.

See what the community is saying about Trustmark

Margins Power Ahead of Peers

- Net profit margins climbed to 28.9%, which stands well above both last year's 6.3% and typical regional banking levels. This illustrates effective cost control and improved loan book performance.

- Analysts' consensus view ties this margin gain to Trustmark’s discipline in expense management and targeted expansion in fast-growing Southeastern US markets.

- A renewed focus on digital infrastructure and tight cost oversight contributed to both scale and margin expansion, which is directly reflected in this substantial margin lift.

- Continued improvement in operational leverage through technology investment is seen as a lever for sustaining strong margins, even as competition in the region intensifies.

- To see how the consensus view shapes the next chapter, read the standout takeaways in the full breakdown. 📊 Read the full Trustmark Consensus Narrative.

Valuation Gap Draws Attention

- Trustmark trades at a Price-To-Earnings ratio of 10.3x, which is below the industry average of 11.2x and the peer group’s 13.3x. The share price ($37.95) remains materially above DCF fair value ($23.60).

- In the analysts’ consensus narrative, this discount relative to sector peers is tempered by only moderate future growth expectations.

- Forecasts put revenue growth at 7.4% per year and margin compression ahead, which means investors may not see rapid upside even if the valuation appears attractive.

- This creates a tension where price targets offer only an 8.3% upside from current levels. Analysts see Trustmark as fairly valued based on known financial catalysts.

Share Count Decline to Boost EPS

- The number of shares outstanding is expected to fall by 1.29% per year for the next 3 years, supporting incremental growth in earnings per share and returns to shareholders.

- Analysts’ consensus view is that this ongoing share reduction will help counterbalance predicted margin pressure and slower top-line gains, keeping EPS growth steady.

- Projected EPS is to rise from current levels to $3.91 by September 2028, according to the consensus forecast. This shows both agreement on outlook and management’s alignment on capital returns.

- This steady EPS growth, even as revenue expectations cool, is credited to disciplined share repurchases and careful management of outstanding shares.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Trustmark on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another angle on the numbers? Take a moment to create your own narrative and bring your perspective to the table. You can do it in minutes. Do it your way

A great starting point for your Trustmark research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Trustmark boasts rising profit margins and steady EPS growth, its limited revenue expansion and only moderate growth outlook may cap future gains.

If you want more upside, use high growth potential stocks screener (62 results) to zero in on established companies predicted to deliver much stronger earnings growth over the next three years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trustmark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRMK

Trustmark

Operates as the bank holding company for Trustmark National Bank that provides banking and other financial solutions to individuals and corporate institutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives