- United States

- /

- Banks

- /

- NasdaqGS:TRMK

Trustmark (TRMK): Evaluating Valuation Following Q3 Revenue Beat and Strategic Loan Growth Momentum

Reviewed by Simply Wall St

Trustmark (TRMK) just posted its third-quarter results, delivering a slight revenue beat as revenues climbed compared to last year and earnings landed right on target. Management pointed to ongoing loan growth and the company's strategic growth initiatives in these results.

See our latest analysis for Trustmark.

Trustmark’s share price has seen steady progress this year, finishing at $38.17 and notching a 10.3% year-to-date share price return. Its 1-year total shareholder return stands at 2.4%. Recent initiatives and ongoing loan growth seem to be maintaining investor interest. The long-term view appears resilient amid a challenging backdrop.

If you’re curious where else steady growth might be brewing, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With Trustmark outperforming revenue forecasts and maintaining stable growth, investors are left to consider whether the current share price reflects all of the future upside or if there could be more value waiting to be unlocked.

Most Popular Narrative: 12.5% Undervalued

Trustmark’s most widely followed narrative sets the fair value at $43.60, which is around $5.40 higher than its recent closing price. The expectations driving that number reveal a mix of regional strengths, digital ambitions, and disciplined management.

Expansion in high-growth U.S. regions and digital investments is expected to drive sustained revenue and margin improvements. Opportunities in wealth management and disciplined expense control support diversified income growth and operational efficiency.

Want to see the numbers behind this optimistic outlook? Analysts expect significant gains that may surprise those only focused on the headline growth rate. If you want to see which financial forecasts fuel these expectations and what bold assumptions separate this fair value from the crowd, the full narrative reveals the reasoning behind each projection.

Result: Fair Value of $43.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Trustmark’s focus on the Southeast exposes it to regional downturns. In addition, slow digital adoption could limit future competitiveness and earnings growth.

Find out about the key risks to this Trustmark narrative.

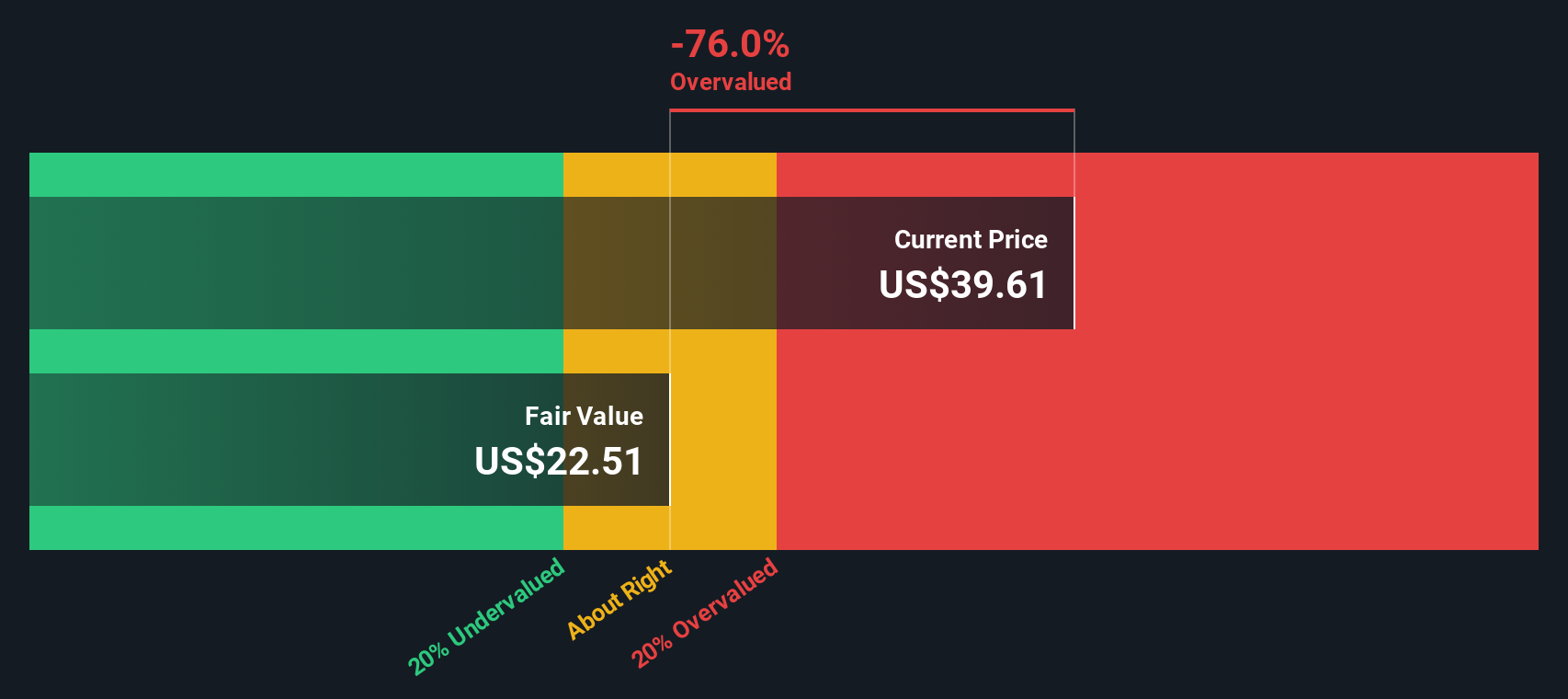

Another View: DCF Model Paints a Different Picture

While analyst consensus sees Trustmark as undervalued, our DCF model tells a different story. According to this approach, the current share price actually sits well above the estimated fair value. This raises doubts about how much upside remains. Could analyst optimism be pricing in more growth than is likely?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Trustmark for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Trustmark Narrative

If you think the story could unfold differently or want to analyze the details for yourself, you can craft your own perspective in just a few minutes, and Do it your way

A great starting point for your Trustmark research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't wait for opportunity to knock. Unlock new possibilities right now and expand your investing horizons by tapping into these standout stock ideas that thousands of smart investors are watching closely:

- Accelerate your hunt for stable income and capital growth by checking out these 15 dividend stocks with yields > 3%, offering yields that stand above the rest.

- Target tomorrow’s industry leaders by uncovering the innovators shaping the future of medicine with these 31 healthcare AI stocks.

- Get ahead of the next wave in digital finance and tap into the momentum offered by these 82 cryptocurrency and blockchain stocks, which is paving the way in blockchain and crypto advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trustmark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRMK

Trustmark

Operates as the bank holding company for Trustmark National Bank that provides banking and other financial solutions to individuals and corporate institutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives