- United States

- /

- Banks

- /

- NasdaqGS:TOWN

Senior Executive VP & CFO of TowneBank William Littreal Buys 20% More Shares

Potential TowneBank (NASDAQ:TOWN) shareholders may wish to note that the Senior Executive VP & CFO, William Littreal, recently bought US$350k worth of stock, paying US$32.29 for each share. That's a very solid buy in our book, and increased their holding by a noteworthy 20%.

The Last 12 Months Of Insider Transactions At TowneBank

In fact, the recent purchase by William Littreal was the biggest purchase of TowneBank shares made by an insider individual in the last twelve months, according to our records. That means that an insider was happy to buy shares at around the current price of US$33.80. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. While we always like to see insider buying, it's less meaningful if the purchases were made at much lower prices, as the opportunity they saw may have passed. In this case we're pleased to report that the insider purchases were made at close to current prices.

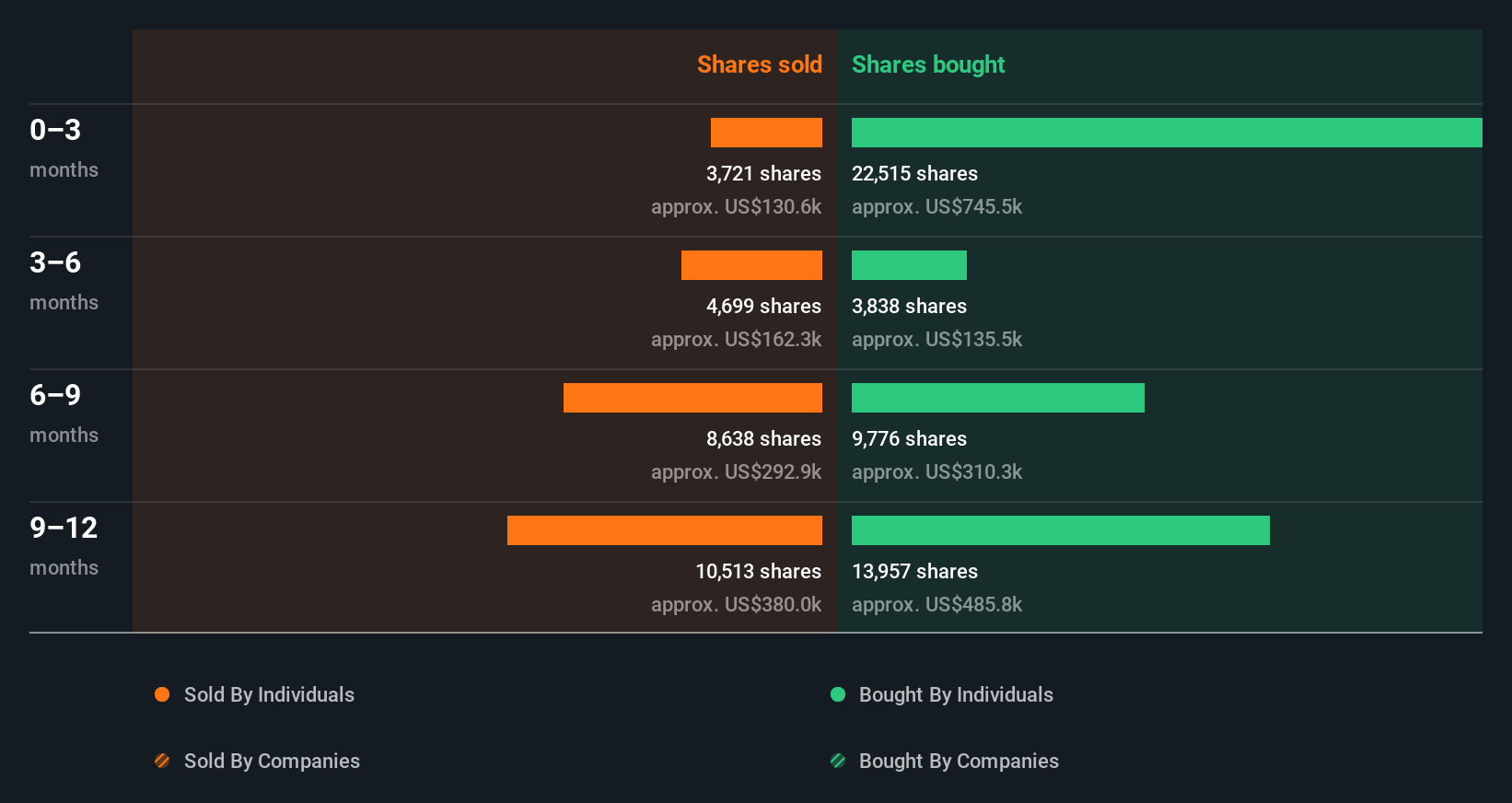

In the last twelve months insiders purchased 51.82k shares for US$1.7m. But insiders sold 27.57k shares worth US$979k. Overall, TowneBank insiders were net buyers during the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

See our latest analysis for TowneBank

TowneBank is not the only stock insiders are buying. So take a peek at this free list of under-the-radar companies with insider buying.

Does TowneBank Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. TowneBank insiders own about US$176m worth of shares (which is 6.9% of the company). Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Do The TowneBank Insider Transactions Indicate?

It is good to see recent purchasing. And the longer term insider transactions also give us confidence. When combined with notable insider ownership, these factors suggest TowneBank insiders are well aligned, and quite possibly think the share price is too low. Looks promising! Therefore, you should definitely take a look at this FREE report showing analyst forecasts for TowneBank.

Of course TowneBank may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if TowneBank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TOWN

TowneBank

Provides retail and commercial banking services for individuals, commercial enterprises, and professionals in Virginia and North Carolina.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success