- United States

- /

- Banks

- /

- NasdaqGS:TOWN

Is There Still Upside in TowneBank After Recent 5.9% Drop?

Reviewed by Bailey Pemberton

Wondering what your next move should be with TowneBank stock? You are not alone. With the share price at $33.62 as of the last close, curiosity is high among investors trying to figure out if there is still upside after some intriguing market activity.

If you zoom out, TowneBank has given its long-term holders some bragging rights, delivering a solid 122.8% return over the past five years. Even its three-year performance stands strong at 23.1%. However, not all periods have been as positive, as just last month the stock dipped 5.9%. This shows that investor sentiment can shift quickly. Still, its 1.2% gain year-to-date and a slight 0.1% increase over the past week suggest that, despite recent volatility, the story is far from over.

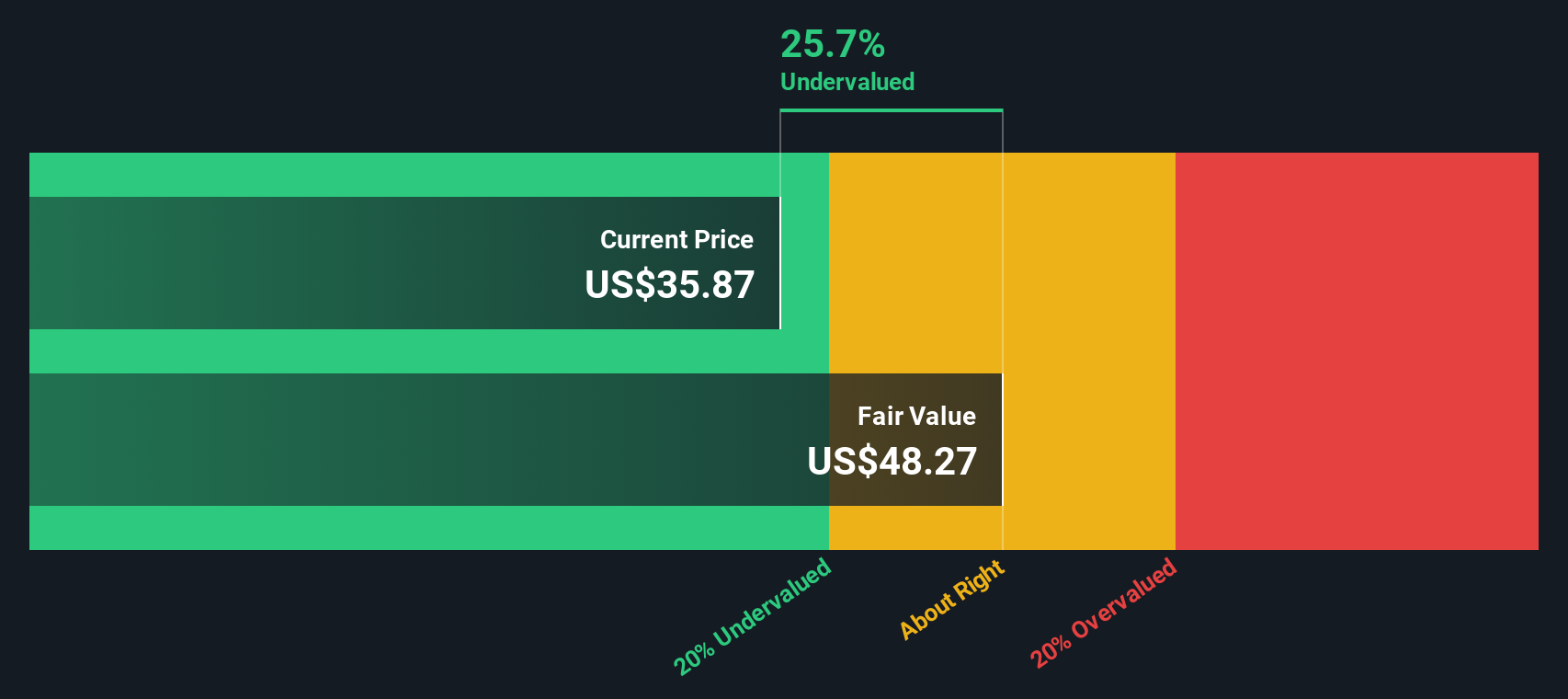

Recent headlines have put the regional banking sector in the spotlight, particularly as regulatory reforms and evolving credit conditions prompt fresh evaluations of bank balance sheets nationwide. For TowneBank, these industry-wide factors highlight both risks and opportunities, helping explain the attention on its valuation. The company’s value score, a quick snapshot that tallies up six different value checks, currently sits at 4 out of 6. This may indicate that the market is overlooking parts of its financial strength.

Now, let us dig deeper into how these valuation checks stack up for TowneBank and why understanding the approach behind them could be your edge. You will want to stick around for an even more insightful angle on valuation at the end of this article.

Why TowneBank is lagging behind its peers

Approach 1: TowneBank Excess Returns Analysis

The Excess Returns Model estimates a company’s fair value by evaluating how efficiently it generates returns above its cost of equity, based on the capital it invests. In TowneBank's case, return on invested capital and the persistence of these excess profits are crucial to determining its long-term intrinsic value.

For TowneBank, the most recent figures show a book value of $30.03 per share and an average return on equity of 10.18%. Analysts project a stable EPS of $3.33 per share, while the cost of equity is estimated at $2.22 per share. This leaves an excess return, a profit above the cost of capital, of $1.12 per share. The stable book value is forecast to reach $32.76 per share, supported by analysis from four independent analysts.

After weighing these metrics, the Excess Returns Model produces an intrinsic value of $62.93 per share. With the stock currently trading at $33.62, this represents a 46.6% discount to its estimated fair value, pointing to a significant level of undervaluation according to this method.

Result: UNDERVALUED

Our Excess Returns analysis suggests TowneBank is undervalued by 46.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

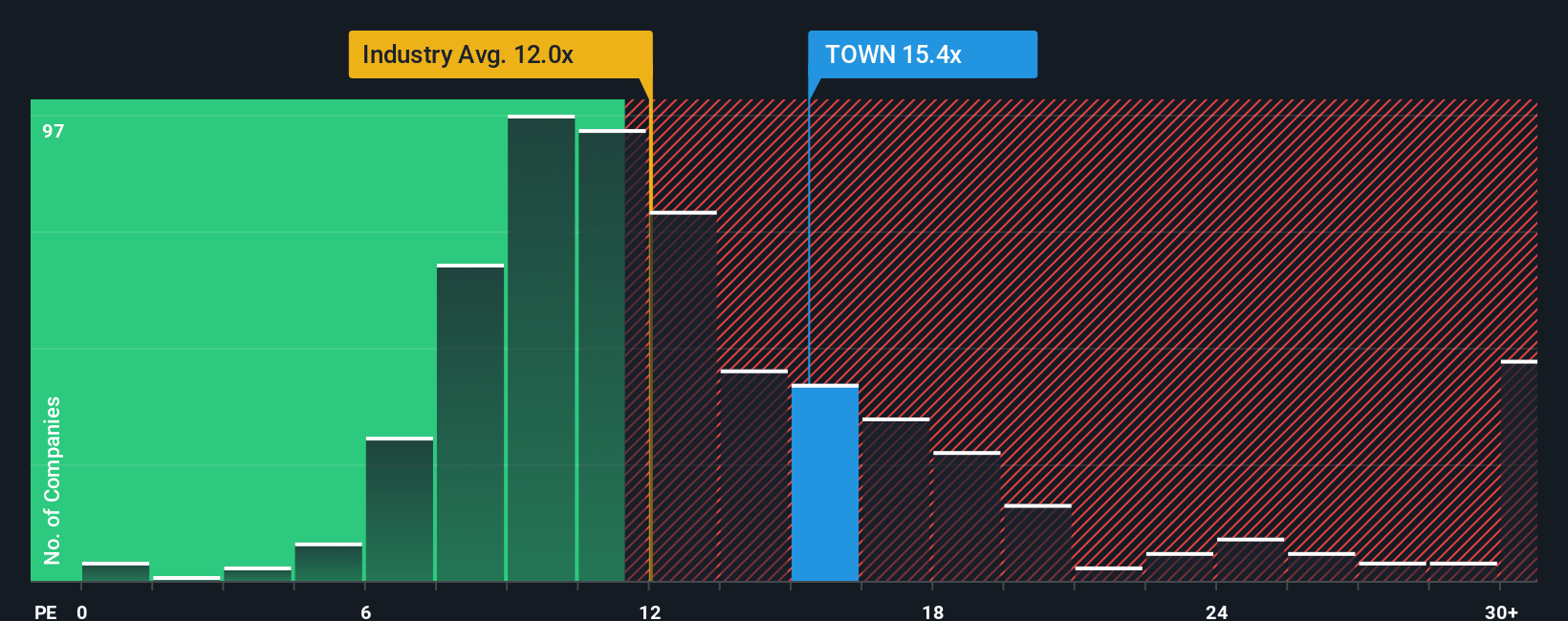

Approach 2: TowneBank Price vs Earnings

The Price-to-Earnings (PE) ratio is a time-tested valuation tool, especially useful for profitable companies like TowneBank. It helps investors gauge whether a stock’s share price fairly reflects its underlying earnings. Generally, companies with stronger expected earnings growth, higher stability, or lower risk command higher PE ratios. Slower-growing or riskier businesses typically trade on lower multiples.

TowneBank currently trades at a PE ratio of 15.5x, which is notably above the banking industry average of 11.3x and also higher than the average 12.8x for its peer group. On the surface, this might suggest TowneBank is somewhat richly valued compared to typical sector benchmarks. However, sector and peer averages often miss the nuances of each company’s unique story.

This is where the Simply Wall St Fair Ratio is useful. This proprietary metric blends key factors such as TowneBank’s earnings outlook, industry position, risk profile, profit margins, and market cap to deliver a more nuanced benchmark. For TowneBank, the Fair Ratio stands at 17.2x, providing a tailored reference point that goes beyond generic comparisons. Given that the current PE ratio is below the Fair Ratio, this indicates TowneBank may actually be trading at a discount relative to its growth, stability, and risk-adjusted fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TowneBank Narrative

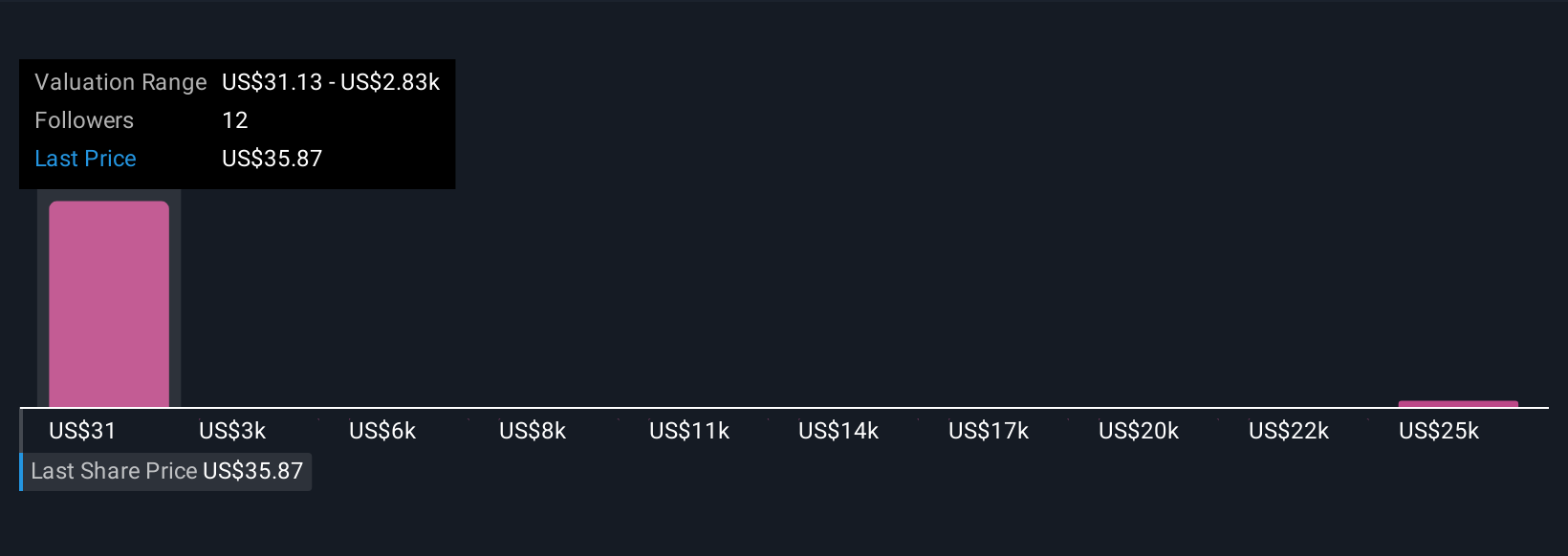

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your chance to bring the numbers to life by attaching a story, your personal perspective, to how you see a company’s future. This connects your forecasts for revenue, earnings, and margins to a specific fair value. Narratives allow you to clearly link your understanding of TowneBank’s story with real financial forecasts, helping you turn insight into action.

Best of all, Narratives are simple to use and available directly on the Simply Wall St platform’s Community page, where millions of investors share and compare viewpoints. By setting your Narrative, you can instantly compare your fair value with the current price, giving you a logical framework for deciding when to buy or sell, rather than relying on gut feeling. Narratives also update automatically as new events like earnings or major news are reported, keeping your outlook relevant and timely. For example, when it comes to TowneBank, some investors believe its fair value could reach as high as $70.00 per share, while others see it closer to $30.00, showing how Narratives capture the full range of investor perspectives.

Do you think there's more to the story for TowneBank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TowneBank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TOWN

TowneBank

Provides retail and commercial banking services for individuals, commercial enterprises, and professionals in Virginia and North Carolina.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives