- United States

- /

- Banks

- /

- NasdaqGS:TCBI

Texas Capital Bancshares (TCBI): Profit Margin Rebound Reinforces Bullish Narratives

Reviewed by Simply Wall St

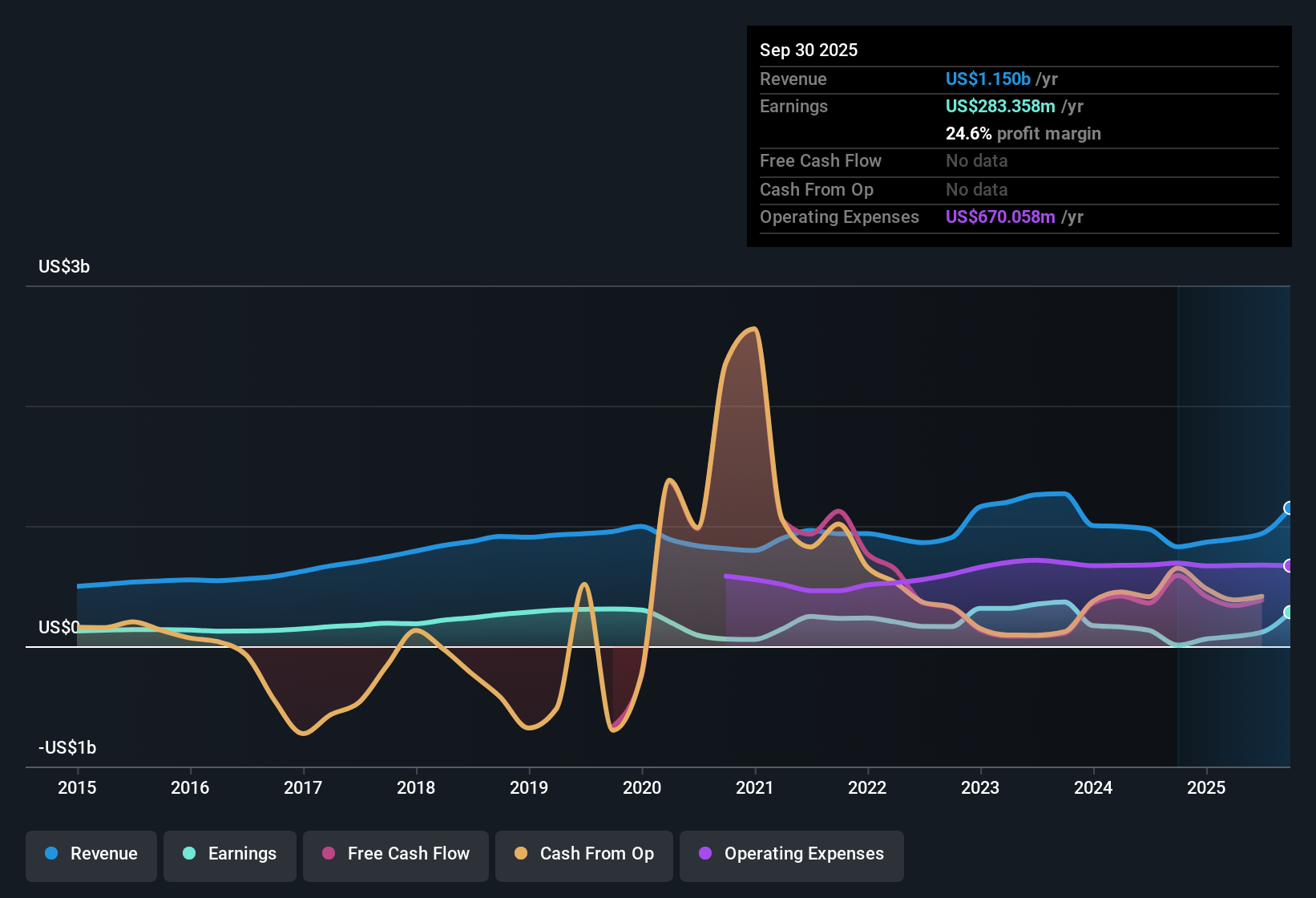

Texas Capital Bancshares (TCBI) reported a sharp turnaround in profitability, posting a net profit margin of 24.6%, up from just 1.1% a year ago. While average annual earnings have declined by 1.7% over the past five years, the most recent year delivered a dramatic surge, with earnings jumping 2919.3% above the five-year average. Looking forward, both revenue and earnings are forecast to grow at rates of 9.6% and 9.09% per year, respectively. However, both growth rates are expected to trail the broader US market.

See our full analysis for Texas Capital Bancshares.Now that we have covered the latest numbers, let’s see how they compare to the most widely discussed narratives, where the earnings surprise might reinforce or challenge prevailing views.

See what the community is saying about Texas Capital Bancshares

Profit Margin Rebounds With Efficiency Push

- Net profit margin sits at 24.6%, after a jump from just 1.1% last year. This signals stronger cost discipline that is leaving more revenue as bottom-line profit.

- The analysts' consensus view sees recent commercial lending expansion and digital platform investment as key to this margin recovery, with:

- Recent investments in digital platforms and fee-based businesses building more resilient and scalable earnings. This is helping cushion profitability as new clients are acquired.

- Analysts expect profit margins to rise further, from today’s 12.5% (as referenced in narrative modeling) to 26.7% in three years. Efficiency gains and client focus are cited as the drivers.

Consensus narrative notes that Texas Capital’s improved margins and ongoing investments could set the stage for further gains. However, sustaining this trajectory as the competitive landscape evolves remains a key challenge.

📊 Read the full Texas Capital Bancshares Consensus Narrative.

Price-to-Earnings Discount Versus Peers

- TCBI trades at a price-to-earnings ratio of 13.6x, well below its peer average of 26.8x, though still modestly above the US banks industry’s 11.3x.

- According to the analysts' consensus view, this valuation gap is justified by revenue growth and profit margin expansion, noting:

- The company’s record of high-quality past earnings and forecasted 9.09% annual earnings growth support a premium over industry averages. However, it still lags broader market growth rates.

- Consensus highlights that, despite this relative discount, the muted difference between TCBI’s $84.52 share price and the $92.43 analyst price target signals that most believe TCBI is fairly valued for now. Future upside is possible if current trends continue.

DCF Fair Value Gap Stands Out

- The current share price of $84.52 is significantly below the DCF fair value estimate of $133.55. This creates a large gap that suggests the market may not be fully recognizing projected growth and profitability.

- The analysts' consensus view points out this DCF valuation gap underpins positive analyst forecasts but cautions:

- The fair value estimate builds in expectations of $1.6 billion in revenue and $438.9 million earnings by 2028. Actual business performance and market sentiment will determine if this upside materializes.

- With the share price at a discount to DCF value yet near consensus targets, consensus remains that TCBI is priced about right for current assumptions. Significant surprises, good or bad, could quickly shift the story.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Texas Capital Bancshares on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something unique in the figures? You can share your perspective and build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Texas Capital Bancshares.

See What Else Is Out There

Although Texas Capital Bancshares has improved profitability and trades at a discount, its growth outlook and valuation still lag those of top-performing peers.

If you want steadier results, check out stable growth stocks screener (2088 results) for companies achieving more consistent revenue and earnings growth across different market environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Capital Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBI

Texas Capital Bancshares

Operates as the bank holding company for Texas Capital Bank, is a full-service financial services firm that delivers customized solutions to businesses, entrepreneurs, and individual customers.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives