- United States

- /

- Banks

- /

- NasdaqGS:TCBI

Robust Earnings and Revenue Outlook Might Change the Case for Investing in Texas Capital Bancshares (TCBI)

Reviewed by Sasha Jovanovic

- Texas Capital Bancshares recently reported third quarter results, showcasing strong year-over-year growth in net interest income and net income, and reaffirmed its 2025 revenue outlook for low double-digit percent growth, while also announcing preferred dividends and an update on its share repurchase program.

- A distinguishing insight is that the company's robust earnings improvement, paired with management's continued confidence in its diversified earnings platform, signals an emphasis on resilience and consistent client engagement.

- We'll examine how Texas Capital's significant year-over-year profit growth shapes the outlook for its revenue-driven investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Texas Capital Bancshares Investment Narrative Recap

To be a shareholder in Texas Capital Bancshares, you’d want to believe in its push for sustained revenue growth, a resilient earnings model, and its focus on capturing economic expansion in Texas. The most important short-term catalyst remains its ability to deliver consistent profit growth while integrating new business lines. Recent announcements, including preferred dividends and share repurchases, do not materially shift the current catalyst or key risk: geographic concentration that leaves earnings sensitive to Texas’s economic cycles.

Among the latest updates, the company’s repurchase of over 87,000 shares in the third quarter brings its total for the year to over 800,000 shares. While this signals ongoing capital returns to shareholders, the main catalyst to watch is still whether Texas Capital can maintain its profit momentum given its concentrated geographic exposure and sector competition.

Yet, contrasting the optimism around new revenue opportunities, investors should also be mindful that...

Read the full narrative on Texas Capital Bancshares (it's free!)

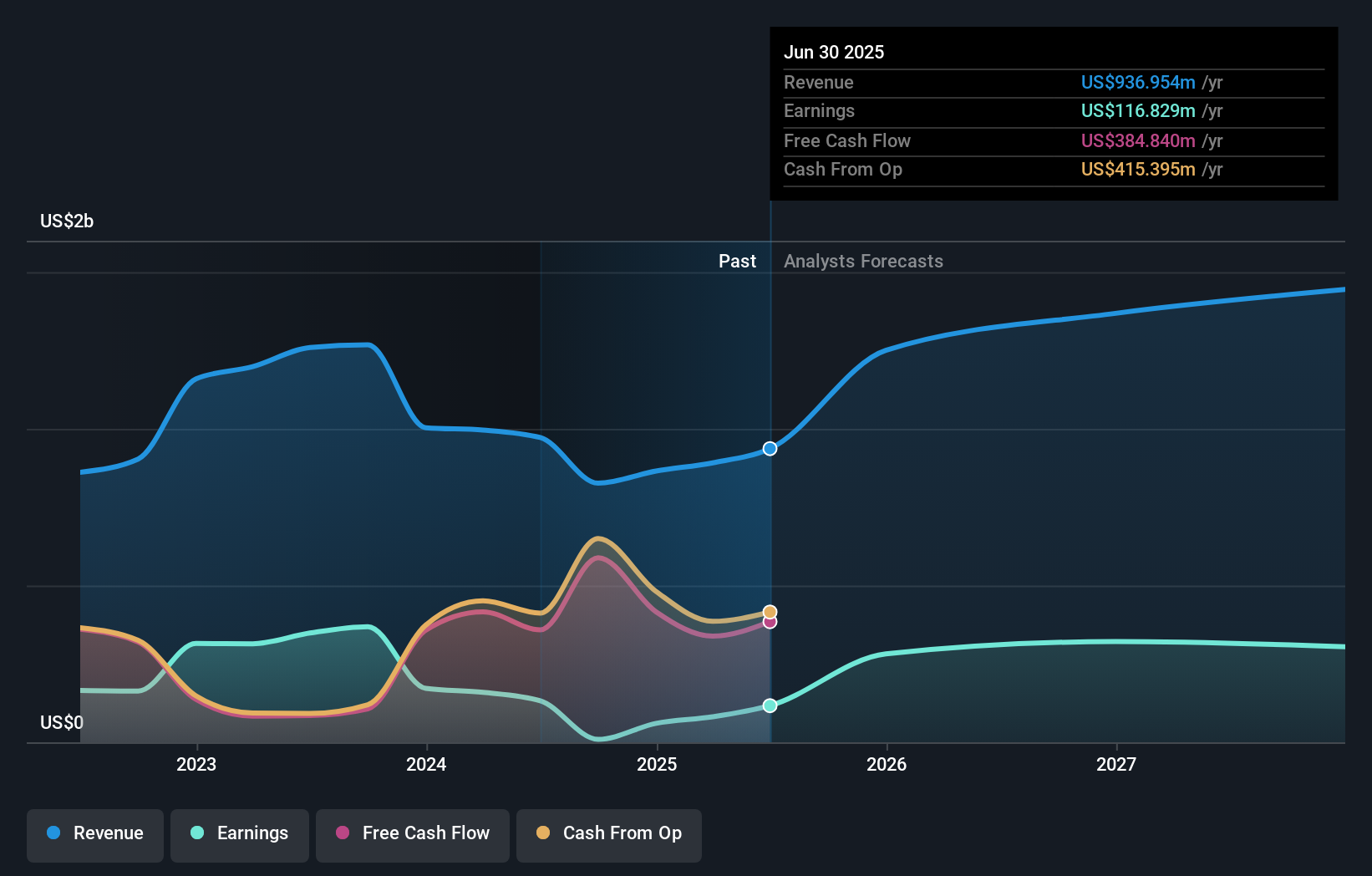

Texas Capital Bancshares' outlook anticipates $1.6 billion in revenue and $438.9 million in earnings by 2028. This scenario assumes a 20.6% annual revenue growth rate and an earnings increase of $322.1 million from today’s earnings of $116.8 million.

Uncover how Texas Capital Bancshares' forecasts yield a $92.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Only one estimate from the Simply Wall St Community pegs Texas Capital Bancshares’ fair value at US$92 per share. While optimism surrounds revenue and client expansion, this reflects how different participants can weigh geographic risk and sustained profit growth, explore more community opinions to see how convictions can vary.

Explore another fair value estimate on Texas Capital Bancshares - why the stock might be worth as much as 10% more than the current price!

Build Your Own Texas Capital Bancshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Capital Bancshares research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Texas Capital Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Capital Bancshares' overall financial health at a glance.

No Opportunity In Texas Capital Bancshares?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Capital Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBI

Texas Capital Bancshares

Operates as the bank holding company for Texas Capital Bank, is a full-service financial services firm that delivers customized solutions to businesses, entrepreneurs, and individual customers.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives