- United States

- /

- Banks

- /

- NasdaqGS:TBBK

Why Bancorp (TBBK) Is Down 7.4% After Strong Q2 Earnings and Major Block Partnership Expansion

Reviewed by Simply Wall St

- The Bancorp, Inc. recently reported second quarter 2025 earnings, including net income of US$59.82 million and basic earnings per share of US$1.28, alongside a significant expansion of its partnership with Block for Cash App card issuance.

- This period also saw Bancorp launch a substantial US$500 million share repurchase authorization, reflecting both increased management confidence and enhanced shareholder return focus.

- Now, we'll examine how Bancorp's strong earnings growth and expanded fintech partnership with Block influence its investment narrative and outlook.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

Bancorp Investment Narrative Recap

To be a shareholder in Bancorp, you need to believe in the continuing momentum of its fintech partnerships, particularly their potential to deliver consistent, growing fee income and earnings. The latest earnings report and the expanded Block partnership may bolster confidence in short-term profits, but do not eliminate key risks, foremost among them is continued reliance on a handful of major partners for growth and revenue stability.

The most relevant recent announcement is Bancorp’s expanded partnership with Block for the Cash App card program. This deepening fintech collaboration underscores the business’s heavy concentration in fintech, which is both its primary catalyst and a potential vulnerability if any major partner encounters operational or financial difficulties.

By contrast, investors should be aware that if large fintech partners stumble or shift priorities, Bancorp’s growth could quickly be impacted by...

Read the full narrative on Bancorp (it's free!)

Bancorp's narrative projects $497.5 million revenue and $337.0 million earnings by 2028. This requires a 0.1% annual revenue decline and a $119.5 million increase in earnings from the current $217.5 million.

Uncover how Bancorp's forecasts yield a $70.76 fair value, a 10% upside to its current price.

Exploring Other Perspectives

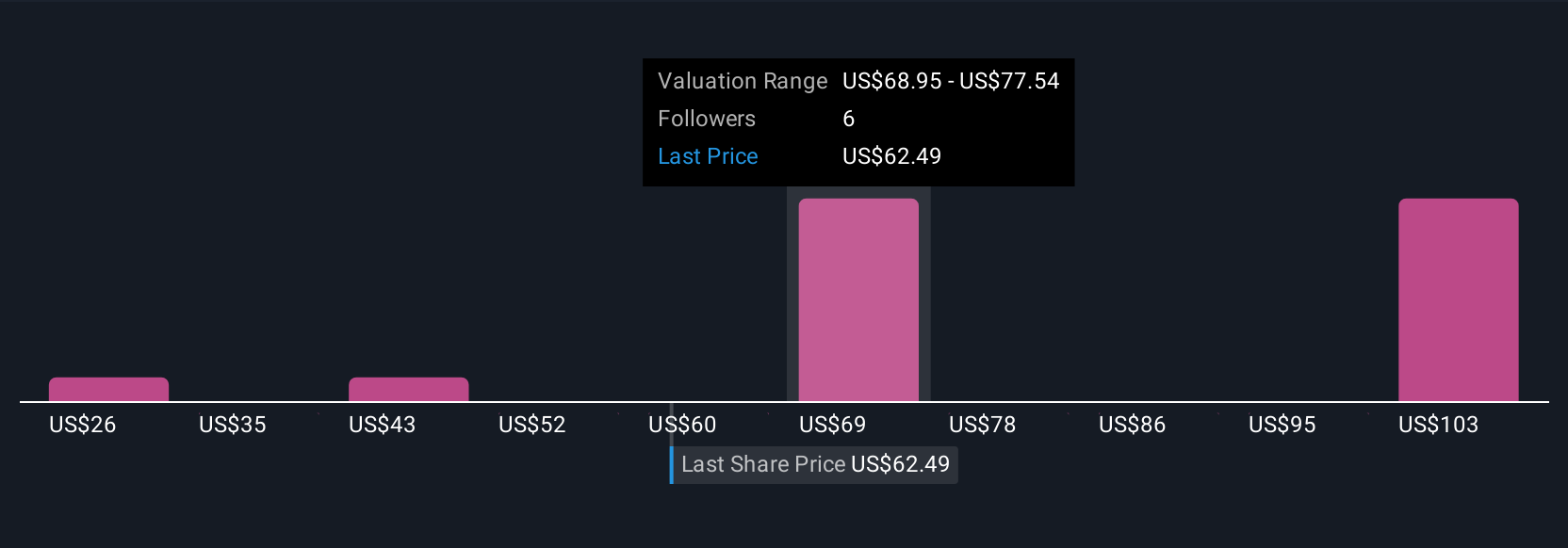

Four individual fair value estimates from the Simply Wall St Community range widely, from US$26 to US$122 per share. With earnings growth still tightly connected to fintech partnerships, you can see just how differently market participants size up the risks and rewards, check other perspectives to broaden your view.

Explore 4 other fair value estimates on Bancorp - why the stock might be worth less than half the current price!

Build Your Own Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bancorp's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TBBK

Bancorp

Operates as the financial holding company for The Bancorp Bank, National Association that provides banking products and services in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives