- United States

- /

- Banks

- /

- NasdaqGS:TBBK

Reviewing Bancorp’s (TBBK) Valuation Following a 5% Share Price Jump

Reviewed by Kshitija Bhandaru

See our latest analysis for Bancorp.

Bancorp’s 5% jump today stands out against a year marked by steady momentum. The company has delivered a 47.7% year-to-date share price return and a 201% three-year total shareholder return. Investors seem increasingly optimistic as recent volatility points to renewed confidence in the bank’s growth story.

If impressive long-term gains have you thinking bigger, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

After such a strong run, the core question for investors is clear: Is Bancorp a stock trading below its real worth, or have the markets already factored in all the company’s future upside?

Most Popular Narrative: 7.9% Overvalued

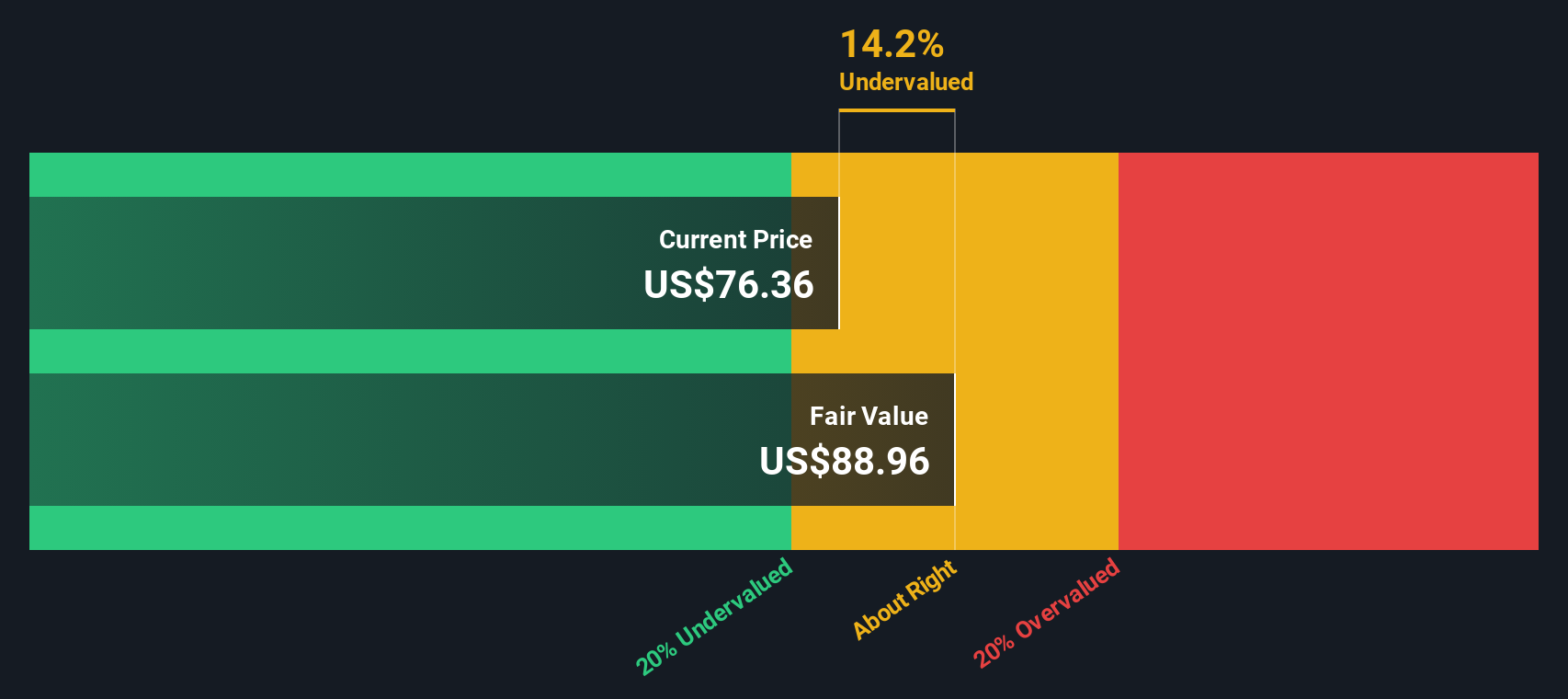

Bancorp’s last close of $76.36 stands above the most widely followed narrative’s fair value, hinting at a share price running ahead of consensus fundamentals. The rationale behind this valuation is shaped by forward-looking catalysts that could soon test these assumptions.

The Fintech Solutions Group's addition of new partnerships and expansion of existing programs, particularly in credit sponsorship, is anticipated to drive significant increases in future earnings. This is due to expected balances reaching $1 billion by the end of 2025.

This narrative is more than just hype. It is built on a bold bet that new fintech deals will turbocharge growth and profitability, with hidden assumptions about shrinking share count and benchmark-busting margins. What is really fueling this premium, and will it hold up? See the specific numbers and the big swings that could change everything.

Result: Fair Value of $70.76 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, much hinges on continued fintech growth. Regulatory changes or a shift in key partner stability could quickly challenge Bancorp’s bullish outlook.

Find out about the key risks to this Bancorp narrative.

Another View: Discounted Cash Flow Says Undervalued

While consensus sees Bancorp as overvalued, our SWS DCF model takes a longer-term cash flow approach and suggests the shares could actually be undervalued. This method values Bancorp at $88.96, which is well above the current price. Which outlook better matches the reality ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bancorp Narrative

If you see Bancorp’s future differently or just want to dig into the data yourself, you can build your own analysis in just a few minutes. Do it your way

A great starting point for your Bancorp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let your next big winner slip by. Take charge of your search and be the first to spot emerging leaders, hidden gems, and steady performers that fit your strategy.

- Uncover tomorrow’s market movers by checking out these 3585 penny stocks with strong financials with strong financials and untapped growth potential.

- Boost your portfolio’s yield when you spot high-paying opportunities in these 19 dividend stocks with yields > 3% that offer robust income streams above 3%.

- Get ahead of the curve by targeting cutting-edge breakthroughs through these 25 AI penny stocks as they shape the rapidly evolving AI landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TBBK

Bancorp

Operates as the financial holding company for The Bancorp Bank, National Association that provides banking products and services in the United States.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026